No products in the cart.

Europe Specialty Food Ingredients Market

- Brand: DigiRoads

Discover the 100+ page report on the Europe Specialty Food Ingredients Market, providing insights into trends, growth drivers, and the competitive landscape. Available in PDF and Excel formats for easy access to detailed data and analysis.

Category: Food and Beverage

Brand: DigiRoads

Europe Specialty Food Ingredients Market Report | Market Size, Industry Analysis, Growth Opportunities, & Forecast (2025-2030)

Europe Specialty Food Ingredients Market Overview

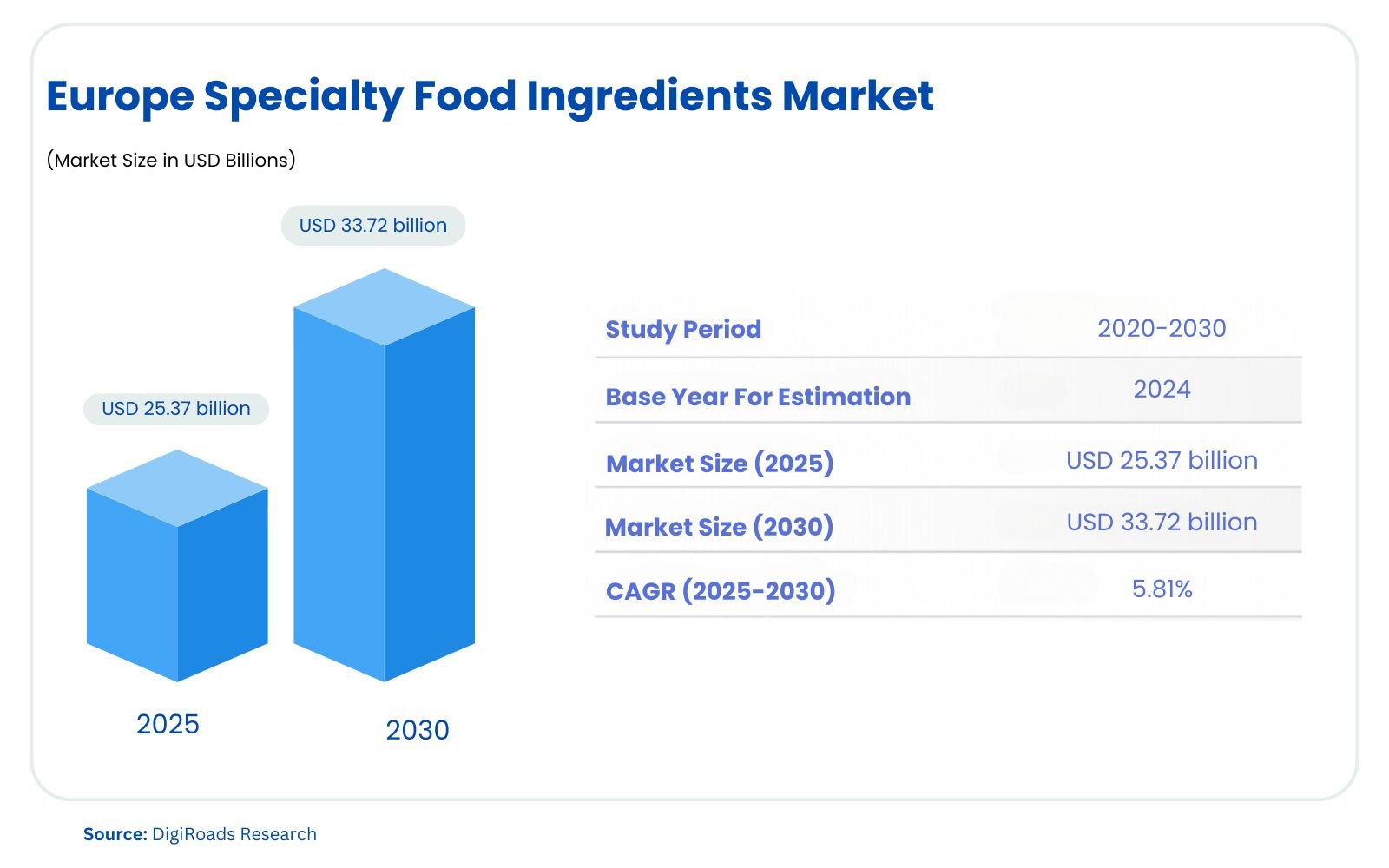

The Europe Specialty Food Ingredients Market is on a steady growth trajectory, with an estimated market size of USD 25.37 billion in 2025. It is projected to reach USD 33.72 billion by 2030, expanding at a CAGR of 5.81% during the forecast period 2025-2030. This growth is fueled by the increasing consumer demand for healthier, natural, and clean-label food products. Specialty ingredients such as sweeteners, emulsifiers, preservatives, and enzymes are gaining popularity for their ability to enhance food and beverage texture, nutritional value, and flavor. As more consumers seek products with organic, non-GMO, and natural claims, food manufacturers are turning to specialty ingredients to meet these preferences.

Germany leads the market, bolstered by its strong food processing industry and growing demand for functional ingredients in baked goods, dairy, and beverages. The rise of plant-based diets and the increasing trend for convenient, processed foods are further driving the need for specialty food ingredients across Europe. Major players such as Cargill, Tate & Lyle, Kerry Group, and Givaudan are strategically innovating and expanding their portfolios to capture this growing demand. As advancements in food technology and consumer preferences evolve, the Europe Specialty Food Ingredients Market is set to grow steadily over the forecast period, offering new opportunities for both local and global market players.

Market Report Coverage:

The “Europe Specialty Food Ingredients Market Report—Future (2025-2030)” by Digiroads Research & Consulting covers an in-depth analysis of the following segments in the market.

| By Ingredient Type | Functional Food Ingredients, Specialty Starch and Texturants, Sweeteners, Flavors, Acidulants, Preservatives, Emulsifiers, Colors, Enzymes, Cultures, Proteins, Specialty Oils, Yeasts |

| By Application | Beverages, Sauces, Dressings, and Condiments, Bakery, Dairy, Confectionery, Dried Processed Foods, Frozen/Chilled Processed Foods, Sweet and Savory Snacks, Other Applications |

| By Country | Spain, United Kingdom, France, Germany, Russia, Italy, Rest of Europe |

Study Assumptions and Definitions

