No products in the cart.

Global Animal Nutrition Market

- Brand: DigiRoads

The Global Animal Nutrition Market continues to grow, driven by rising demand for quality animal feed to enhance livestock health and productivity. With a focus on sustainable and innovative solutions, this market sees advancements in nutritional supplements, feed additives, and customized diets to meet the evolving needs of the global agriculture industry.

Category: Food and Beverage

Brand: DigiRoads

Global Animal Nutrition Market Report | Market Size, Industry Analysis, Growth Opportunities, & Forecast (2025-2030)

Global Animal Nutrition Market Overview

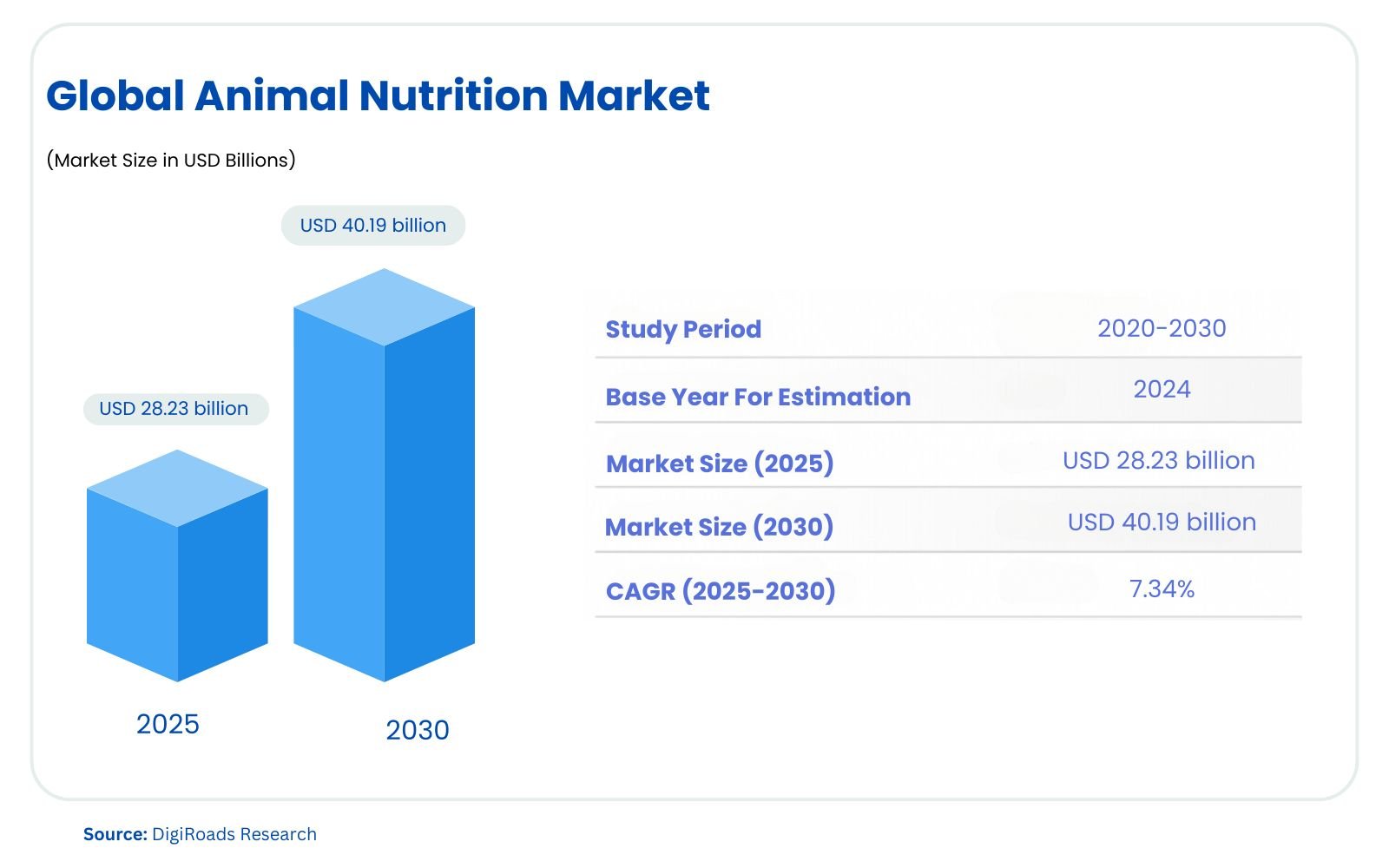

The global animal nutrition market is set for remarkable growth, with an estimated market size of USD 28.23 billion in 2025, and is forecasted to reach USD 40.19 billion by 2030, expanding at a CAGR of 7.34% during the forecast period 2025-2030. The Global Animal Nutrition Market report provides a comprehensive analysis of the global market for animal feed and nutrition. It covers the market trends, key drivers, challenges, and opportunities that shape the growth of the industry from 2025 to 2030. The report offers insights into the evolving demand for high-quality animal nutrition products, driven by the growing awareness of the importance of animal health and productivity in livestock and poultry farming.

Key factors influencing market growth include the rise in meat consumption, advancements in animal feed technology, and the increasing need for sustainable and nutritious feed options. The report also explores the impact of regulatory standards, shifting consumer preferences, and technological innovations on market dynamics. Additionally, it provides an in-depth regional analysis, highlighting key markets such as North America, Europe, and the Asia-Pacific region.

With detailed market segmentation, competitive landscape analysis, and expert forecasts, this report is a valuable resource for industry stakeholders, including animal feed manufacturers, livestock farmers, nutritionists, and investors. It equips decision-makers with data-driven insights to make informed strategies and capitalize on emerging market trends.

The report spans the period from 2025 to 2030, focusing on future developments and growth trajectories in the animal nutrition sector.

Market Report Coverage:

