No products in the cart.

Australia Meat, Poultry, and Seafood Market

- Brand: DigiRoads

Australia Food and Beverage Market Report on Meat, Poultry, and Seafood: This 100+ pages report offers detailed insights into market trends, growth drivers, and competitive landscape. Available in PDF and Excel formats for comprehensive analysis and easy data access.

Category: Food and Beverage

Brand: DigiRoads

Australia Meat, Poultry, And Seafood Market Report | Market Size, Industry Analysis, Growth Opportunities, & Forecast (2025-2030)

Australia Meat, Poultry, And Seafood Market Overview

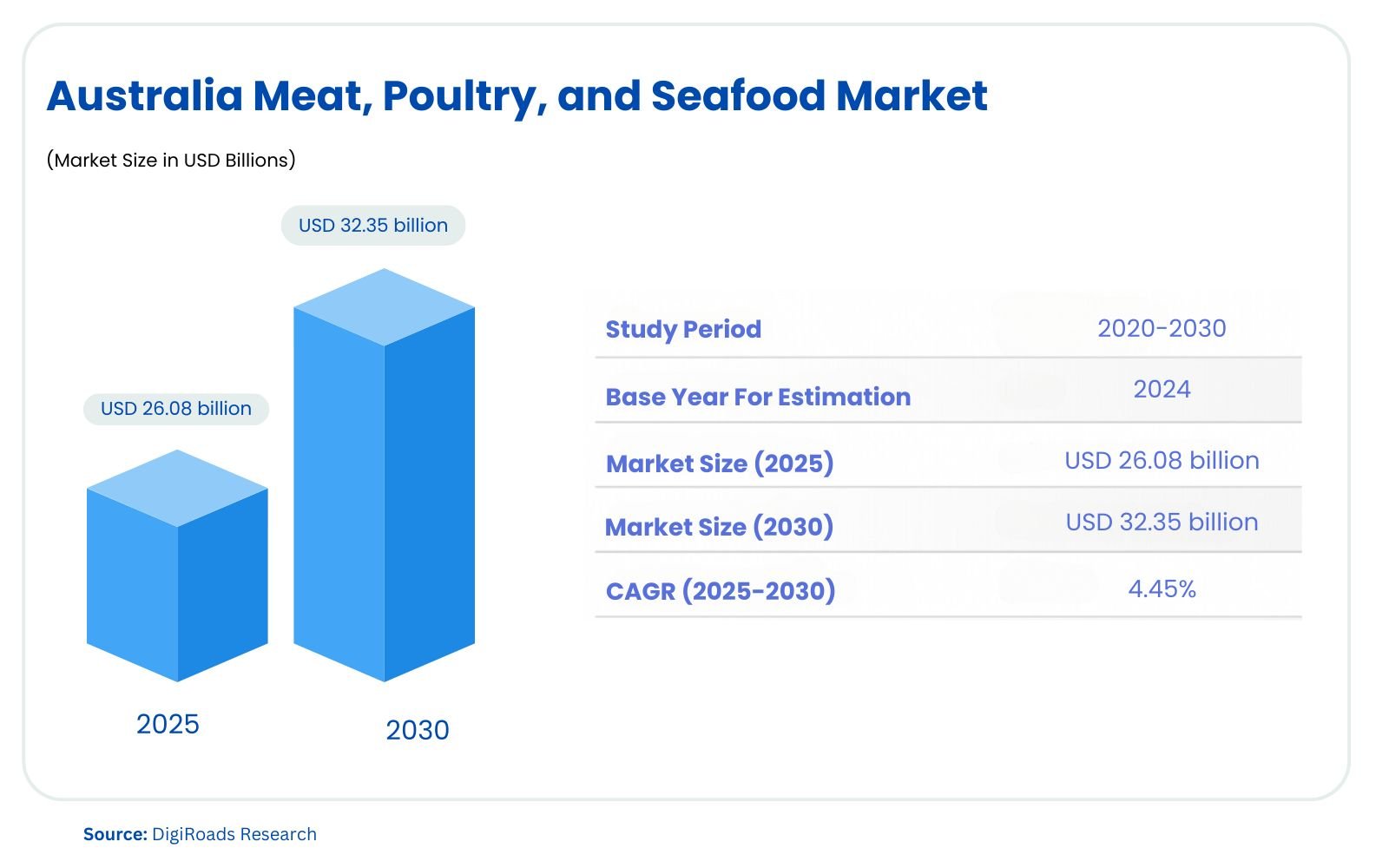

The Australia meat, poultry, and seafood market is witnessing steady growth, with an estimated market size of USD 26.08 billion in 2025 and is projected to reach USD 32.35 billion by 2030, expanding at a CAGR of 4.45% during the forecast period 2025-2030. The Australia Meat, Poultry, and Seafood Market is experiencing steady growth, driven by rising consumer demand and increasing awareness of the health benefits of various meat types.