This report on the Europe Specialty Food Ingredients Market is based on key assumptions and definitions that ensure a comprehensive understanding of the market dynamics. The market size and growth projections are derived from current trends, historical data, and forecasted scenarios for the period from 2025 to 2030. It is assumed that the demand for specialty food ingredients will continue to increase due to consumer preference for clean-label, natural, and health-conscious food products. Additionally, the ongoing advancements in food technology, such as fermentation and molecular gastronomy, are expected to drive market growth during the forecast period.

Specialty food ingredients are defined as ingredients used in food production to provide specific functional benefits, such as flavor, texture, and nutritional enhancement. These include sweeteners, emulsifiers, preservatives, enzymes, proteins, and colorants, among others. The report covers ingredients across a wide range of applications including beverages, bakery, dairy, sauces, dressings, and snacks. Geographically, the study focuses on key European markets, including Germany, the United Kingdom, France, and Italy, with a special emphasis on both established and emerging markets in the region. The study considers data from both global and regional players to gauge competitive landscape trends.

Market Scope

The scope of the Europe Specialty Food Ingredients Market report covers a detailed analysis of the market trends, drivers, challenges, and opportunities from 2025 to 2030. It focuses on the demand for specialty food ingredients across various segments, including functional food ingredients, sweeteners, flavors, emulsifiers, preservatives, and enzymes. The report examines the market’s role in diverse applications, such as beverages, bakery, dairy, confectionery, and frozen processed foods. It also highlights the growing consumer preference for natural, clean-label ingredients, driven by the rise in health-consciousness and plant-based diets.

Geographically, the study covers key European markets, including Germany, the United Kingdom, France, Italy, and Spain, along with the rest of Europe. The competitive landscape is analyzed with major players like Cargill, Kerry Group, and DSM, focusing on strategies like product innovation, partnerships, and market expansions. This report provides comprehensive insights for businesses and stakeholders looking to invest in or expand their operations in the specialty food ingredients sector.

MARKET OUTLOOK

Executive Summary

The Europe Specialty Food Ingredients Market is set to expand at a CAGR of 5.81%, reaching USD 33.72 billion by 2030. This growth is driven by the increasing consumer demand for natural, clean-label, and functional ingredients in food products, propelled by a rising health-conscious population and the growing popularity of plant-based diets. Key trends such as the demand for low-sugar alternatives, healthier food choices, and the ongoing shift toward sustainable production methods are shaping the market’s landscape.

