No products in the cart.

Brazil Gluten-Free Foods & Beverages Market

- Brand: DigiRoads

Discover the 100+ page report on the Brazil Gluten-Free Foods & Beverages Market, providing insights into trends, growth drivers, and the competitive landscape. Available in PDF and Excel formats for easy access to detailed data and analysis.

Category: Food and Beverage

Brand: DigiRoads

Brazil Gluten-Free Foods and Beverages Market Report | Market Size, Industry Analysis, Growth Opportunities, & Forecast (2025-2030)

Brazil Gluten-Free Foods and Beverages Market Overview

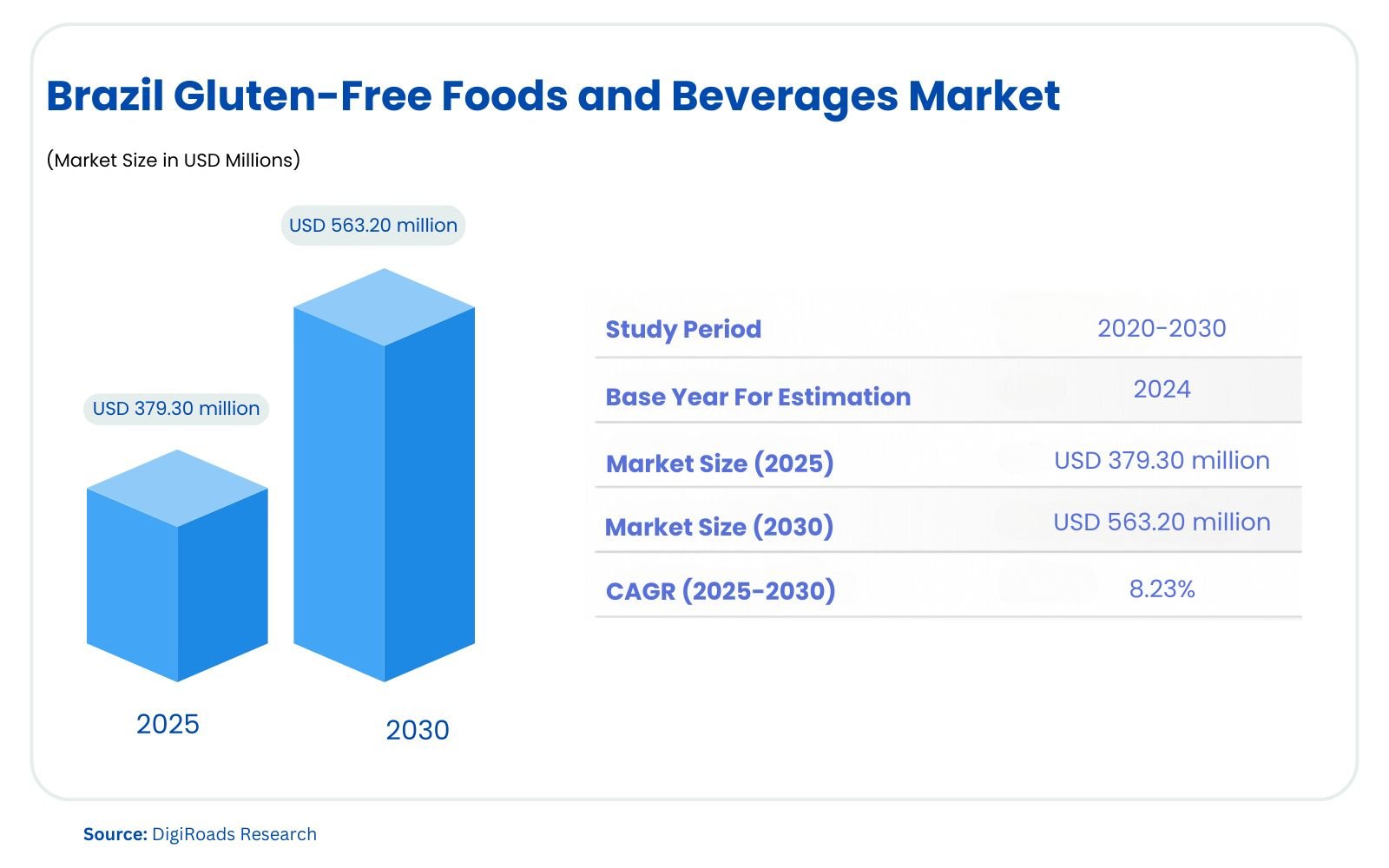

The Brazil gluten-free foods and beverages market is experiencing significant expansion, with an estimated market size of USD 379.30 million in 2025, projected to reach USD 563.20 million by 2030, growing at a CAGR of 8.23% during the forecast period 2025-2030. As the largest and fastest-growing market for gluten-free products in South America, Brazil accounted for around half of the regional market share in 2024. The rising demand for healthy and allergen-free food among health-conscious consumers has fueled this growth.

