No products in the cart.

Global Food Allergen Testing Market

- Brand: DigiRoads

Explore the 100+ page report on the Global Food Allergen Testing Market, offering insights into trends, growth drivers, and the competitive landscape. Available in PDF and Excel formats for convenient access to detailed data and analysis.

Category: Food and Beverage

Brand: DigiRoads

Global Food Allergen Testing Market Report | Market Size, Industry Analysis, Growth Opportunities, & Forecast (2025-2030)

Global Food Allergen Testing Market Overview

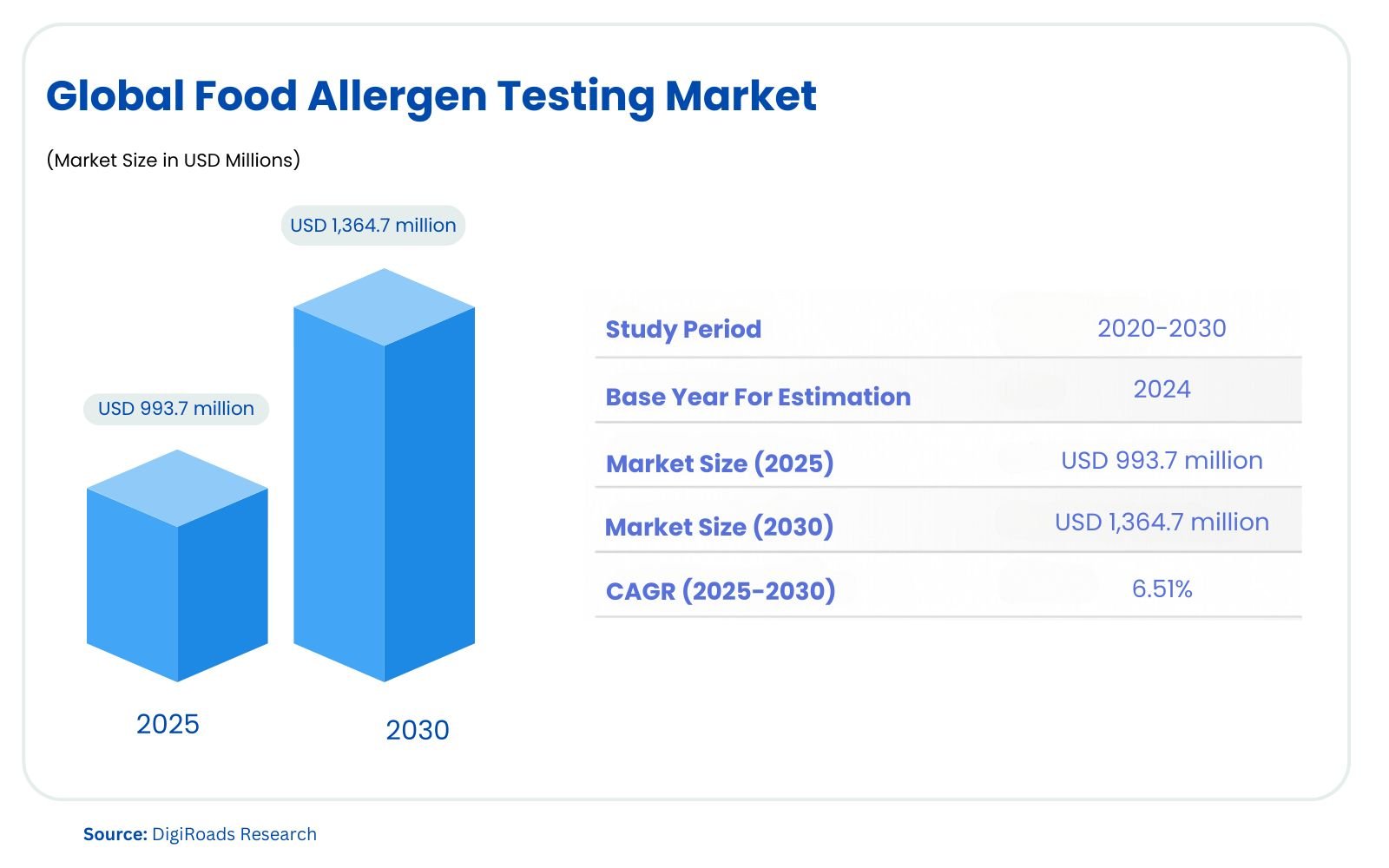

The global Food Allergen Testing Market is witnessing consistent growth, with an estimated market size of USD 993.7 million in 2025, and is projected to reach USD 1,364.7 million by 2030, expanding at a CAGR of 6.51% during the forecast period 2025-2030. The food allergen testing market is witnessing significant growth, driven by rising consumer awareness and increasing cases of food allergies worldwide. This surge is attributed to heightened demand for transparency in food labeling and the adoption of advanced testing technologies.

