Global Food Authentication Testing Market

- Brand: DigiRoads

Explore the 100+ page report on the Global Food Authentication Testing Market, offering insights into trends, growth drivers, and the competitive landscape. Available in PDF and Excel formats for convenient access to detailed data and analysis.

Global Food Authentication Testing Market Report | Market Size, Industry Analysis, Growth Opportunities, & Forecast (2025-2030)

Global Food Authentication Testing Market Overview

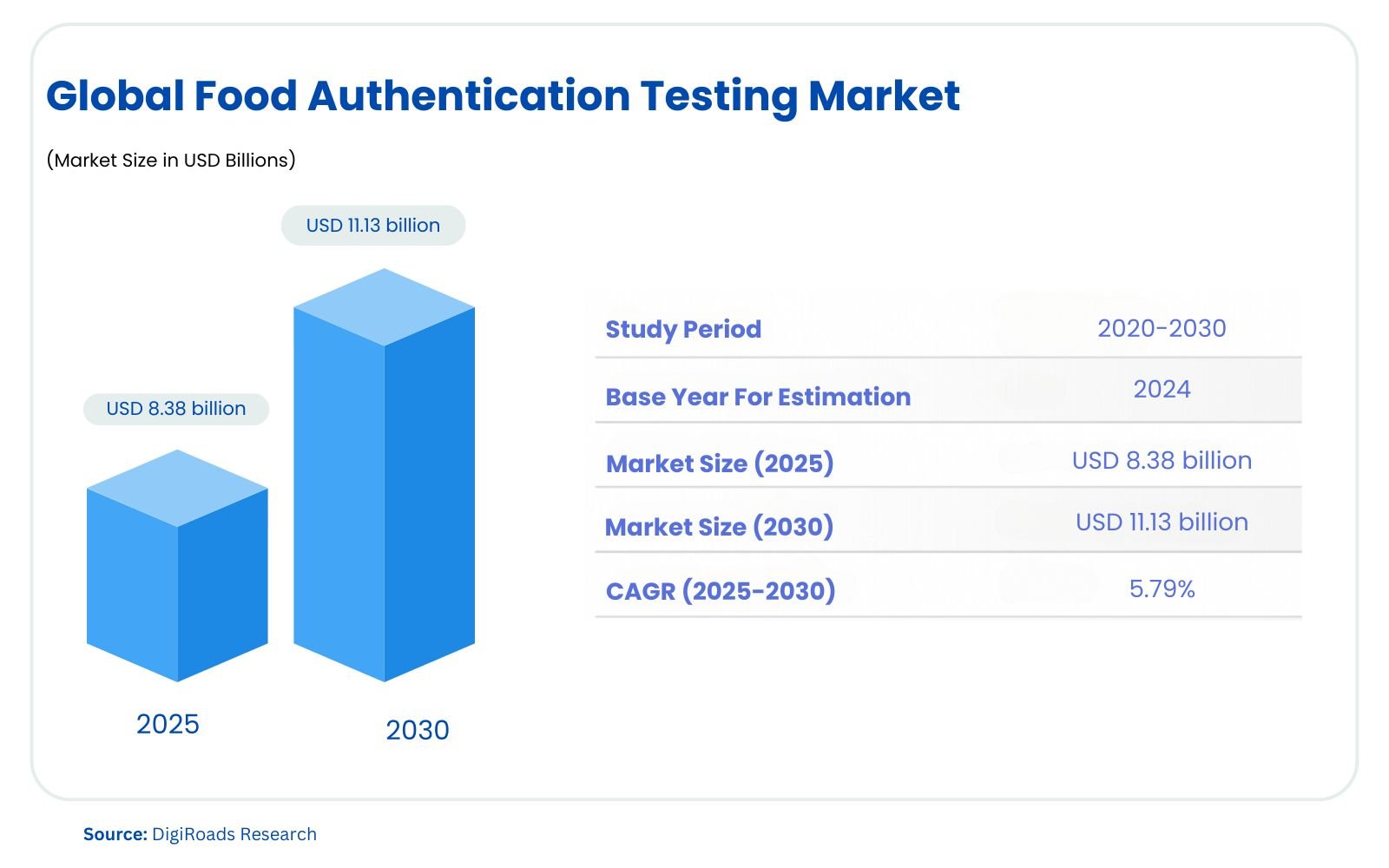

The global Food Authentication Testing Market is experiencing steady expansion, with an estimated market size of USD 8.38 billion in 2025 and projected to reach USD 11.13 billion by 2030, expanding at a CAGR of 5.79% during the forecast period 2025-2030. The global food authentication testing market is poised for significant growth from 2025 to 2030, driven by increasing consumer demand for transparency and quality assurance in food products. Rising concerns over food fraud, adulteration, and mislabeling are propelling the adoption of advanced testing technologies such as PCR, DNA sequencing, and mass spectrometry. These technologies ensure compliance with stringent food safety regulations worldwide and cater to the growing preference for ethically sourced and certified food products.