Key drivers include increasing investments in R&D by global manufacturers and a surge in new product launches. Product innovation and strategic marketing through various channels are pivotal trends in maintaining market competitiveness. Notable growth is also observed in gluten-free alcoholic beverages, reflecting evolving consumer preferences.

The market is segmented by product type, including beverages, bread products, cookies and snacks, dairy substitutes, meat substitutes, and condiments. Leading players like Bob’s Red Mill, Dr. Schar, and General Mills Inc. dominate the market with continuous innovation and expansion strategies.

This dynamic market reflects a transition from niche specialty items to mainstream products, driven by the perception of gluten-free options as healthier choices. As demand continues to rise, Brazil’s gluten-free industry is positioned for substantial growth and innovation through 2030.

Market Report Coverage:

The “Brazil Gluten-Free Foods and Beverages Market Report—Future (2025-2030)” by Digiroads Research & Consulting covers an in-depth analysis of the following segments in the market.

| Beverages | Includes gluten-free alcoholic and non-alcoholic drinks catering to health trends. |

| Bread Products | Gluten-free bread and bakery items popular among health-conscious consumers. |

| Cookies & Snacks | Gluten-free cookies, biscuits, and snacks driving market demand. |

Study Assumptions and Definitions

This study on the Brazil Gluten-Free Foods and Beverages Market for the period 2025–2030 is based on a comprehensive analysis of market trends, consumer preferences, and competitive dynamics. It assumes consistent economic growth in Brazil, leading to increased consumer purchasing power and a growing awareness of health and wellness trends. The study also considers the expanding availability of gluten-free products, driven by innovations and investments by key market players.

The definition of gluten-free products in this study aligns with regulatory standards, indicating foods and beverages that contain less than 20 ppm (parts per million) of gluten. The market encompasses products made for individuals with celiac disease, gluten sensitivity, and those adopting gluten-free diets for perceived health benefits.

The study assumes that factors such as increasing urbanization, the rise in health-conscious consumers, and product innovation will continue to drive demand. Additionally, it considers that distribution channels such as supermarkets, hypermarkets, and online platforms will enhance accessibility to gluten-free products.

The data in this study is sourced from credible industry reports, government publications, and expert insights, ensuring accuracy and relevance to stakeholders interested in the Brazil Gluten-Free Foods and Beverages Market.

Market Scope

The Brazil Gluten-Free Foods and Beverages Market for 2025–2030 focuses on analyzing the growth, trends, and key drivers shaping the market. This study encompasses various gluten-free product categories, including beverages, bread products, cookies and snacks, condiments, dairy/dairy substitutes, and meat/meat substitutes.

The scope includes a detailed evaluation of consumer demand patterns influenced by rising health awareness, increased prevalence of gluten-related disorders, and the growing adoption of gluten-free diets for lifestyle reasons. The market also examines the competitive landscape, highlighting key players such as Bob’s Red Mill, Dr. Schar, and General Mills Inc., along with their strategies for product innovation and market expansion.

Additionally, the study covers distribution channels like supermarkets, hypermarkets, specialty stores, and online platforms, analyzing their role in enhancing accessibility to gluten-free products. Regional trends, regulatory frameworks, and emerging opportunities are integral parts of this market’s scope.

MARKET OUTLOOK

Executive Summary

The Brazil Gluten-Free Foods and Beverages Market is poised for significant growth during the forecast period 2025–2030, registering a robust CAGR of 8.23%. As the largest and fastest-growing gluten-free market in South America, Brazil holds over 50% of the regional market share, driven by increasing consumer awareness of health and wellness. The market has evolved from catering to niche dietary needs to becoming a mainstream choice, fueled by rising health-consciousness and growing prevalence of celiac disease and gluten sensitivity.

