Europe Organic Food and Beverages Market

- Brand: DigiRoads

Discover the 100+ page report on the Europe Organic Food and Beverages Market, providing insights into trends, growth drivers, and the competitive landscape. Available in PDF and Excel formats for easy access to detailed data and analysis.

Europe Organic Food and Beverages Market Report | Market Size, Industry Analysis, Growth Opportunities, & Forecast (2025-2030)

Europe Organic Food and Beverages Market Overview

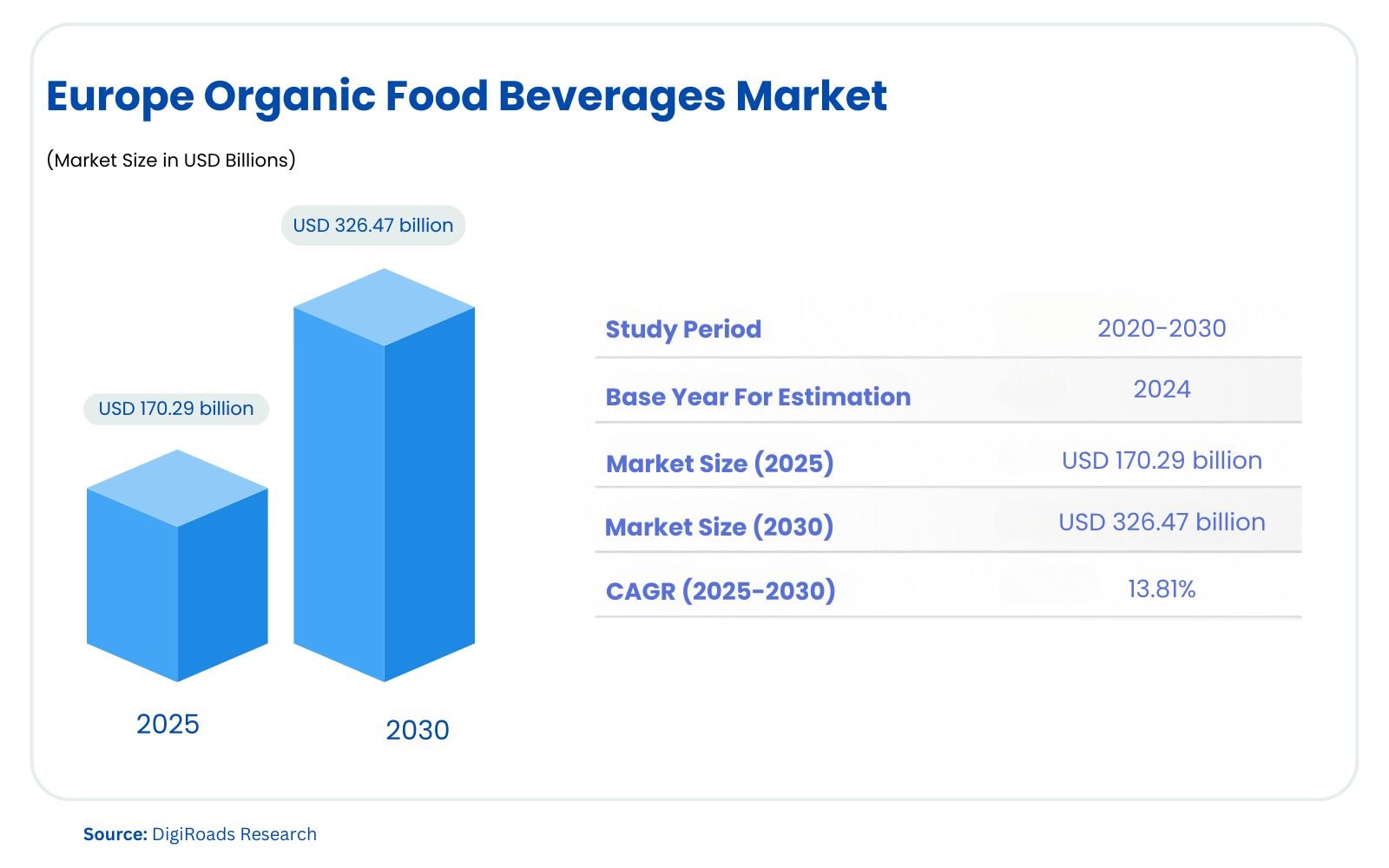

The Europe Organic Food and Beverages Market is experiencing remarkable growth, with a projected market size of USD 170.29 billion in 2025. It is anticipated to expand further, reaching USD 326.47 billion by 2030, driven by a robust CAGR of 13.81% during the forecast period 2025-2030. The Europe Organic Food and Beverages Market is projected to experience significant growth from 2025 to 2030. With increasing consumer demand for natural, healthy products, organic food and beverages are gaining popularity across the region. Rising health consciousness, coupled with a growing awareness of environmental sustainability, is driving the shift toward organic offerings in both food and beverages.