The “Global Animal Nutrition Market Report—Future (2025-2030)” by Digiroads Research & Consulting covers an in-depth analysis of the following segments in the market.

| Product Type | Animal feed, feed additives, and nutritional supplements. |

| Formulation Type | Conventional feed, organic feed, and customized formulations. |

| Distribution Channel | Direct sales, distributors, and online platforms. |

| By Region | North America, Europe, Asia, Latin America, Middle East and Africa |

Study Assumptions and Definitions

The analysis of the Global Animal Nutrition Market is based on several key assumptions to ensure accuracy and relevance. The forecast period for this study spans from 2025 to 2030, with projections based on the assumption of steady growth in global demand for high-quality animal nutrition products. The market dynamics are assumed to be influenced by factors such as rising meat consumption, increased awareness about animal health, and technological advancements in feed manufacturing. The impact of regulatory changes and sustainability trends is also considered in the market projections.

The term Animal Nutrition refers to the science of formulating balanced diets that provide animals with essential nutrients, including proteins, vitamins, minerals, and energy sources. Feed additives are considered substances added to animal feed to enhance its nutritional value or improve animal performance. Livestock includes animals raised for food production, such as cattle, poultry, and swine, while aquatic animals refers to fish and other marine species raised for consumption.

Geography covers key regions, including North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa, with each region having distinct market drivers and consumer preferences. The study assumes steady technological innovation, growing demand for sustainable feed, and an increase in global meat and dairy production over the forecast period.

Market Scope

The Market Scope of the Global Animal Nutrition Market report encompasses a thorough analysis of the global industry, focusing on the period from 2025 to 2030. This report covers key market drivers, such as rising demand for animal-based protein, advancements in feed technology, and growing awareness about animal health and nutrition. It examines product categories like animal feed, feed additives, and nutritional supplements, offering insights into their market dynamics across various animal types, including livestock (cattle, poultry, swine), aquatic animals, and pets.