Key market drivers include innovation in product offerings, investments in R&D, and the introduction of new gluten-free products. Leading players, such as Bob’s Red Mill, Dr. Schar, General Mills Inc., and Brazi Bites, are leveraging strategic product launches and marketing campaigns to capture market share. Additionally, the growing demand for gluten-free alcoholic beverages and organic food products is further driving growth.

Market segmentation spans beverages, bread products, cookies and snacks, condiments, dairy/dairy substitutes, meat/meat substitutes, and other gluten-free items. Distribution channels such as supermarkets, hypermarkets, and e-commerce platforms are enhancing consumer access to gluten-free options.

The competitive landscape is characterized by intense rivalry, with companies striving to differentiate themselves through quality, innovation, and consumer engagement. Moreover, increasing urbanization and purchasing power in Brazil are creating new opportunities for market players to expand their footprint.

In summary, the Brazil Gluten-Free Foods and Beverages Market is on a transformative growth trajectory. Its evolution from niche dietary solutions to mainstream products highlights the shift in consumer preferences towards healthier and sustainable food choices. This report provides valuable insights into market dynamics, trends, competitive strategies, and future opportunities, making it an essential resource for stakeholders aiming to capitalize on this expanding market.

COMPETITIVE LANDSCAPE

The Brazil Gluten-Free Foods and Beverages Market is moderately fragmented, with regional and multinational players competing fiercely for market share.

Key Market Players

- Bob’s Red Mill

- Dr. Schar

- General Mills Inc.

- Brazi Bites

- H.J. Heinz Company

- Raisio PLC

- Hero Group AG

Market Share Analysis

The Brazil Gluten-Free Foods and Beverages Market is highly competitive, with several key players holding significant market shares. As of 2025, the market is dominated by brands like Bob’s Red Mill, Dr. Schar, General Mills Inc., and Brazi Bites, which have successfully positioned themselves as leaders in the gluten-free segment.

Bob’s Red Mill and Dr. Schar are among the largest contributors to market share, leveraging their established global presence and reputation for offering a wide range of gluten-free products. General Mills Inc. follows closely, with its well-known gluten-free cereal brands gaining traction in Brazil. Brazi Bites has seen considerable growth in the frozen foods sector, carving out a niche with its gluten-free snack offerings.

While larger players dominate the market, emerging brands and local companies are also capitalizing on the rising demand for gluten-free products. The market share distribution is influenced by factors such as product innovation, distribution networks, and brand loyalty.

The market is witnessing a trend towards consolidation, with players focusing on expanding their product portfolios and reaching a broader consumer base. As the demand for gluten-free products continues to grow, companies are expected to maintain or increase their market shares through strategic partnerships, product diversification, and expanding distribution channels.

MARKET DYNAMICS

Market Drivers and Key Innovations

The Brazil Gluten-Free Foods and Beverages Market is primarily driven by the increasing demand for healthy and organic products. Health-conscious consumers are shifting towards gluten-free options, not only due to medical reasons like celiac disease but also because of perceived health benefits. This shift is driving both demand and growth in the gluten-free market.

Another key driver is the rise in consumer awareness about food intolerances and allergies, prompting more people to seek gluten-free alternatives. Additionally, the growing trend of organic and clean-label foods has further fueled the popularity of gluten-free products, as these often align with consumers’ preferences for natural and additive-free food.

The market is also being shaped by innovations in product offerings. Companies are increasingly focusing on R&D to develop new gluten-free products that cater to diverse tastes and dietary preferences. For example, Bob’s Red Mill and General Mills Inc. have expanded their gluten-free portfolios to include healthier options such as gluten-free granolas and snacks. Similarly, Brazi Bites has introduced frozen gluten-free snacks, tapping into the growing convenience food segment.

Key innovations include the development of gluten-free alcoholic beverages, as the demand for gluten-free beer and wine increases. Advancements in gluten-free baking technologies have also contributed to the market’s expansion, making gluten-free products more accessible and desirable to a broader consumer base.

As manufacturers continue to innovate and respond to shifting consumer demands, the Brazil Gluten-Free Foods and Beverages Market is expected to experience robust growth through 2030.