Food allergen testing ensures safety by detecting allergens like milk, eggs, peanuts, soy, and seafood in food products. Key technologies used include enzyme-linked immunosorbent assays (ELISA), polymerase chain reaction (PCR), and mass spectrometry. The food and beverage industry relies heavily on these tests to meet regulatory standards, prevent cross-contamination, and protect sensitive consumers.

North America leads the market due to strict regulations and increased awareness, while Asia-Pacific shows rapid growth with rising investments in food safety. Notable players, including Eurofins Scientific, SGS SA, and Thermo Fisher Scientific, are introducing innovative solutions to enhance testing accuracy and efficiency.

The global expansion of supply chains and stricter compliance requirements continue to drive market growth, positioning food allergen testing as a critical component of food safety and quality assurance.

Market Report Coverage:

The “Food Allergen Testing Market Report—Future (2025-2030)” by Digiroads Research & Consulting covers an in-depth analysis of the following segments in the market.

| By Technology | Immunoassay-Based, Polymerase Chain Reaction-Based, Biosensors-Based |

| By Source | Milk, Wheat, Egg, Peanut & Soy, Seafood |

| By Food Tested | Dairy Products, Bakery and Confectionery Products, Meat and Poultry, Beverages, Baby Food and Infant Formula |

| By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Study Assumptions and Definitions

This study on the food allergen testing market assumes a comprehensive analysis of the industry’s growth drivers, trends, challenges, and opportunities from 2025 to 2030. It considers market dynamics, including advancements in testing technologies, rising prevalence of food allergies, and stringent regulatory requirements worldwide. The study is based on historical data (2020–2025) and forecasts market behavior through key indicators such as CAGR, market value, and segment-wise growth.

The study assumes a uniform regulatory framework across regions for comparative analysis but acknowledges regional variations in food safety standards. It incorporates data from authoritative sources like the CDC, FDA, WHO, and major market players.

Definitions:

- Food Allergen Testing: Analytical methods used to detect allergens in food products, ensuring safety and regulatory compliance.

- Technologies: Includes immunoassay-based (e.g., ELISA), PCR-based, and biosensor-based methods for detecting allergens.

- Allergens: Substances like milk, eggs, peanuts, soy, and seafood that may cause allergic reactions in sensitive individuals.

- CAGR: Compound Annual Growth Rate, representing market growth over a specified period.

These assumptions and definitions establish a standardized framework to evaluate market trends, providing actionable insights for stakeholders, including manufacturers, regulators, and consumers.

Market Scope

The food allergen testing market encompasses the technologies, methodologies, and services designed to detect and quantify allergens in food products. It spans a wide range of testing solutions, including immunoassay-based (ELISA), polymerase chain reaction (PCR)-based, and biosensor-based methods, to ensure food safety and regulatory compliance.

This market covers various food sources, such as milk, wheat, eggs, peanuts, soy, and seafood, addressing the needs of consumers with allergies and intolerances. It also includes multiple food categories, including dairy products, bakery and confectionery, meat and poultry, beverages, and baby food.

Geographically, the market extends across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, reflecting a global demand for allergen testing solutions driven by increasing consumer awareness and stringent food safety regulations. The market serves food manufacturers, regulatory agencies, and testing laboratories, ensuring allergen-free products and consumer protection.

MARKET OUTLOOK

Executive Summary

The global food allergen testing market is poised for significant growth, projected to increase from USD 993.7 million in 2025 to USD 1,364.7 million by 2030, expanding at a CAGR of 6.51%. This expansion is fueled by rising consumer awareness of food allergies and increasing demand for accurate allergen labeling. Food allergen testing ensures safety and compliance by detecting allergens such as milk, wheat, eggs, peanuts, soy, and seafood in food products, using advanced technologies like ELISA, PCR, and biosensors.

Key drivers of the market include heightened food safety regulations, growing cases of food allergies, and the globalization of food supply chains, which raises the risk of allergen cross-contamination. North America leads the market due to strict regulatory frameworks and high awareness levels, while the Asia-Pacific region is witnessing rapid growth due to rising investments in food safety and the increasing prevalence of allergies.