The scope also includes regional analysis, highlighting prominent markets in North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. The study looks into key market segments, including formulation types (organic and conventional), ingredient types (proteins, vitamins, amino acids), and distribution channels (direct, distributors, and online platforms). Furthermore, the report assesses technological innovations, sustainability efforts, and emerging market trends that are shaping the animal nutrition landscape through 2030.

MARKET OUTLOOK

Executive Summary

The Global Animal Nutrition Market is poised for substantial growth from 2025 to 2030, driven by increasing global demand for animal-based protein, advancements in feed technology, and rising awareness of animal health and productivity. As consumers become more conscious of the nutritional value of animal products, the need for high-quality, sustainable animal nutrition has gained significant momentum. This report provides a comprehensive analysis of the market, encompassing key drivers, challenges, and opportunities across different segments, including animal feed, feed additives, and nutritional supplements.

Key factors driving the market include the expansion of livestock farming to meet the growing global demand for meat and dairy products. Additionally, the increasing focus on animal health and performance, coupled with rising consumer demand for sustainable and organic products, is reshaping the market landscape. Technological innovations in feed formulation and the rising popularity of precision nutrition are expected to further propel market growth.

The market is segmented by animal type, including livestock (cattle, poultry, swine), aquatic animals, and pets. It also examines different formulation types (organic, conventional) and ingredient categories (proteins, vitamins, amino acids). Regional analysis reveals significant growth opportunities across North America, Europe, Asia-Pacific, and emerging markets in Latin America and the Middle East & Africa.

The report also delves into distribution channels, which include direct sales, distributors, and online platforms, providing insights into how these channels are evolving in the digital age. Sustainability is a central theme in the market, with eco-friendly and organic feed solutions becoming increasingly important.

COMPETITIVE LANDSCAPE

The Global Animal Nutrition Market is moderately fragmented, with regional and multinational players competing fiercely for market share.

Key Market Players

- Cargill, Incorporated

- Archer Daniels Midland Company (ADM)

- BASF SE

- DSM Nutritional Products

- Nutreco N.V.

- Land O’Lakes, Inc.

- Evonik Industries AG

- Alltech Inc.

- ForFarmers N.V.

- The Mosaic Company

Market Share Analysis

The Global Animal Nutrition Market is characterized by a competitive landscape with several key players holding significant shares across various segments. As of the latest analysis, Cargill, Incorporated, Archer Daniels Midland Company (ADM), and DSM Nutritional Products are among the leading companies, commanding a substantial share of the global market. These players are recognized for their extensive distribution networks, advanced feed technologies, and diverse product offerings, which include feed additives, premixes, and nutritional supplements.

The market share distribution is also influenced by the growing trend of sustainable feed solutions, with companies like Alltech Inc. and Evonik Industries AG leading in the development of eco-friendly and organic feed products. The shift towards precision nutrition and customized feed formulations has further intensified competition, particularly in the livestock and aquaculture sectors.

Asia-Pacific holds the largest market share, driven by the growing demand for animal protein and the expansion of livestock and poultry industries in countries like China and India. North America and Europe also contribute significant shares, with increasing adoption of advanced animal nutrition technologies and higher consumption of premium animal products.

In terms of product segments, feed additives and premixes have seen rapid growth, with companies such as Kemin Industries, Inc. and Biomin Holding GmbH gaining traction through innovations in nutritional supplements and functional ingredients.

Overall, the market is expected to experience increased consolidation, as major players leverage mergers, acquisitions, and partnerships to expand their reach and product portfolios.

MARKET DYNAMICS

Market Drivers and Key Innovations

Several key drivers are fueling the growth of the Global Animal Nutrition Market from 2025 to 2030. One of the primary drivers is the rising global demand for animal-based protein, particularly in developing economies, where the consumption of meat and dairy products is increasing rapidly. This surge in demand requires efficient and high-quality animal nutrition solutions to enhance productivity and meet dietary needs. Additionally, advancements in animal health and a growing awareness of the connection between nutrition and performance are motivating farmers and producers to invest in superior feed products.