Market Challenges

- High Production Costs: The production of gluten-free foods and beverages often requires specialized ingredients and manufacturing processes, which can be more expensive than conventional products. These higher costs can result in higher prices for consumers, limiting the market’s reach.

- Limited Availability of Raw Materials: The availability of high-quality gluten-free ingredients can be a challenge, especially for small and medium-sized companies. The sourcing of alternative grains and flour, such as rice or quinoa, can face supply chain disruptions or pricing fluctuations.

- Consumer Skepticism: Despite the growing demand for gluten-free products, some consumers remain skeptical about the benefits of gluten-free diets unless they have a medical reason to follow them. Convincing the broader population about the advantages of gluten-free foods is a key challenge for market players.

- Cross-Contamination Risks: In production facilities where both gluten-containing and gluten-free products are made, the risk of cross-contamination can be significant. This can limit the appeal of gluten-free products for consumers with severe gluten sensitivities or celiac disease.

- Intense Competition: The Brazil gluten-free market is highly competitive, with both established global brands and local players vying for market share. Companies must constantly innovate and differentiate their offerings to maintain their position and meet changing consumer demands.

Market Opportunities

- Immersive Technologies: Growing Health Consciousness: As more consumers in Brazil adopt healthier lifestyles, there is a significant opportunity to expand the market for gluten-free foods and beverages. This trend is fueled by a greater focus on wellness, making gluten-free products an attractive option for health-conscious individuals.

- Expansion of Gluten-Free Alcoholic Beverages: The increasing demand for gluten-free alcoholic drinks, such as beer, wine, and spirits, presents a growing market opportunity. Companies can innovate in this segment by offering new, appealing gluten-free alcoholic options to cater to diverse consumer preferences.

- Rising Demand for Organic and Clean-Label Products: Consumers are increasingly seeking organic, natural, and clean-label foods. Gluten-free products that meet these criteria can capture the attention of a broader audience, particularly among those who prioritize transparency and sustainability in food choices.

- Innovation in Gluten-Free Snacks and Convenience Foods: There is a rising demand for convenient, ready-to-eat gluten-free snacks. Brands that innovate by offering gluten-free versions of popular snacks like chips, granola bars, and ready meals have the potential to tap into a large and growing market.

- E-Commerce and Online Sales Channels: With the rise of online shopping, there is an opportunity for gluten-free food brands to expand their presence in e-commerce. By leveraging digital platforms, companies can reach a wider audience and cater to the increasing preference for shopping from home.

- Product Diversification: There is a growing opportunity for companies to diversify their gluten-free product lines, including offering gluten-free options in categories like dairy substitutes, condiments, and meat alternatives, thus meeting the varied dietary needs of consumers.

RECENT STRATEGIES & DEVELOPMENTS IN THE MARKET

Increased Product Launches:

- Companies like Bob’s Red Mill and General Mills Inc. have significantly expanded their gluten-free product offerings. For instance, Bob’s Red Mill launched a new line of gluten-free baking mixes and flour blends to meet rising consumer demand for easy-to-use gluten-free products.

Expansion in E-commerce:

- Brands are increasingly focusing on e-commerce platforms to boost their sales. With the surge in online shopping, companies like Brazi Bites have expanded their reach through Amazon and other online retailers to cater to health-conscious consumers who prefer shopping for specialty foods online.

Focus on Clean-Label and Organic Products:

- Gluten-free food brands are capitalizing on the clean-label trend. Companies such as Dr. Schar have incorporated organic and non-GMO ingredients into their gluten-free product lines, catering to the growing demand for transparency in food labeling.

Investment in R&D for New Product Development:

- Companies are investing heavily in research and development to create innovative gluten-free products. For example, Raisio PLC has been developing new gluten-free snack options, including high-protein and low-sugar alternatives, to appeal to both health-conscious consumers and those with dietary restrictions.

Strategic Partnerships and Acquisitions:

- H.J. Heinz Company has expanded its product portfolio through strategic acquisitions. Recently, Heinz acquired a gluten-free brand to strengthen its presence in the growing gluten-free segment, enhancing its product range and market competitiveness.

Emphasis on Gluten-Free Beverages:

- The gluten-free beverage market, particularly non-alcoholic options, is being prioritized by leading companies. Raisio PLC and General Mills have been focusing on gluten-free alcoholic beverages, which is one of the fastest-growing segments in the market.