The dairy segment dominates the market due to the high incidence of milk allergies, while immunoassay-based testing technologies, particularly ELISA, hold the largest share owing to their sensitivity, cost-effectiveness, and widespread adoption.

The competitive landscape is dynamic, with key players such as Eurofins Scientific, SGS SA, Neogen Corporation, and Thermo Fisher Scientific driving innovation. Recent developments include the introduction of multiplex allergen testing platforms and blockchain-based allergen tracking systems.

Despite its growth potential, the market faces challenges such as variability in testing methods, regulatory complexities, and a shortage of trained professionals. However, continuous technological advancements and increased investment in research and development are expected to overcome these hurdles.

In summary, the food allergen testing market is a critical component of the global food safety ecosystem, ensuring compliance, protecting consumer health, and driving innovation in allergen detection and management.

COMPETITIVE LANDSCAPE

The Food Allergen Testing Market is moderately fragmented, with regional and multinational players competing fiercely for market share.

Key Market Players

- Eurofins Scientific

- SGS SA

- Intertek Group plc

- ALS Limited

- Neogen Corporation

- Thermo Fisher Scientific

- Merieux Nutrisciences

- Romer Labs

- Bio-Rad Laboratories

- Quest Diagnostics

Market Share Analysis

The food allergen testing market is characterized by a diverse and competitive landscape, with a few key players dominating the market share while numerous regional and specialized companies contribute to its growth. Companies such as Eurofins Scientific, SGS SA, and Intertek Group plc hold significant market shares due to their global reach, extensive service portfolios, and advanced testing technologies. These players leverage their established expertise and resources to cater to multinational food producers and ensure compliance with stringent international food safety standards.

Neogen Corporation and Thermo Fisher Scientific are among the leading innovators, capturing notable shares with cutting-edge solutions like rapid testing kits and multiplex allergen detection platforms. These companies focus on developing cost-effective, accurate, and scalable technologies to address growing consumer demands and regulatory requirements.

The immunoassay-based testing segment, dominated by ELISA methods, constitutes the largest share due to its reliability and cost-effectiveness. Regionally, North America leads the market, driven by robust food safety regulations and heightened consumer awareness. Asia-Pacific, however, is emerging as the fastest-growing region due to rising food safety investments and increasing prevalence of food allergies.

In summary, market share distribution reflects a blend of technological innovation, regulatory compliance, and regional dynamics, with established players maintaining leadership while emerging firms drive competition.

MARKET DYNAMICS

Market Drivers and Key Innovations

The food allergen testing market is experiencing robust growth due to several driving factors. Key among these is the increasing prevalence of food allergies and intolerances worldwide, particularly in children. Rising consumer awareness about food safety and demand for transparency in ingredient labeling have further spurred the adoption of allergen testing. Regulatory bodies, such as the FDA and EFSA, enforce stringent food labeling and allergen management standards, compelling manufacturers to implement advanced testing procedures to ensure compliance and maintain consumer trust.

Globalization of food supply chains has amplified the risk of allergen cross-contamination, necessitating comprehensive testing solutions. The growth of the food and beverage industry, with innovations in new product development, also fuels demand for allergen testing technologies.

Key innovations in the market focus on improving testing accuracy, speed, and versatility. Immunoassay-based methods, particularly ELISA, dominate due to their sensitivity and cost-effectiveness. Recent advancements include multiplex testing platforms capable of detecting multiple allergens in a single run, blockchain-based allergen tracking systems for supply chain transparency, and rapid test kits for real-time allergen detection.

Companies like Thermo Fisher Scientific and Neogen Corporation lead the way with innovations like allergen-specific antibodies and blockchain integration. Meanwhile, partnerships and mergers among major players accelerate the development of next-generation testing methods.

In summary, the market thrives on rising allergen awareness, regulatory support, and technological breakthroughs, ensuring safer food production and consumer protection globally.

Market Challenges

Complexity in Testing Methods

- Diverse allergens require distinct detection techniques, making standardization difficult.

- Low-level allergen detection and cross-contamination issues complicate testing accuracy.

Regulatory Variability

- Different regions have unique allergen testing regulations, creating compliance challenges for global manufacturers.

- Frequent updates to regulations increase the complexity and cost of adherence.

Limited Trained Personnel

- Advanced testing methods like PCR and mass spectrometry require specialized skills.

- A shortage of qualified professionals hampers testing operations and increases turnaround times.

High Operational Costs

- Advanced allergen testing technologies can be expensive to implement and maintain, particularly for small and medium-sized enterprises.