With a strong preference for poultry, particularly chicken, and an expanding seafood sector, this market is expected to continue its growth trajectory. Key segments include beef, lamb, pork, poultry, and seafood, both fresh and frozen, as well as value-added products like pre-prepared poultry, sausages, and canned seafood. The market is divided into two primary channels: commercial and institutional, with a significant volume of products consumed across food service outlets.

The commercial sector, consisting of restaurants, cafes, and catering services, drives substantial demand for meat and seafood products, especially for high-quality offerings. The institutional sector, including hospitals and schools, also plays a key role in shaping consumption patterns. Additionally, the rise of convenience-driven consumer preferences has led to an uptick in demand for fully cooked, heat-and-serve options and frozen seafood.

With market dynamics shaped by evolving consumer preferences and the expansion of local production, this report provides comprehensive insights into market size, trends, and key players. It’s an essential resource for stakeholders seeking to understand the growth potential in Australia’s vibrant meat, poultry, and seafood market.

Market Report Coverage:

The “Australia Meat Poultry And Seafood Market Report—Future (2025-2030)” by Digiroads Research & Consulting covers an in-depth analysis of the following segments in the market.

| Beef, Lamb, Pork, Goat, Kangaroo, Poultry, Fully Cooked Poultry, Pre-prepared Poultry, Bacon, Ham, Smallgoods, Fish, Salmon, Seafood, Frozen Prepared Seafood, Canned Fish, Sausages, Meat Patties, Minced Meat |

| Commercial (Restaurants, Cafes, Catering Services), Institutional (Hospitals, Schools) |

| On-trade (Restaurants, Cafes, Catering), Off-trade (Supermarkets, Specialty Stores, Online Stores) |

Study Assumptions and Definitions

This report on the Australia Meat, Poultry, and Seafood Market is based on several key assumptions to ensure accurate projections and comprehensive insights. It assumes that the market will continue to grow steadily due to the increasing consumer demand for meat and seafood, driven by rising health consciousness and the expansion of food service industries. The analysis also assumes stable market conditions, with no major disruptions such as drastic economic downturns or significant changes in government regulations that would alter market dynamics.

Definitions of product categories include fresh, frozen, and chilled meats, with subcategories based on specific types such as beef, lamb, poultry, and seafood. Additionally, the report distinguishes between commercial and institutional channels, with commercial referring to food service outlets like restaurants and cafes, and institutional representing sectors like healthcare and education. The market size and growth projections are based on current consumption patterns, distribution channel trends, and evolving consumer preferences.

The study also assumes that the adoption of plant-based meat alternatives will remain a moderate influence on the market, with a continued preference for traditional meat products among a large portion of the Australian population. Data is analyzed based on historical trends, consumer behavior, and key market drivers identified in the report.

Market Scope

The Australia Meat, Poultry, and Seafood Market is a dynamic sector characterized by the growing demand for diverse protein sources, including red meat, poultry, and seafood. This market scope covers key product categories such as beef, lamb, pork, poultry, and various types of seafood, both fresh and frozen. It examines consumption patterns within two primary distribution channels: commercial (restaurants, cafes, and catering services) and institutional (hospitals and schools). The market is influenced by factors such as changing consumer preferences, health awareness, and the rise of convenience-driven food trends.

The scope also evaluates the impact of plant-based meat alternatives and technological advancements in meat processing, packaging, and distribution. It provides insights into trends, opportunities, and challenges facing the industry, including the role of exports, local production, and sustainability initiatives. By analyzing market size, growth projections, and competitive landscape, this study offers a comprehensive view of the industry, enabling stakeholders to make informed decisions regarding investments, product development, and strategic partnerships.

MARKET OUTLOOK

Executive Summary

The Australia Meat, Poultry, and Seafood Market is poised for steady growth, driven by increasing consumer demand for high-quality protein sources and a growing health-conscious population. The market is expected to expand due to the rising popularity of poultry, especially chicken, and the continued demand for seafood. Additionally, factors such as the expansion of local meat production, advances in meat processing technology, and the diversification of product offerings are fueling market growth. The market encompasses a wide variety of product categories, including beef, lamb, pork, poultry, seafood, and value-added products such as fully cooked poultry, sausages, and smallgoods.