Another significant driver is the focus on sustainability and eco-friendly solutions. Consumers are becoming more conscious of the environmental impact of food production, leading to a demand for organic, non-GMO, and sustainable feed options. Companies are innovating in the development of sustainable ingredients like plant-based proteins, algae, and insect-based feeds to reduce the carbon footprint of animal farming.

Key innovations in the market include precision nutrition and customized feed formulations. These innovations use data analytics and advanced feed technologies to create tailored diets for animals based on their specific needs, age, and production goals. This approach not only enhances animal health but also improves feed efficiency and reduces waste.

Moreover, feed additives are a significant area of innovation, with companies focusing on the development of probiotics, prebiotics, and enzymes that improve digestion, gut health, and overall productivity. These innovations are driving efficiency in livestock farming and aquaculture, helping to meet the growing global protein demand sustainably.

Market Challenges

- Fluctuating Raw Material Prices: The cost of key ingredients like grains, protein sources, and vitamins can fluctuate due to climate change, trade policies, and supply chain disruptions, affecting the cost of animal feed.

- Regulatory Compliance: Stringent regulations regarding feed additives, labeling, and quality standards, especially in regions like Europe and North America, can make market entry difficult for new players and increase operational costs for existing companies.

- Sustainability Pressure: Growing consumer demand for sustainable and organic feed solutions places pressure on companies to develop eco-friendly products without compromising on cost-efficiency or nutritional value.

- Disease Outbreaks: The occurrence of animal diseases, such as avian influenza or foot-and-mouth disease, can disrupt the supply chain and reduce the demand for certain animal nutrition products, especially in affected regions.

- Market Fragmentation: The animal nutrition market is highly fragmented with numerous small and medium-sized players competing with established giants, which can result in pricing pressures and difficulty in establishing a unique market position.

- Consumer Awareness and Trust: Increasing consumer awareness about the sources and quality of animal nutrition products can lead to skepticism and resistance toward certain feed ingredients, such as genetically modified organisms (GMOs) and artificial additives.

- Technological Adoption: Although innovation is driving the industry, the adoption of new technologies, such as precision nutrition and data-driven feed formulations, can be costly and requires significant investment in infrastructure and expertise.

- Labor Shortages: The animal farming sector is facing labor shortages, particularly in regions reliant on manual feed production, which can affect the efficiency and cost-effectiveness of feed production.

Market Opportunities

- Rising Meat Consumption: Increasing global demand for meat, particularly in emerging economies like China and India, presents significant opportunities for growth in animal nutrition, as farmers require high-quality feed to meet production targets.

- Sustainable Feed Solutions: With growing emphasis on sustainability, there is an opportunity to develop and promote eco-friendly, organic, and non-GMO feed ingredients that meet the demands of environmentally-conscious consumers and regulatory bodies.

- Precision Nutrition: The rise of precision nutrition technologies offers an opportunity for innovation in customized feed formulations tailored to the specific needs of different animal species, improving animal health and feed efficiency.

- Aquaculture Expansion: The increasing demand for seafood globally creates opportunities in the aquaculture sector, where the need for specialized feed additives and nutrition products is growing to boost fish health and growth rates.

- Technological Advancements: Innovations in feed additives, such as probiotics, enzymes, and functional ingredients, provide opportunities to enhance digestibility, gut health, and overall productivity, leading to greater adoption of these products by farmers and feed manufacturers.

- Growth in Pet Care Industry: As the pet care industry expands, particularly in developed markets, there is rising demand for premium, nutritionally balanced pet food, creating a growing market for specialized animal nutrition products.

- Regulatory Support for Sustainable Practices: Government initiatives and regulatory support for sustainable agricultural practices offer a favorable environment for the development and adoption of sustainable animal nutrition products.