Specialty food ingredients play an integral role in enhancing the flavor, texture, and nutritional profile of food products. They are widely used in a variety of applications, including beverages, bakery, dairy, confectionery, and processed foods. Functional ingredients, sweeteners, flavors, emulsifiers, and enzymes are among the most sought-after segments, reflecting the demand for healthier, innovative food solutions. Additionally, the increased focus on clean-label products and transparency in ingredient sourcing is pushing food manufacturers to explore natural preservatives and other minimally processed ingredients.

The market is characterized by the presence of both global and regional players, including industry giants such as Cargill, Kerry Group, DSM, Givaudan, and Tate & Lyle. These companies are adopting strategies such as mergers and acquisitions, product innovation, and geographical expansions to strengthen their market presence and meet evolving consumer preferences.

Geographically, Germany, the United Kingdom, and France are the largest markets, with rising demand in other regions, including Spain and Italy. Despite the opportunities, the market faces challenges such as regulatory hurdles and price fluctuations of raw materials. However, ongoing advancements in food technology, such as fermentation and molecular gastronomy, are expected to fuel the market’s growth during the forecast period.

COMPETITIVE LANDSCAPE

The Europe Specialty Food Ingredients Market is moderately fragmented, with regional and multinational players competing fiercely for market share.

Key Market Players

- Cargill Inc.

- Archer Daniels Midland Company (ADM)

- International Flavors & Fragrances Inc. (IFF)

- Kerry Group

- Givaudan SA

- Koninklijke DSM NV

- Ingredion Incorporated

- Sensient Technologies

- Advanced Enzyme Technologies Limited

- Tate & Lyle PLC

Market Share Analysis

The Europe Specialty Food Ingredients Market is characterized by a competitive landscape with several dominant players capturing significant market share. Among the key market leaders are Cargill Inc., Archer Daniels Midland Company (ADM), International Flavors & Fragrances Inc. (IFF), Kerry Group, and Givaudan SA, which collectively hold a substantial portion of the market. These companies maintain their dominance through innovation, a wide product portfolio, and strategic investments in R&D to address the rising consumer demand for clean-label and natural ingredients.

In recent years, companies like Tate & Lyle PLC and Ingredion Incorporated have strengthened their positions by expanding product offerings in categories like sweeteners, emulsifiers, and natural flavors. Additionally, Sensient Technologies and Koninklijke DSM NV have leveraged their capabilities in specialty colors and enzymes to cater to growing demand in the beverage and dairy sectors.

The market share distribution is also influenced by regional preferences, with Germany being a major consumer, followed by the United Kingdom and France. The growing acceptance of functional foods and natural ingredients across Europe has prompted key players to focus on product diversification and regional expansion, securing a competitive edge.

Overall, the market remains fragmented with both global and regional players contributing to the evolving trends in the specialty food ingredients sector. The competitive environment continues to foster innovation, pushing companies to introduce advanced, health-conscious food solutions.

MARKET DYNAMICS

Market Drivers and Key Innovations

The Europe Specialty Food Ingredients Market is driven by several key factors that reflect changing consumer preferences and industry dynamics. The growing demand for clean-label, organic, and natural food products is a primary driver. Consumers are increasingly seeking foods with fewer artificial ingredients, leading to a higher demand for natural preservatives, emulsifiers, sweeteners, and colorants. This shift toward health-conscious and sustainable choices is also spurred by the rising awareness of food additives’ potential health risks.

The popularity of plant-based diets is another significant driver. As more consumers embrace plant-based foods, the demand for plant-derived specialty ingredients, such as plant-based emulsifiers and proteins, continues to rise. Additionally, the increasing interest in functional foods, which offer health benefits beyond basic nutrition, further propels the market. These foods often include ingredients like probiotics, prebiotics, and functional fibers, catering to the growing need for digestive health and wellness.

Key innovations are shaping the market’s future. Companies are heavily investing in research and development to introduce new ingredients that meet evolving consumer needs. For example, Tate & Lyle launched Optimizer Stevia 8.10, a cost-effective stevia variant designed to provide a sugar-like taste at high replacement ratios. Moreover, advancements in enzyme technology, like cellulase and glucoamylase, are enhancing product yields in brewing and alcohol production. In addition, natural fermentation techniques and molecular gastronomy are being employed to create innovative taste profiles and textures. These innovations not only align with consumer demand but also enable food manufacturers to stay competitive in the dynamic market.