- Continuous training and infrastructure upgrades add to operational expenses.

Inconsistent Test Reliability

- Variations in testing procedures and equipment can result in inconsistent or inaccurate results.

- Ensuring uniform accuracy across diverse food matrices remains a challenge.

Supply Chain Complexities

- Globalization increases the risk of cross-contamination, requiring more comprehensive testing measures.

- Managing allergen risks across multi-tiered supply chains is resource-intensive.

Consumer Misunderstanding

- Misinformation about allergen labeling and testing results may lead to distrust or misinterpretation of food safety measures.

Technological Adoption Barriers

- Small businesses may struggle to adopt cutting-edge technologies due to cost and scalability concerns.

Market Opportunities

Rising Consumer Awareness

- Growing awareness of food allergies and intolerances presents an opportunity to expand the adoption of allergen testing, particularly in the food service and retail sectors.

Technological Advancements

- Innovation in rapid testing technologies, such as multiplex assays and biosensors, offers faster and more cost-effective solutions, driving market growth.

- The development of blockchain-based allergen tracking systems can enhance transparency in global supply chains.

Expansion in Emerging Markets

- Increasing food safety regulations and rising food allergy incidences in emerging economies, particularly in Asia-Pacific, create new market opportunities for allergen testing solutions.

Regulatory Developments

- Stricter government regulations regarding allergen labeling and safety provide a growing demand for reliable testing services to meet compliance.

Customization of Testing Solutions

- Growing demand for customized allergen testing kits and platforms tailored to specific allergens or food products presents opportunities for specialized service providers.

Increased Investment in Food Safety

- Food manufacturers are investing more in food safety, offering opportunities for partnerships and collaborations to implement advanced allergen testing systems.

Allergen-Free Food Movement

- The rising trend for allergen-free and allergen-friendly foods drives the need for effective testing to ensure compliance with consumer expectations and product claims.

Strategic Partnerships & Acquisitions

- Collaborations between food producers, technology providers, and testing labs can create synergies to offer more efficient, scalable allergen testing solutions.

Growth of Online and Direct-to-Consumer Testing Solutions

- The expansion of direct-to-consumer allergen testing kits and platforms presents new market opportunities, particularly for personalized food safety solutions.

RECENT STRATEGIES & DEVELOPMENTS IN THE MARKET

Launch of Rapid Allergen Testing Kits

- In March 2024, Thermo Fisher Scientific introduced a new rapid allergen testing kit capable of detecting multiple allergens simultaneously, improving testing speed and accuracy. This innovation addresses the growing demand for faster results in the food industry.

Blockchain-Based Allergen Tracking

- Neogen Corporation launched a blockchain-based allergen tracking system in January 2024, enhancing traceability and transparency in the food supply chain. This system helps ensure that allergens are properly identified and managed from production to distribution.

Expansion of Immunoassay Product Lines

- R-Biopharm AG announced in February 2024 the release of a new immunoassay kit for the simultaneous detection of multiple allergens, further solidifying the dominance of immunoassay-based methods in the food allergen testing market.

Growth in Online and Digital Platforms

- In June 2024, a leading allergen testing provider launched a comprehensive online platform that allows food manufacturers to manage and interpret test results. This platform offers enhanced data analytics and reporting features, streamlining the testing process.

Strategic Partnerships for R&D

- In May 2024, two major food allergen testing companies formed a strategic partnership to develop next-generation testing methods focused on improving accuracy, reliability, and the ability to detect low-level allergens in complex food matrices.

Expansion of Testing Facilities in Asia-Pacific

- SGS Group expanded its allergen testing facilities in China in 2024, reflecting the region’s growing demand for food safety testing due to the rising prevalence of food allergies and stricter regulations.

Regulatory Compliance Focus

- Eurofins Scientific and Intertek Group plc have been actively expanding their testing services to help food manufacturers comply with increasingly stringent global food safety regulations, particularly in the European Union and North America.

Adoption of Multiplex Testing Platforms

- Bio-Rad Laboratories launched a multiplex allergen testing platform in March 2024 that can detect multiple allergens in a single test, allowing food manufacturers to streamline testing processes and enhance efficiency.

KEY BENEFITS FOR STAKEHOLDERS

Enhanced Consumer Safety

- Manufacturers & Suppliers: By implementing advanced allergen testing, stakeholders can ensure that their products are safe for consumers, particularly those with food allergies, enhancing product safety and minimizing the risk of recalls.