In terms of market channels, the commercial sector—comprising restaurants, cafes, and catering services—remains the largest consumer of meat and seafood, with rising demand for convenience-driven products like pre-prepared poultry and frozen seafood. Meanwhile, the institutional sector, including healthcare and educational institutions, also plays a significant role in shaping consumption patterns. A notable trend is the shift toward more sustainable practices within the industry, as consumers and producers alike focus on the environmental impact of food production.

Key market drivers include the increasing focus on health and nutrition, with meat and seafood considered essential sources of protein and essential nutrients. However, the market faces challenges such as the growing adoption of vegan and plant-based diets, which could moderate growth in some segments.

The report also identifies key players in the market, such as JBS Food Australia, Meat and Livestock Australia, and Australian Agricultural Company, which are focusing on strengthening their distribution networks and expanding product portfolios. This study provides valuable insights into market dynamics, segmentation, and growth projections, offering stakeholders a comprehensive understanding of the opportunities and challenges within the Australian meat, poultry, and seafood industry.

COMPETITIVE LANDSCAPE

The Australia Meat Poultry And Seafood Market is moderately fragmented, with regional and multinational players competing fiercely for market share.

Key Market Players

- Australian Meat Company

- Australian Meat Group

- Samex Australian Meat Group

- Meat and Livestock Australia

- JBS Food Australia

- Industry Park Pty Ltd

- Teys Australia Pty Ltd.

- Thomas Foods International Consolidated Pty Limited

- Tip Top Meats

- Beef Producers Australia

- Australian Agricultural Company

Market Share Analysis

The Australia Meat, Poultry, and Seafood Market is highly competitive, with several major players dominating different product segments. JBS Food Australia holds a significant market share, driven by its extensive meat processing capabilities and diversified product offerings, including beef, lamb, and poultry. The company has further strengthened its position by acquiring Huon Aquaculture, expanding its presence in the seafood sector.

Meat and Livestock Australia (MLA) is another prominent player, focusing on the promotion and development of Australia’s meat industry, particularly in beef and lamb. MLA plays a key role in shaping industry standards and export strategies, which further solidifies its market position.

Teys Australia and Thomas Foods International are also major contributors to the market, with a strong focus on beef and lamb production. Both companies have a large network of processing plants and are expanding their product lines to include value-added products like sausages and small goods.

In the poultry segment, Australian Agricultural Company and Tip Top Meats are leading players, providing a wide range of poultry products, including fresh and frozen chicken, as well as fully cooked options.

While large companies dominate the market, smaller players and regional producers also capture niche segments, particularly in the seafood and specialty meat categories. The market remains fragmented, with both large and small enterprises actively vying for market share through product innovation, distribution network expansion, and sustainability initiatives.

MARKET DYNAMICS

Market Drivers and Key Innovations

The Australia Meat, Poultry, and Seafood Market is driven by several key factors that contribute to its growth and evolving landscape. One of the primary drivers is the increasing consumer awareness of the health benefits associated with meat and seafood consumption. Meat is a rich source of essential proteins, vitamins, and minerals, making it a staple in Australian diets. This growing demand for protein-rich foods, especially among health-conscious consumers, is boosting the market.

Another major driver is the expansion of local production facilities and meat processing plants. With technological advancements, Australian producers can ensure high-quality, safe products that meet global standards, making local meat and seafood highly competitive. The increasing focus on sustainability and animal welfare is also prompting industry players to adopt eco-friendly practices, which resonate well with environmentally-conscious consumers.

The growing popularity of convenience foods, such as pre-prepared poultry and frozen seafood, is reshaping consumer preferences. Ready-to-eat and easy-to-cook products cater to busy lifestyles and contribute to the rising demand for processed meat items.

Key innovations in the market include the development of plant-based meat alternatives, which are gaining traction among consumers seeking sustainable protein sources. While not yet mainstream, these alternatives are expected to influence the market, especially among younger, health-conscious populations. Additionally, advancements in meat preservation technologies, such as improved freezing and packaging methods, are extending the shelf life of products, enhancing convenience, and reducing food waste.

Together, these drivers and innovations are shaping a dynamic, growing market, offering opportunities for both traditional and emerging players in the industry.

Market Challenges

- Growing Adoption of Vegan and Plant-Based Diets: Increasing awareness about the environmental and health impacts of meat consumption is driving a shift toward plant-based diets, which poses a challenge to the traditional meat market.