North America and Europe currently dominate the market due to their robust regulatory frameworks and technological advancements. Meanwhile, the Asia-Pacific region is anticipated to witness the fastest growth during the forecast period, fueled by rising awareness and demand for premium, authentic food products. Key players like Eurofins Scientific, SGS SA, and Thermo Fisher Scientific are actively investing in R&D to develop cost-effective and efficient testing solutions.

This report offers a comprehensive analysis of market drivers, restraints, trends, and competitive dynamics. It also explores opportunities across regions and provides projections based on in-depth research. Stay ahead in the rapidly evolving food authentication testing market with insights tailored to guide strategic decisions.

Market Report Coverage:

The “Global Food Authentication Testing Market Report—Future (2025-2030)” by Digiroads Research & Consulting covers an in-depth analysis of the following segments in the market.

| By Technology | PCR, DNA Sequencing/Barcoding, Next-Generation Sequencing, ELISA, NMR/Molecular Spectrometry, |

| By Geography | North America, Europe, Asia-Pacific, South America, Middle-East & Africa |

Study Assumptions and Definitions

This report on the Global Food Authentication Testing Market for 2025–2030 provides an in-depth analysis of market dynamics, segmentation, and growth opportunities. The study assumes that the global demand for food authenticity testing will grow steadily due to increasing concerns about food fraud, regulatory enforcement, and rising consumer awareness. It considers advancements in testing technologies like PCR, DNA sequencing, and mass spectrometry, which are expected to play a significant role in market expansion.

The report defines food authenticity testing as the process of verifying whether food products comply with their labeling and claims. This includes testing for adulteration, mislabeling, and contamination across various food categories. Key definitions used in the study include:

- PCR Technique: A molecular biology method to amplify DNA sequences for food authenticity verification.

- ELISA: A biochemical technique for detecting specific proteins in food samples.

- Geography Segments: North America, Europe, Asia-Pacific, South America, and the Middle-East & Africa.

The analysis covers economic, technological, and regulatory assumptions influencing the market, with projections derived from validated historical data and future trends. It excludes impacts from unforeseen disruptive global events or unquantifiable market conditions.

Market Scope

The Global Food Authentication Testing Market, covering the years 2025–2030, evaluates the demand for technologies and solutions to ensure food authenticity. This includes verifying claims of origin, purity, and composition to combat food fraud and ensure regulatory compliance. The scope encompasses advanced testing methods like PCR, DNA sequencing, ELISA, and mass spectrometry, widely used across industries such as packaged food, beverages, and nutraceuticals.

Geographical coverage spans North America, Europe, Asia-Pacific, South America, and the Middle-East & Africa, providing insights into regional trends and growth opportunities. The study includes analysis by technology and geography, offering a detailed segmentation to understand market dynamics.

Factors such as stringent regulations, consumer demand for transparent labeling, and technological advancements in molecular spectrometry and next-generation sequencing are explored. The report excludes the influence of unpredictable global events while focusing on actionable insights for stakeholders and investors in the food testing ecosystem.

MARKET OUTLOOK

Executive Summary

The Global Food Authentication Testing Market, projected to grow significantly during 2025–2030, is driven by increasing concerns over food safety, authenticity, and compliance with stringent regulations. The rising incidences of food fraud, including mislabeling, adulteration, and counterfeit products, have amplified the demand for advanced testing technologies worldwide.

Key technologies analyzed in this market include PCR techniques, DNA sequencing/barcoding, next-generation sequencing (NGS), ELISA, NMR/molecular spectrometry, and mass spectrometry (liquid or gas chromatography). These methods offer precision in identifying contaminants, verifying ingredient authenticity, and ensuring compliance with quality standards.

Geographically, Europe holds the largest market share, supported by robust regulatory frameworks and consumer awareness. Asia-Pacific is expected to exhibit the highest CAGR, fueled by expanding food industries, rising exports, and increased awareness of food quality standards. North America, South America, and the Middle East & Africa also showcase considerable market potential due to growing regulatory scrutiny and the demand for safe and transparent food practices.