Sustainability and Local Sourcing Initiatives:

- Companies like Hero Group AG are focusing on sustainability, sourcing gluten-free ingredients locally in Brazil to reduce supply chain disruptions and enhance the appeal of their products as eco-friendly and socially responsible.

KEY BENEFITS FOR STAKEHOLDERS

Expanding Market Opportunities:

- The growing demand for gluten-free products presents significant opportunities for food manufacturers, suppliers, and retailers to expand their product portfolios and enter a rapidly growing market. Stakeholders can leverage the increasing awareness around gluten intolerance and health-conscious consumer trends to capture new customer segments.

Increased Consumer Demand for Health-Conscious Products:

- With the rise in health-consciousness and dietary preferences, stakeholders can benefit from the surge in demand for gluten-free foods and beverages. This trend supports long-term growth for companies, especially those that focus on innovative, organic, and clean-label gluten-free products.

Diversification and Competitive Advantage:

- For established players, expanding into the gluten-free sector offers a competitive edge by diversifying their product offerings. This enables companies to cater to a broader range of consumers, particularly those with celiac disease, gluten sensitivity, or those following gluten-free lifestyles.

Improved Market Access Through E-commerce and Retail Channels:

- Stakeholders can capitalize on the growing online shopping trend to increase market reach. E-commerce platforms allow brands to access a larger audience, especially those looking for specialty gluten-free products. Additionally, traditional retail channels also offer a broad customer base.

Strategic Partnerships and Collaborations:

- Collaborations between food manufacturers, ingredient suppliers, and distributors offer mutual benefits, including access to better resources, market insights, and innovation. Such partnerships can lead to more efficient product development, marketing strategies, and quicker market penetration.

Brand Loyalty and Consumer Trust:

- As consumers demand more transparent, ethical, and clean-label products, stakeholders can benefit from building stronger brand loyalty by adhering to these preferences. Brands that focus on quality, sustainability, and innovation are likely to foster long-term relationships with health-conscious customers.

Profitability in Niche Market Segments:

- The gluten-free market, while specialized, is growing rapidly in Brazil. Stakeholders focusing on niche gluten-free categories such as beverages, snacks, and dairy substitutes can carve out profitable segments in the marketplace with fewer competitors.

At DigiRoads Research, we emphasize reliability by employing robust market estimation and data validation methodologies. Our insights are further enhanced by our proprietary data forecasting model, which projects market growth trends up to 2030. This forward-thinking approach ensures our analysis not only captures the current market landscape but also anticipates future developments, equipping stakeholders with actionable foresight.

We go a step further by offering an exhaustive set of regional and country-level data points, supplemented by over 60 detailed charts at no additional cost. This commitment to transparency and accessibility allows stakeholders to gain a deep understanding of the industry’s structural and operational dynamics. By providing exclusive and hard-to-access data, DigiRoads Research empowers businesses to make informed strategic decisions with confidence.

In essence, our methodology and data delivery foster a collaborative and data-driven decision-making environment, enabling businesses to navigate industry challenges and capitalize on opportunities effectively.

Contact Us For More Inquiry.

Table of Contents

INTRODUCTION

- Market Overview

- Years Considered for Study

- Market Segmentation

- Study Assumptions and Definitions

- Market Scope

RESEARCH METHODOLOGY

MARKET OUTLOOK

- Executive Summary

- Market Snapshot

- Market Segments

- Beverages:

- Includes gluten-free alcoholic and non-alcoholic drinks catering to health trends.

- Bread Products:

- Gluten-free bread and bakery items popular among health-conscious consumers.

- Cookies & Snacks:

- Gluten-free cookies, biscuits, and snacks driving market demand.

- Beverages:

COMPETITIVE LANDSCAPE

- Recent Strategies (Key Strategic Moves)

- Market Share Analysis

- Company Profiles

- Bob’s Red Mill

- Dr. Schar

- General Mills Inc.

- Brazi Bites

- H.J. Heinz Company

- Raisio PLC

- Hero Group AG

MARKET DYNAMICS

- Market Drivers

- Market Challenges

- Market Opportunities

- Porter’s Five Forces’ Analysis

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Threat of New Entrant

- Threat of Substitutes

- Competitive Rivalry

GLOSSARY OF PROMINENT SECONDARY SOURCES

DISCLAIMER

ABOUT US