Key segments include organic fruits and vegetables, dairy products, meat, fish, poultry, and frozen & processed foods, along with organic alcoholic and non-alcoholic beverages such as juices, tea, coffee, and wine. Supermarkets and hypermarkets remain dominant distribution channels, while online retailing is gaining traction among consumers seeking convenience and variety.

Leading companies like General Mills, Nestlé, Danone, and Amy’s Kitchen are heavily investing in product innovation, partnerships, and regional expansions to cater to the increasing demand for organic options. As consumer preferences continue to evolve, the market is expected to grow at a strong CAGR, reaching a forecasted value of USD 326.47 billion by 2030. The demand for transparency in food production and the push for sustainable practices will further shape the future of the European organic food and beverages market.

This report provides an in-depth analysis of the market trends, drivers, and forecasts, offering valuable insights for stakeholders looking to tap into the growing organic food sector.

Market Report Coverage:

The “Europe Organic Food and Beverages Market Report—Future (2025-2030)” by Digiroads Research & Consulting covers an in-depth analysis of the following segments in the market.

| Product Type | Organic Foods (Fruits & Vegetables, Meat, Dairy, Frozen, Other), Organic Beverages (Alcoholic: Wine, Beer, Spirits; Non-alcoholic: Juices, Dairy Beverages, Coffee, Tea, Carbonated, Other) |

| Distribution Channel | Supermarkets/Hypermarkets, Convenience Stores, Specialist Stores, Online Retailing, Other Channels |

| Geography | United Kingdom, France, Germany, Italy, Russia, Spain, Rest of Europe |

Study Assumptions and Definitions

This report on the Europe Organic Food and Beverages Market is based on several key assumptions. The market sizing, trends, and forecasts are derived from historical data, expert insights, and industry analysis. It is assumed that the market will continue to experience growth driven by the rising consumer demand for organic products, sustainability concerns, and increasing health consciousness. The data presented is projected for the years 2025–2030, with particular focus on key regions including the United Kingdom, France, Germany, Italy, Russia, Spain, and the rest of Europe.

Definitions:

- Organic Food: Products that are grown without the use of synthetic pesticides, fertilizers, or genetically modified organisms (GMOs). These include organic fruits, vegetables, meats, dairy, and processed foods.

- Organic Beverages: Beverages made from organically grown ingredients, encompassing both alcoholic (e.g., organic wines, beers, and spirits) and non-alcoholic drinks (e.g., juices, dairy beverages, coffee, tea).

- Distribution Channels: Refers to the methods through which organic food and beverages reach consumers, including supermarkets, hypermarkets, convenience stores, specialist stores, and online retailing.

The report’s assumptions and definitions aim to offer a clear understanding of the market dynamics, ensuring a consistent and reliable framework for analysis.

Market Scope

The scope of this report covers a comprehensive analysis of the Europe Organic Food and Beverages Market from 2025 to 2030. It examines the market dynamics, including growth drivers, challenges, and trends, to provide a detailed understanding of the evolving organic sector. The report focuses on key product segments such as organic foods (fruits and vegetables, dairy, meat, fish, poultry, and processed foods) and organic beverages (both alcoholic and non-alcoholic, including juices, coffee, tea, and carbonated beverages). Additionally, it evaluates the market by distribution channels, covering supermarkets, convenience stores, specialist stores, and online retailing. Geographic analysis is also a significant aspect, with in-depth insights into key regions such as the United Kingdom, France, Germany, Italy, Russia, Spain, and the Rest of Europe. The report provides market sizing, forecasts, and strategic insights to help stakeholders understand opportunities and plan for future growth in the European organic food and beverage sector.