- Private Label Products: The increasing demand for customized and cost-effective feed products presents an opportunity for private-label brands to expand their market share by offering tailored nutrition solutions at competitive prices.

- Expansion in Emerging Markets: Developing regions, especially in Africa and Southeast Asia, present untapped growth potential as they continue to industrialize and adopt modern livestock and poultry farming practices, requiring improved nutrition solutions.

RECENT STRATEGIES & DEVELOPMENTS IN THE MARKET

Expansion of Sustainable Feed Offerings:

- DSM Nutritional Products has increased its investment in sustainable animal nutrition by focusing on the development of feed ingredients that reduce the carbon footprint, with their initiative to reduce greenhouse gas emissions by 30% by 2030.

- Cargill has launched an innovative plant-based protein feed ingredient designed to reduce dependence on animal-derived proteins, responding to the growing demand for sustainable feed solutions.

Strategic Acquisitions:

- Nutreco acquired Hi-Pro Feeds, a leading North American animal nutrition company, in 2024, expanding its presence in the North American market and strengthening its feed and livestock nutrition portfolio.

- Evonik Industries acquired Perfect Day, a biotech company specializing in animal-free dairy proteins, to strengthen its position in the growing market for plant-based and alternative feed solutions.

Adoption of Precision Nutrition:

- Alltech introduced ALLSYNCTM, a precision feeding technology platform, enabling farmers to tailor feed formulations to specific animal needs, optimizing growth, and reducing waste.

- Land O’Lakes has rolled out a digital platform to help farmers with real-time data on feed optimization and livestock health, driving the adoption of data-driven nutrition solutions.

Increased Investment in Aquaculture Nutrition:

- BASF has launched a new line of aquaculture feed additives designed to improve feed efficiency, health, and growth rates in fish, aligning with the increasing demand for sustainable seafood production.

- Kemin Industries has introduced Kemin Aqua, a specialized division aimed at providing nutraceutical products to the aquaculture sector, focusing on improving gut health and immune function in fish.

Introduction of Plant-Based and Insect-Based Feeds:

- Protix, a leading company in insect-based feed, has expanded its production facility in the Netherlands, now producing over 5,000 tons of insect protein annually to meet the growing demand for alternative protein sources in animal feed.

- Archer Daniels Midland (ADM) has introduced Soy Protein Concentrate as a more sustainable protein source in animal feed, contributing to reduced dependency on conventional feed ingredients like fishmeal.

Technological Partnerships for Feed Innovation:

- Kemin Industries partnered with IHS Markit to integrate artificial intelligence into feed formulation processes, improving feed efficiency and productivity while reducing environmental impact.

- BASF collaborates with Agrifood Technology to develop smart feed additives that enhance nutrient absorption and optimize feed usage, reducing overall feed costs for farmers.

Focus on Premium Pet Nutrition:

- Nestlé Purina Petcare has launched a new line of high-protein, premium pet foods, responding to the increasing consumer demand for functional, nutritionally balanced products tailored to specific pet health needs.

- Mars Petcare has developed a series of nutritionally complete pet foods with enhanced vitamins, minerals, and prebiotics, targeting the growing trend of premium pet care.

KEY BENEFITS FOR STAKEHOLDERS

Increased Profitability for Manufacturers:

- Adoption of advanced technologies, such as precision nutrition and sustainable feed solutions, allows manufacturers to improve feed efficiency, reduce waste, and optimize production costs. This leads to higher profitability through enhanced product offerings and cost-effective manufacturing processes.

Improved Animal Health and Productivity:

- Livestock farmers benefit from high-quality, nutritionally balanced feed that promotes better animal health, growth, and reproduction rates. This results in improved productivity, reduced disease incidence, and optimized resource usage, ultimately enhancing overall farm profitability.