Major players, including Eurofins Scientific, SGS SA, Intertek Group, and Thermo Fisher Scientific, are actively enhancing their service portfolios through technological innovation and strategic partnerships. Competitive dynamics reveal a focus on adopting next-generation technologies and expanding geographically to tap emerging markets.

The report delves into market dynamics, identifying key drivers such as consumer demand for transparency, stringent government regulations, and technological advancements. Restraints include high costs associated with advanced testing and limited adoption in developing regions. The analysis incorporates Porter’s Five Forces, market segmentation by technology and geography, and key trends shaping the industry.

This comprehensive overview provides actionable insights for stakeholders, enabling informed decision-making in the evolving food authentication testing market. The report emphasizes growth opportunities, competitive strategies, and future trends influencing the global food testing landscape.

COMPETITIVE LANDSCAPE

The Global Food Authentication Testing Market is moderately fragmented, with regional and multinational players competing fiercely for market share.

Key Market Players

- Eurofins Scientific

- Intertek Group PLC

- SGS SA

- NSF International

- EMSL Analytical Inc.

- Merieux NutriSciences Corporation

- Thermo Fisher Scientific Inc.

- Danaher Corporation (AB SCIEX LLC)

- ALS Limited

Market Share Analysis

The global food authentication testing market is highly competitive, with several key players dominating the market share. Eurofins Scientific, SGS SA, Intertek Group PLC, and Thermo Fisher Scientific Inc. are the leading companies, holding substantial portions of the market due to their extensive global reach, strong service offerings, and continuous investment in research and development. These players leverage a wide range of advanced testing technologies, such as PCR, DNA sequencing, and mass spectrometry, to meet the increasing demand for food safety and traceability.

In terms of regional market share, Europe holds the largest share in 2025, driven by stringent food safety regulations and the growing demand for authentic, quality food products. North America follows closely, benefiting from strong regulatory frameworks and increasing consumer awareness regarding food authenticity. Asia-Pacific is expected to witness the highest growth rate due to rapid industrialization, growing food safety concerns, and the adoption of advanced testing technologies.

The competitive landscape is also characterized by strategic partnerships, mergers and acquisitions, and collaborations, further intensifying the market rivalry. As the demand for food authenticity testing grows, key players are focusing on expanding their technological capabilities and regional presence to maintain a competitive edge.

MARKET DYNAMICS

Market Drivers and Key Innovations

The global food authentication testing market is driven by several key factors, including rising consumer awareness about food safety, increasing incidences of food fraud, and stringent government regulations concerning food authenticity. As global supply chains become more complex, ensuring food safety and traceability has become a critical concern for consumers, manufacturers, and regulatory bodies. The growing demand for clean-label products and organic foods further fuels the need for reliable food authentication testing, as consumers seek transparency regarding the quality and origin of their food.

Another significant driver is the increasing adoption of advanced technologies, which enhance the precision and efficiency of food testing. Techniques like PCR (Polymerase Chain Reaction), DNA sequencing, next-generation sequencing, and mass spectrometry offer higher accuracy, enabling quick detection of contaminants, adulterants, and counterfeit ingredients. These technologies are also expanding their applications beyond food fraud detection to include verifying geographic origin, quality, and compliance with food standards.

Key innovations in the market include the development of portable and rapid testing solutions, which allow for on-site testing with minimal turnaround time. Integration of Artificial Intelligence (AI) and machine learning in food authentication processes is another emerging trend, helping automate data analysis, improve the accuracy of results, and streamline testing workflows. These innovations enhance the ability to address food safety challenges and improve overall supply chain management, driving the adoption of food authentication testing solutions across the globe.

Market Challenges

- Competition from OTT Platforms: High Cost of Testing: Advanced food authentication testing technologies, such as DNA sequencing and mass spectrometry, can be expensive to implement and maintain, which may limit their adoption among small and medium-sized enterprises (SMEs).

- Lack of Standardization: The absence of universally accepted standards for food authentication testing can lead to inconsistencies in testing procedures and results, hindering the development of a cohesive global market.

- Limited Awareness in Emerging Markets: While food authentication testing is gaining traction in developed markets, emerging economies may face challenges related to limited awareness of the importance of food authenticity, leading to slower adoption rates.