MARKET OUTLOOK

Executive Summary

The Europe Organic Food and Beverages Market is poised for robust growth from 2025 to 2030, driven by increasing consumer demand for healthier and more sustainable food options. The market, valued at approximately USD 170.29 billion in 2025, is projected to grow at a significant CAGR of 13.81%, reaching an estimated USD 326.47 billion by 2030. This growth is propelled by rising health consciousness, environmental concerns, and a growing preference for products free from pesticides, synthetic chemicals, and genetically modified organisms (GMOs).

The market is segmented into organic foods and organic beverages. The organic food segment includes fruits and vegetables, dairy products, meat, fish, poultry, and frozen and processed foods, with organic fruits and vegetables leading the segment. Organic beverages are categorized into alcoholic (wine, beer, spirits) and non-alcoholic options such as juices, coffee, tea, and carbonated beverages. Non-alcoholic beverages are expected to witness high growth due to the increasing demand for natural and health-oriented drinks.

Key distribution channels include supermarkets/hypermarkets, convenience stores, specialist stores, and online retailing, with online platforms gaining traction due to the convenience of home delivery and the expanding digital shopper base. Geographically, the United Kingdom, France, Germany, and Italy are key markets, with strong growth anticipated across Europe, driven by an expanding organic food and beverage consumer base.

The competitive landscape is dominated by leading players like General Mills, Nestlé, Danone, Amy’s Kitchen, and The Hain Celestial Group. These companies are adopting strategies such as product innovations, acquisitions, and collaborations to strengthen their market presence.

This report offers detailed insights into the market dynamics, trends, and forecasts, helping stakeholders navigate the evolving organic food and beverage sector in Europe.

COMPETITIVE LANDSCAPE

The Europe Organic Food and Beverages Market is moderately fragmented, with regional and multinational players competing fiercely for market share.

Key Market Players

- General Mills, Inc.

- Nestlé S.A.

- Danone S.A. (The WhiteWave Foods Company)

- Amy’s Kitchen, Inc.

- The Hain Celestial Group, Inc.

- Clipper Teas

- Starbucks Corporation

- Sasma BV

- Narayan Foods

- PureOrganic Drinks Limited

Market Share Analysis

The Europe Organic Food and Beverages Market is highly competitive, with several major players holding significant market shares. As of recent market trends, companies like General Mills, Inc., Nestlé S.A., Danone S.A., Amy’s Kitchen, Inc., and The Hain Celestial Group, Inc. dominate the market. These key players focus on expanding their product portfolios and investing in organic ingredients to meet the growing demand for healthy, sustainable options.

General Mills and Nestlé lead in the organic food and beverage sector, leveraging their extensive distribution networks and brand recognition. Danone’s acquisition of WhiteWave Foods has strengthened its position in the organic dairy and plant-based product segments. Meanwhile, Amy’s Kitchen and The Hain Celestial Group focus on organic ready-to-eat foods and snacks, which are gaining popularity among health-conscious consumers.

In terms of market segmentation, organic beverages (both alcoholic and non-alcoholic) are witnessing significant growth, driven by consumer preferences for natural ingredients and health-conscious choices. Distribution channels like supermarkets, online retail, and specialist stores are increasingly prominent, with e-commerce playing a crucial role in driving organic product sales.

Overall, the market is expected to grow steadily, with these leading companies maintaining their dominance while capitalizing on evolving consumer demands for healthier, organic food and beverages.

MARKET DYNAMICS

Market Drivers and Key Innovations

The Europe Organic Food and Beverages Market is driven by several key factors, with growing consumer demand for healthier, sustainable, and environmentally friendly products being one of the most significant drivers. Consumers are increasingly aware of the health benefits associated with organic foods, including reduced pesticide exposure, higher nutritional value, and fewer artificial additives. This trend towards health-conscious living is fueling the demand for organic products across various segments, including fruits, vegetables, dairy, and beverages.

Additionally, the rising concerns about environmental sustainability are encouraging consumers to choose organic products, which are perceived to be more eco-friendly due to lower levels of chemical usage in production. The shift towards plant-based diets is also contributing to the market’s growth, especially in the organic beverage segment, with consumers seeking plant-based alternatives to dairy and meat.

Key innovations in the market include the development of new organic product lines and the introduction of organic ready-to-eat meals, snacks, and beverages. Companies like The Hain Celestial Group and Amy’s Kitchen are innovating with organic snack offerings, while MeliBio’s plant-based honey, introduced through a partnership with Narayan Foods, is an example of innovation in the organic food sector. Additionally, advancements in organic beverage options, including non-alcoholic and alcoholic drinks, are catering to the increasing demand for healthy and sustainable choices. Innovations in packaging, with eco-friendly materials and sustainable production methods, are also helping companies meet consumer preferences for environmentally conscious brands.