Market Challenges

- Regulatory Hurdles: The food ingredients industry faces strict regulatory guidelines, which vary across European countries. Navigating these regulations and ensuring compliance can be a complex and time-consuming process for market players.

- Price Fluctuations: Volatility in raw material prices, especially for natural ingredients like plant-based proteins and sweeteners, can affect production costs and profit margins for manufacturers.

- Health Risks of Food Additives: While specialty food ingredients are widely used, there is growing concern about the potential health risks associated with certain additives. This could lead to stricter regulations or decreased consumer demand for certain products.

- Consumer Misinformation: There is a high level of consumer scrutiny regarding food ingredients. Incorrect or misleading information about the benefits of certain ingredients can lead to a loss of trust, impacting demand.

- Supply Chain Disruptions: Global supply chain issues, including transportation delays and disruptions caused by geopolitical factors, can impact the availability of essential raw materials and lead to production bottlenecks.

- Intense Competition: The market is highly fragmented with both regional and global players. Companies face intense competition from established brands, making it difficult to maintain market share and pricing power.

- Environmental Concerns: The growing focus on sustainability poses challenges for ingredient suppliers to develop eco-friendly, responsibly sourced ingredients that meet both consumer expectations and environmental regulations.

Market Opportunities

- Growing Demand for Clean-Label Products: Consumers increasingly seek transparency in food labeling, favoring products with natural and organic ingredients. This trend presents an opportunity for manufacturers to innovate with clean-label specialty food ingredients.

- Health and Wellness Trends: The rising focus on healthy eating provides significant opportunities for ingredients like functional foods, natural sweeteners, probiotics, and plant-based alternatives. These ingredients align with the growing demand for health-conscious food options.

- Expansion of Plant-Based Foods: The increasing popularity of plant-based diets creates opportunities for specialty ingredients like plant-based proteins, emulsifiers, and flavors to cater to the vegan and vegetarian market.

- Technological Advancements: The development of advanced food processing technologies, such as fermentation, molecular gastronomy, and ingredient encapsulation, provides opportunities for creating novel and refined ingredients that meet evolving consumer preferences.

- Rising Demand for Convenience Foods: The growth in demand for ready-to-eat, processed, and convenience foods opens up opportunities for specialty ingredients to enhance food safety, shelf life, and nutritional value.

- Sustainability and Ethical Sourcing: Growing consumer interest in sustainability presents opportunities for manufacturers to capitalize on eco-friendly, responsibly sourced ingredients, which could become a major differentiator in the market.

- Expansion in Emerging Markets: As demand for processed and packaged food increases in emerging European markets, there are opportunities for global and regional players to expand their presence and capitalize on untapped consumer segments.

RECENT STRATEGIES & DEVELOPMENTS IN THE MARKET

Product Innovation:

- Tate & Lyle launched Optimizer Stevia 8.10 in August 2024, a budget-friendly sweetener alternative that closely mimics the taste of sugar. This product is designed to meet the demand for sugar reduction in food and beverage manufacturing.

Technological Advancements:

- Cargill introduced Genuine Zero, a sugar-free chocolate product, in February 2024, targeting the industrial confectionery, bakery, and ice cream sectors. The chocolate is sweetened with EverSweet and is free of lactose, making it suitable for lactose-intolerant consumers.

Strategic Partnerships and Acquisitions:

- Kerry Group expanded its portfolio with the acquisition of Ojah, a leading supplier of plant-based proteins. This acquisition enhances Kerry’s position in the growing plant-based food sector and strengthens its ability to meet consumer demand for sustainable food options.

Sustainability Initiatives:

- DSM has focused on sustainability by launching new plant-based emulsifiers and promoting its commitment to sustainable sourcing of ingredients. This move aligns with the rising consumer preference for environmentally-friendly and ethically sourced food products.

Expansion of Product Offerings:

- BASF Aroma Ingredients enhanced its Isobionics portfolio by introducing two new natural flavors: Isobionics Natural alpha-Bisabolene 98 and Isobionics Natural (-)-alpha-Bisabolol 99 in 2023. These new offerings cater to the increasing demand for natural ingredients in flavor and fragrance products.