- Rising Production Costs: The cost of meat production, including feed, labor, and transportation, is rising, which could lead to higher product prices and affect consumer demand.

- Sustainability and Environmental Concerns: The meat industry faces pressure to adopt more sustainable practices, such as reducing carbon emissions and improving animal welfare, which can increase operational costs.

- Health and Safety Concerns: Issues related to food safety, such as contamination, zoonotic diseases, and concerns about antibiotic use in livestock, could harm consumer confidence in meat products.

- Fluctuating Raw Material Prices: The prices of raw materials such as feed and livestock are subject to fluctuations, which can impact profitability and pricing strategies for meat producers.

- Supply Chain Disruptions: The COVID-19 pandemic highlighted vulnerabilities in global supply chains, and disruptions, such as labor shortages and logistical challenges, can affect meat availability and pricing.

- Competition from Plant-Based Alternatives: The growing variety of plant-based and lab-grown meat products presents significant competition, particularly in the younger, health-conscious demographic.

- Export Dependency: Australia’s reliance on meat exports makes the market vulnerable to changes in international trade policies, tariffs, and the global demand for meat.

Market Opportunities

- Expansion into Emerging Export Markets: Australia has growing opportunities to expand its meat and seafood exports to new regions, particularly in Asia-Pacific and Middle Eastern markets, thanks to favorable trade agreements and increasing international demand.

- Rising Demand for Plant-Based and Alternative Proteins: The growing trend of plant-based diets presents an opportunity for Australian producers to diversify their offerings by investing in plant-based meat and alternative protein products to cater to health-conscious consumers.

- Focus on Sustainable and Organic Meat Production: Increasing consumer interest in organic and sustainably produced meat creates an opportunity for producers to offer eco-friendly and ethically sourced products, catering to environmentally-conscious consumers.

- Growth of Online Meat Retail: With the rising demand for e-commerce, particularly in food sectors, expanding online meat sales platforms presents a significant opportunity to capture a larger share of the market, providing convenience for customers.

- Health and Wellness Trends: Consumers are becoming more health-conscious, creating demand for leaner cuts of meat, functional foods, and products with added health benefits like omega-3-enriched seafood and low-fat poultry options.

- Technological Advancements in Processing and Packaging: Investments in innovative processing and packaging technologies can enhance product shelf life, reduce waste, improve food safety, and meet the demand for convenient, ready-to-cook meals.

- Development of Value-Added Meat Products: The demand for value-added products, such as pre-marinated meats, sausages, and ready-to-eat meals, is growing, offering opportunities for producers to diversify their product offerings and cater to busy, convenience-seeking consumers.

RECENT STRATEGIES & DEVELOPMENTS IN THE MARKET

Expansion of Export Markets:

- Australia’s trade agreements, such as the one with the UAE, are opening new markets for Australian meat exports. The agreement is expected to boost Australian exports by A$678 million annually, which is a key driver for growth in the industry.

Acquisition by Key Players:

- In August 2021, JBS, a global leader in meat processing, acquired Huon Aquaculture, Australia’s second-largest salmon producer. This acquisition diversifies JBS’s offerings into seafood and strengthens its position in the Australian market.

Sustainability Initiatives:

- The Australian meat industry is increasingly adopting sustainability practices, focusing on reducing carbon emissions and improving animal welfare. For example, Meat and Livestock Australia (MLA) is investing in carbon-neutral initiatives and more sustainable farming practices to meet the growing demand for eco-friendly products.

Investment in Technology for Processing:

- Australian meat producers are incorporating advanced technologies, such as automated processing systems and precision farming techniques, to improve efficiency and product quality. This includes the use of artificial intelligence and machine learning to optimize meat production and packaging.

Plant-Based Meat Developments:

- With the growing trend of plant-based diets, several Australian companies are entering the plant-based protein sector. The Australian Meat Group has launched plant-based meat alternatives to cater to the rising demand for sustainable protein sources.

Online Sales Expansion:

- As e-commerce for food products grows, Australian meat producers and retailers are increasingly focusing on expanding their online presence. Companies are partnering with major online grocery platforms to enhance product accessibility and meet the rising demand for home deliveries.

Diversification of Product Offerings:

- Producers are diversifying into value-added products such as ready-to-eat meals, marinated meats, and pre-cooked poultry. This strategy is aimed at capturing the growing segment of consumers seeking convenience without compromising on quality.