Overall, these drivers and innovations are expected to support the continued growth of the Europe Organic Food and Beverages Market through 2030.

Market Challenges

- High Costs: Organic products are typically more expensive than conventional products due to the higher production and certification costs, making it difficult for some consumers to afford them.

- Supply Chain Limitations: The limited availability of organic raw materials and the complexities of organic farming methods can lead to supply chain disruptions and challenges in meeting rising consumer demand.

- Certification and Regulation Issues: Navigating the complex certification and regulatory requirements for organic products can be challenging for new and smaller companies, potentially limiting market entry.

- Market Fragmentation: The market for organic products is highly fragmented, with numerous small and local players competing against large multinational corporations, making it difficult for companies to differentiate themselves.

- Consumer Education: Despite growing demand, there is still a lack of awareness and understanding among some consumers about the benefits of organic products, which can limit market growth.

- Counterfeit and Mislabeling: Some products are falsely labeled as organic or do not meet organic standards, which can undermine consumer trust and hinder market expansion.

- Seasonality and Limited Availability: Organic produce is often subject to seasonality and limited availability, which can cause fluctuations in supply and pricing, affecting product consistency.

- Intense Competition: The increasing number of brands entering the organic food and beverages sector makes it difficult for companies to maintain a competitive edge and grow market share.

Market Opportunities

- Growing Consumer Health Consciousness: The increasing awareness of health and wellness among European consumers is driving demand for organic products, as they are perceived as healthier and more sustainable.

- Rising Demand for Sustainable Products: As environmental concerns grow, consumers are shifting towards organic food and beverages due to their eco-friendly production processes, presenting a significant opportunity for market growth.

- Expansion of Online Retail: The rise in e-commerce and online grocery shopping provides an opportunity for organic food and beverage brands to reach a broader customer base and offer convenient shopping experiences.

- Product Innovation and Diversification: There is significant potential for growth in product innovation, such as plant-based organic beverages, functional foods, and organic snacks, catering to changing consumer preferences.

- Government Support and Incentives: Increased support from European governments, including subsidies and incentives for organic farming, is likely to encourage more farmers to adopt organic practices, expanding product availability.

- Premium Product Segments: There is a growing demand for premium organic products, including organic wines, dairy, and specialty foods, offering companies opportunities to target affluent consumer segments.

- Expanding Distribution Channels: Companies can tap into emerging distribution channels like specialty stores, health food shops, and organic-focused supermarkets to cater to growing demand.

- Rising Popularity of Organic Beverages: The growing interest in organic non-alcoholic beverages such as fruit juices, coffee, and plant-based milk presents opportunities for beverage manufacturers to introduce new, organic offerings.

RECENT STRATEGIES & DEVELOPMENTS IN THE MARKET

Strategic Partnerships and Acquisitions:

- In November 2022, MeliBio, the first company to produce real honey without bees, raised USD 2.2 million and partnered with Narayan Foods to sell plant-based honey across 75,000 European stores. This collaboration demonstrates the expansion of plant-based organic products into the European market.

Expansion of Online Sales Channels:

- In November 2022, Ocado and Planet Organic began offering allplants’ plant-based meals, such as Protein Powder Buddha Bowl and Truffle Mushroom Orzo, through their online and supermarket channels. This highlights the growing importance of e-commerce and online retailing for organic food and beverage brands.

Product Innovations:

- In July 2021, The Hain Celestial Group launched several organic innovations, including Celestial Seasonings Cold Brew Iced Tea in five flavors and Garden Veggie Puffs made with non-GMO ingredients. These products reflect the trend toward healthier, organic snack and beverage options.

Introduction of Organic Teas:

- Clipper Teas, a leading brand in organic beverages, introduced a range of new organic tea options, tapping into the growing preference for natural, organic ingredients in the European beverage market.

Sustainability Initiatives:

- Major companies, such as Nestlé S.A. and Danone S.A., are increasingly focusing on sustainable sourcing practices for their organic product lines. These initiatives are in response to rising consumer demand for eco-friendly and ethically sourced food and beverages.

Focus on Health-Conscious Products:

- Amy’s Kitchen and The Hain Celestial Group have been expanding their product portfolios to include more organic, gluten-free, and plant-based offerings, responding to the rising trend of health-conscious consumer behavior across Europe.