Market Penetration in Emerging Regions:

- International Flavors & Fragrances Inc. (IFF) has expanded its presence in Eastern Europe, capitalizing on the rising demand for processed foods and beverages. This move helps the company tap into growing markets like Poland, Romania, and Hungary.

Clean-Label and Functional Ingredients Focus:

- Givaudan has intensified its focus on clean-label and functional ingredients with innovations in health-enhancing products. They have expanded their portfolio with probiotics and plant-based emulsifiers to cater to the demand for natural and health-conscious food options.

KEY BENEFITS FOR STAKEHOLDERS

- Market Expansion: Stakeholders can benefit from access to the rapidly growing demand for specialty food ingredients in Europe, particularly with the increasing focus on health-conscious, sustainable, and clean-label food products.

- Innovation Opportunities: Companies can capitalize on the growing trend of product innovation, especially in the areas of sugar reduction, plant-based foods, and natural ingredients. This presents a significant opportunity for differentiation in a competitive market.

- Increased Consumer Demand: With changing consumer preferences towards healthier, functional, and natural food products, stakeholders have the opportunity to develop and market ingredients that meet these evolving needs.

- Strategic Partnerships: Through partnerships, acquisitions, or collaborations, stakeholders can enhance their product offerings and gain access to new markets, thereby strengthening their competitive advantage and fostering innovation.

- Sustainability Focus: Stakeholders can leverage the growing demand for sustainable and ethically sourced ingredients to align their businesses with consumer and regulatory expectations. This helps in boosting brand loyalty and reputation.

- Data-Driven Decision Making: The increasing availability of market insights and analytics allows stakeholders to make informed decisions, optimize their strategies, and mitigate risks in the dynamic specialty food ingredient market.

- Regulatory Compliance: As regulations around food safety, labeling, and sustainability become more stringent, stakeholders can benefit from ensuring compliance with these evolving standards, enhancing their market presence and trust with consumers.

At DigiRoads Research, we emphasize reliability by employing robust market estimation and data validation methodologies. Our insights are further enhanced by our proprietary data forecasting model, which projects market growth trends up to 2030. This forward-thinking approach ensures our analysis not only captures the current market landscape but also anticipates future developments, equipping stakeholders with actionable foresight.

We go a step further by offering an exhaustive set of regional and country-level data points, supplemented by over 60 detailed charts at no additional cost. This commitment to transparency and accessibility allows stakeholders to gain a deep understanding of the industry’s structural and operational dynamics. By providing exclusive and hard-to-access data, DigiRoads Research empowers businesses to make informed strategic decisions with confidence.

In essence, our methodology and data delivery foster a collaborative and data-driven decision-making environment, enabling businesses to navigate industry challenges and capitalize on opportunities effectively.

Contact Us For More Inquiry.

Table of Contents

INTRODUCTION

- Market Overview

- Years Considered for Study

- Market Segmentation

- Study Assumptions and Definitions

- Market Scope

RESEARCH METHODOLOGY

MARKET OUTLOOK

- Executive Summary

- Market Snapshot

- Market Segments

- By Ingredient Type:

- Functional Food Ingredients, Specialty Starch and Texturants, Sweeteners, Flavors, Acidulants, Preservatives, Emulsifiers, Colors, Enzymes, Cultures, Proteins, Specialty Oils, Yeasts

- By Application:

- Beverages, Sauces, Dressings, and Condiments, Bakery, Dairy, Confectionery, Dried Processed Foods, Frozen/Chilled Processed Foods, Sweet and Savory Snacks, Other Applications

- By Country:

- Spain, United Kingdom, France, Germany, Russia, Italy, Rest of Europe

- By Ingredient Type:

COMPETITIVE LANDSCAPE

- Recent Strategies (Key Strategic Moves)

- Market Share Analysis

- Company Profiles

- Cargill Inc.

- Archer Daniels Midland Company (ADM)

- International Flavors & Fragrances Inc. (IFF)

- Kerry Group

- Givaudan SA

- Koninklijke DSM NV

- Ingredion Incorporated

- Sensient Technologies

- Advanced Enzyme Technologies Limited

- Tate & Lyle PLC

MARKET DYNAMICS

- Market Drivers

- Market Challenges

- Market Opportunities

- Porter’s Five Forces’ Analysis

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Threat of New Entrant

- Threat of Substitutes

- Competitive Rivalry

GLOSSARY OF PROMINENT SECONDARY SOURCES

DISCLAIMER

ABOUT US