- Consumers: Access to accurate allergen labeling and safer products, fostering greater trust in food brands and manufacturers.

Regulatory Compliance

- Food Manufacturers: Meeting increasingly stringent regulatory standards for allergen testing and labeling, ensuring compliance with local and global regulations such as those set by the FDA, EFSA, and other food safety bodies.

- Regulatory Authorities: Ensures public health is safeguarded by promoting industry adherence to allergen safety standards.

Improved Marketability & Brand Reputation

- Brands and Manufacturers: By offering allergen-free or allergen-friendly products, companies can cater to a growing consumer segment, enhancing brand reputation and marketability. Testing ensures that products live up to allergen-free claims.

- Retailers: Providing allergen-tested products can attract health-conscious consumers, driving sales and improving consumer loyalty.

Cost Savings in the Long Term

- Manufacturers: Accurate and efficient allergen testing methods, such as immunoassays, reduce the risk of costly food recalls and the associated damage to brand reputation. This also minimizes waste by detecting allergens early in the production process.

- Consumers: Reduced risk of accidental allergic reactions translates to fewer medical expenses, particularly for individuals with severe allergies.

Supply Chain Transparency

- Food Producers & Suppliers: Blockchain-based allergen tracking systems provide transparency across the food supply chain, helping identify potential cross-contamination points and ensuring a consistent level of food safety.

- Consumers: Gain greater confidence in the sourcing, production, and safety of the food they purchase, knowing that manufacturers have a transparent approach to managing allergens.

Access to Emerging Markets

- Testing Companies: The rise of food allergies, especially in emerging economies, offers testing companies opportunities to expand their services. Companies like SGS and Eurofins can tap into growing demand in Asia-Pacific and other regions with increasing health awareness.

- Retailers & Food Producers: Can access new markets by meeting local food safety regulations, positioning themselves as leaders in allergen-safe food production.

Technological Advancements

- Industry Players: The adoption of rapid testing technologies, multiplex assays, and AI-powered solutions ensures quicker results, lower costs, and improved testing accuracy, allowing stakeholders to stay competitive in the evolving food safety landscape.

At DigiRoads Research, we emphasize reliability by employing robust market estimation and data validation methodologies. Our insights are further enhanced by our proprietary data forecasting model, which projects market growth trends up to 2030. This forward-thinking approach ensures our analysis not only captures the current market landscape but also anticipates future developments, equipping stakeholders with actionable foresight.

We go a step further by offering an exhaustive set of regional and country-level data points, supplemented by over 60 detailed charts at no additional cost. This commitment to transparency and accessibility allows stakeholders to gain a deep understanding of the industry’s structural and operational dynamics. By providing exclusive and hard-to-access data, DigiRoads Research empowers businesses to make informed strategic decisions with confidence.

In essence, our methodology and data delivery foster a collaborative and data-driven decision-making environment, enabling businesses to navigate industry challenges and capitalize on opportunities effectively.

Contact Us For More Inquiry.

Table of Contents

INTRODUCTION

- Market Overview

- Years Considered for Study

- Market Segmentation

- Study Assumptions and Definitions

- Market Scope

RESEARCH METHODOLOGY

MARKET OUTLOOK

- Executive Summary

- Market Snapshot

- Market Segments

- By Technology

- Immunoassay-Based

- Polymerase Chain Reaction-Based

- Biosensors-Based

- By Source

- Milk

- Wheat

- Egg

- Peanut & Soy

- Seafood

- By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

- By Technology

COMPETITIVE LANDSCAPE

- Recent Strategies (Key Strategic Moves)

- Market Share Analysis

- Company Profiles

- Eurofins Scientific

- SGS SA

- Intertek Group plc

- ALS Limited

- Neogen Corporation

- Thermo Fisher Scientific

- Merieux Nutrisciences

- Romer Labs

- Bio-Rad Laboratories

- Quest Diagnostics

- Microbac Laboratories, Inc.

- Fera Science Limited

- LGC Limited

- TÜV SÜD

- Bureau Veritas

- detailedLab, Inc.

- Charles Lawrence International, Inc.

- Ecovadis

- Genomatica

- Food Allergy Research & Education (FARE)

MARKET DYNAMICS

- Market Drivers

- Market Challenges

- Market Opportunities

- Porter’s Five Forces’ Analysis

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Threat of New Entrant

- Threat of Substitutes

- Competitive Rivalry

GLOSSARY OF PROMINENT SECONDARY SOURCES

DISCLAIMER

ABOUT US