These developments demonstrate the dynamic evolution of the market and how companies are leveraging partnerships, innovations, and sustainability efforts to capture consumer attention and expand market presence.

KEY BENEFITS FOR STAKEHOLDERS

Access to Growing Market:

- Stakeholders such as producers, distributors, and retailers can tap into the rapidly growing organic food and beverages market, expected to reach USD 326.47 billion by 2030, benefiting from the increasing demand for healthier and sustainable options.

Increased Profitability:

- As consumer demand shifts towards organic products, companies offering organic food and beverages can achieve higher profit margins due to premium pricing and consumer willingness to pay more for organic and ethically sourced products.

Strategic Partnerships and Collaborations:

- Stakeholders can benefit from forming partnerships, such as the collaboration between MeliBio and Narayan Foods, to access wider distribution networks and enhance their product offerings with innovative organic solutions, expanding their reach across Europe.

Sustainability and Brand Image:

- Companies focusing on organic products and sustainable practices improve their brand image, attracting environmentally conscious consumers and meeting the growing demand for eco-friendly, ethically produced goods.

Diversification Opportunities:

- Retailers and distributors can diversify their product portfolios by incorporating organic food and beverage offerings, meeting the rising consumer preference for plant-based and organic food options across different categories (fruits, vegetables, beverages, snacks).

Regulatory Support:

- Governments in Europe are increasingly implementing policies that promote organic farming and sustainable practices, offering potential incentives and support for companies involved in organic food production, making it a favorable environment for market growth.

Innovation in Product Development:

- With the demand for healthier options on the rise, stakeholders can invest in the development of innovative organic products, leveraging trends such as plant-based foods, organic beverages, and gluten-free options, aligning with consumer preferences for health-focused alternatives.

These benefits create substantial growth opportunities for various stakeholders involved in the European organic food and beverages market, fostering a profitable, sustainable, and competitive environment.

At DigiRoads Research, we emphasize reliability by employing robust market estimation and data validation methodologies. Our insights are further enhanced by our proprietary data forecasting model, which projects market growth trends up to 2030. This forward-thinking approach ensures our analysis not only captures the current market landscape but also anticipates future developments, equipping stakeholders with actionable foresight.

We go a step further by offering an exhaustive set of regional and country-level data points, supplemented by over 60 detailed charts at no additional cost. This commitment to transparency and accessibility allows stakeholders to gain a deep understanding of the industry’s structural and operational dynamics. By providing exclusive and hard-to-access data, DigiRoads Research empowers businesses to make informed strategic decisions with confidence.

In essence, our methodology and data delivery foster a collaborative and data-driven decision-making environment, enabling businesses to navigate industry challenges and capitalize on opportunities effectively.

Contact Us For More Inquiry.

Table of Contents

-

INTRODUCTION

- Market Overview

- Years Considered for Study

- Market Segmentation

- Study Assumptions and Definitions

- Market Scope

-

RESEARCH METHODOLOGY

-

MARKET OUTLOOK

- Executive Summary

- Market Snapshot

- Market Segments

- Product Type:

- Organic Foods (Fruits & Vegetables, Meat, Dairy, Frozen, Other), Organic Beverages (Alcoholic: Wine, Beer, Spirits; Non-alcoholic: Juices, Dairy Beverages, Coffee, Tea, Carbonated, Other)

- Distribution Channel:

- Supermarkets/Hypermarkets, Convenience Stores, Specialist Stores, Online Retailing, Other Channels

- Geography:

- United Kingdom, France, Germany, Italy, Russia, Spain, Rest of Europe

- Product Type:

-

COMPETITIVE LANDSCAPE

- Recent Strategies (Key Strategic Moves)

- Market Share Analysis

- Company Profiles

- General Mills, Inc.

- Nestlé S.A.

- Danone S.A. (The WhiteWave Foods Company)

- Amy’s Kitchen, Inc.

- The Hain Celestial Group, Inc.

- Clipper Teas

- Starbucks Corporation

- Sasma BV

- Narayan Foods

- PureOrganic Drinks Limited

-

MARKET DYNAMICS

- Market Drivers

- Market Challenges

- Market Opportunities

- Porter’s Five Forces’ Analysis

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Threat of New Entrant

- Threat of Substitutes

- Competitive Rivalry

-

GLOSSARY OF PROMINENT SECONDARY SOURCES

-

DISCLAIMER

-

ABOUT US