Focus on Health-Conscious Consumer Segments:

- There is a growing emphasis on producing leaner cuts of meat and healthier options like omega-3-enriched seafood. This is in response to consumer demand for nutritious and functional food products.

KEY BENEFITS FOR STAKEHOLDERS

Increased Market Access through Trade Agreements:

- Stakeholders, including producers and exporters, benefit from favorable trade agreements (e.g., UAE trade deal) that open new markets, leading to expanded export opportunities and increased revenue potential.

Diversified Product Offerings:

- By focusing on plant-based and alternative protein products, meat producers can cater to a growing health-conscious segment, creating new revenue streams and attracting a broader consumer base.

Improved Profitability with Value-Added Products:

- Stakeholders can tap into the growing demand for ready-to-eat meals, pre-cooked poultry, and other convenience foods, enhancing product margins and driving higher sales.

Enhanced Sustainability Practices:

- Adoption of sustainable farming and production practices benefits stakeholders by meeting consumer demand for ethically sourced products, increasing brand loyalty, and improving environmental impact.

Technological Advancements for Efficiency:

- Investment in advanced processing technologies and automated systems allows stakeholders to increase production efficiency, reduce operational costs, and ensure consistent product quality.

Health-Focused Innovations:

- Stakeholders can benefit from creating healthier meat products (e.g., leaner cuts, omega-3 enriched seafood), meeting rising consumer demand for nutritious options and gaining a competitive advantage in the market.

Expansion of Online Retail Opportunities:

- Online sales platforms provide stakeholders with access to a larger consumer base, increasing the reach and convenience for customers, which translates into more sales and higher profits.

Sustained Industry Growth through Export Expansion:

- Exporters and suppliers benefit from increased trade volumes and market diversification, ensuring sustained growth in the face of domestic market fluctuations.

Stronger Competitive Positioning:

- By focusing on innovation, sustainability, and consumer trends, stakeholders can position themselves as market leaders, strengthening their competitive position and securing long-term business success.

At DigiRoads Research, we emphasize reliability by employing robust market estimation and data validation methodologies. Our insights are further enhanced by our proprietary data forecasting model, which projects market growth trends up to 2030. This forward-thinking approach ensures our analysis not only captures the current market landscape but also anticipates future developments, equipping stakeholders with actionable foresight.

We go a step further by offering an exhaustive set of regional and country-level data points, supplemented by over 60 detailed charts at no additional cost. This commitment to transparency and accessibility allows stakeholders to gain a deep understanding of the industry’s structural and operational dynamics. By providing exclusive and hard-to-access data, DigiRoads Research empowers businesses to make informed strategic decisions with confidence.

In essence, our methodology and data delivery foster a collaborative and data-driven decision-making environment, enabling businesses to navigate industry challenges and capitalize on opportunities effectively.

Contact Us For More Inquiry.

Table of Contents

INTRODUCTION

- Market Overview

- Years Considered for Study

- Market Segmentation

- Study Assumptions and Definitions

- Market Scope

RESEARCH METHODOLOGY

MARKET OUTLOOK

- Executive Summary

- Market Snapshot

- Market Segments

- Product Types:

- Beef, Lamb, Pork, Goat, Kangaroo, Poultry, Fully Cooked Poultry, Pre-prepared Poultry, Bacon, Ham, Smallgoods, Fish, Salmon, Seafood, Frozen Prepared Seafood, Canned Fish, Sausages, Meat Patties, Minced Meat

- Market Channel:

- Commercial (Restaurants, Cafes, Catering Services), Institutional (Hospitals, Schools)

- Distribution Channels:

- On-trade (Restaurants, Cafes, Catering), Off-trade (Supermarkets, Specialty Stores, Online Stores)

- Product Types:

COMPETITIVE LANDSCAPE

- Recent Strategies (Key Strategic Moves)

- Market Share Analysis

- Company Profiles

- AMC Entertainment Holdings, Inc.

- B&B Theatres

- CGR Cinemas

- Cinemark Holdings, Inc.

- Cinemex

- Cineplex Inc.

- Cinepolis

- Cineworld Group plc.

- CJ CGV

- Odeon Cinemas Group

- PVR INOX Ltd

- UGC

- Vue International

- Wanda Film Holding Co.

- Yelmo Cines

MARKET DYNAMICS

- Market Drivers

- Market Challenges

- Market Opportunities

- Porter’s Five Forces’ Analysis

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Threat of New Entrant

- Threat of Substitutes

- Competitive Rivalry

GLOSSARY OF PROMINENT SECONDARY SOURCES

DISCLAIMER

ABOUT US