Access to Innovative Products:

- Stakeholders gain access to the latest innovations in animal nutrition, including plant-based proteins, insect-based feeds, and precision feeding technologies. These innovations not only meet the growing consumer demand for sustainable and healthy animal products but also provide competitive advantages in the market.

Sustainability and Environmental Benefits:

- Sustainable feed solutions help farmers and feed manufacturers align with global sustainability goals, reducing their environmental footprint through eco-friendly ingredients and optimized feed formulations. This helps in meeting increasingly stringent environmental regulations and satisfying consumer demand for sustainable food production.

Market Expansion Opportunities:

- Companies can expand their reach into emerging markets, such as Asia-Pacific, Latin America, and Africa, where industrial farming and animal protein consumption are growing rapidly. This offers stakeholders the opportunity to tap into new revenue streams and establish a presence in high-growth regions.

Regulatory Compliance and Risk Management:

- Adopting advanced feed formulations and organic products helps stakeholders meet regulatory standards, especially in markets with stringent regulations like the EU and North America. Compliance with these regulations reduces business risks and enhances brand reputation in the global market.

Enhanced Consumer Trust:

- By focusing on transparency, high-quality ingredients, and sustainable practices, stakeholders can strengthen consumer trust. This is especially important in the premium pet food market, where consumers increasingly demand high-quality, traceable, and responsibly sourced products.

Strategic Partnerships and Collaborations:

- Stakeholders can form strategic partnerships with technology providers, researchers, and other companies to foster innovation in feed development, sustainability, and nutrition. Collaborations can lead to shared resources, knowledge, and market access, benefiting all parties involved.

Long-Term Growth and Competitive Advantage:

- Stakeholders who invest in innovative animal nutrition solutions, such as functional feed additives, sustainable ingredients, and digital platforms, are better positioned for long-term growth. These innovations provide a competitive edge in an increasingly crowded market, ensuring continued success and resilience in the face of industry challenges.

At DigiRoads Research, we emphasize reliability by employing robust market estimation and data validation methodologies. Our insights are further enhanced by our proprietary data forecasting model, which projects market growth trends up to 2030. This forward-thinking approach ensures our analysis not only captures the current market landscape but also anticipates future developments, equipping stakeholders with actionable foresight.

We go a step further by offering an exhaustive set of regional and country-level data points, supplemented by over 60 detailed charts at no additional cost. This commitment to transparency and accessibility allows stakeholders to gain a deep understanding of the industry’s structural and operational dynamics. By providing exclusive and hard-to-access data, DigiRoads Research empowers businesses to make informed strategic decisions with confidence.

In essence, our methodology and data delivery foster a collaborative and data-driven decision-making environment, enabling businesses to navigate industry challenges and capitalize on opportunities effectively.

Contact Us For More Inquiry.

Table of Contents

INTRODUCTION

- Market Overview

- Years Considered for Study

- Market Segmentation

- Study Assumptions and Definitions

- Market Scope

RESEARCH METHODOLOGY

MARKET OUTLOOK

- Executive Summary

- Market Snapshot

- Market Segments

- Product Type

- Animal feed

- feed additives

- nutritional supplements

- Formulation Type

- Conventional feed

- organic feed

- customized formulations

- By Region:

- North America

- Europe, Asia

- Latin America

- Middle East

- Africa

- Product Type

COMPETITIVE LANDSCAPE

- Recent Strategies (Key Strategic Moves)

- Market Share Analysis

- Company Profiles

- Cargill, Incorporated

- Archer Daniels Midland Company (ADM)

- BASF SE

- DSM Nutritional Products

- Nutreco N.V.

MARKET DYNAMICS

- Market Drivers

- Market Challenges

- Market Opportunities

- Porter’s Five Forces’ Analysis

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Threat of New Entrant

- Threat of Substitutes

- Competitive Rivalry

GLOSSARY OF PROMINENT SECONDARY SOURCES

DISCLAIMER

ABOUT US