- Complexity in Food Supply Chains: The increasing complexity of global food supply chains makes it challenging to monitor and verify every stage of production, from sourcing to processing, increasing the risk of food fraud.

- Regulatory Hurdles: Different regions have varying regulatory requirements, and navigating these regulations can be challenging for companies, particularly when introducing new technologies or entering new markets.

- Limited Testing Infrastructure: In certain regions, there is a lack of infrastructure and trained professionals to conduct food authentication testing, which can delay the availability of accurate results.

- Resistance to New Technologies: Traditional testing methods remain prevalent in some parts of the food industry, with businesses reluctant to invest in newer, more advanced technologies, despite their potential to improve accuracy and efficiency.

Market Opportunities

- Immersive Technologies: Growing Demand for Organic and Clean-label Foods: As consumers increasingly demand organic, non-GMO, and clean-label products, there is a significant opportunity for food authentication testing to verify product claims and ensure transparency.

- Expansion in Emerging Markets: Emerging economies in Asia-Pacific, Latin America, and Africa present untapped opportunities for growth, driven by improving consumer awareness and increasing regulatory requirements for food safety and authenticity.

- Advancements in Testing Technologies: The continuous development of more cost-effective, faster, and accurate testing technologies (e.g., DNA barcoding, next-generation sequencing) creates opportunities for innovation and market expansion.

- Government Regulations and Policies: Growing government initiatives and regulations aimed at combating food fraud and improving food safety offer opportunities for the adoption of food authentication testing across various food sectors.

- E-commerce and Online Food Sales: The rise of e-commerce platforms and online food sales increases the need for robust food authentication testing to assure consumers of the authenticity of food products sold through online channels.

- Increasing Focus on Food Fraud Prevention: As food fraud incidents continue to rise globally, there is an increasing demand for authentication testing to prevent fraud, protect brands, and ensure consumer safety.

- Strategic Partnerships and Collaborations: Collaborations between testing companies, food manufacturers, and regulatory bodies can create synergies, enabling businesses to expand their reach and improve the efficiency of authentication testing solutions.

- Growing Consumer Awareness: As consumers become more knowledgeable about food sourcing and integrity, the demand for third-party verification and authentication testing services is expected to rise significantly.

RECENT STRATEGIES & DEVELOPMENTS IN THE MARKET

Technological Advancements:

- Companies like Thermo Fisher Scientific and Eurofins Scientific have focused on incorporating next-generation sequencing (NGS) and PCR techniques to enhance the accuracy and speed of food authenticity testing.

- NGS technology is gaining popularity due to its ability to provide highly accurate identification of food components, helping in the authentication of complex food products.

Expansion into Emerging Markets:

- In response to the rising demand for food safety and authenticity testing, key players are expanding their presence in emerging markets such as China, India, and Brazil.

- For example, Intertek Group has strengthened its foothold in Asia-Pacific, capitalizing on the growing regulatory pressure for food safety testing in this region.

Strategic Acquisitions:

- Several companies have pursued acquisitions to enhance their service offerings. Eurofins Scientific, for instance, acquired various testing labs to expand its capabilities in food authenticity testing.

- This helps companies to scale their testing services across different geographies and build stronger market portfolios.

Partnerships with Regulatory Bodies:

- Companies are increasingly forming partnerships with governmental agencies and non-governmental organizations to align with food safety standards. This ensures compliance with increasing global regulatory frameworks around food authenticity.

- Eurofins and SGS are actively involved in collaborating with regulatory bodies to standardize food authenticity testing procedures globally.

Focus on Sustainability and Clean Label Products:

- Companies are responding to consumer demand for sustainable and clean-label products by enhancing food authentication to verify claims such as organic, non-GMO, and fair trade.

- Leading firms such as Intertek and NSF International are now offering testing services that align with sustainability trends in the food industry.

Investments in Automation and AI:

- The integration of AI and automation in food testing processes is gaining momentum to improve efficiency and reduce human errors. Mass spectrometry and NMR techniques are being enhanced with AI to provide faster and more reliable results.

- This trend is particularly evident in companies like Thermo Fisher Scientific, which is investing in AI-powered solutions to streamline food authentication testing.

Product Innovation:

- Companies are continuously innovating their product offerings by developing new testing methods and applications. For example, testing solutions based on molecular spectrometry (NMR) and mass spectrometry are being adapted for more diverse food categories, including beverages and functional foods.

COVID-19 Impact and Focus on Supply Chain Integrity:

- The pandemic has accelerated the demand for food authentication solutions to ensure food quality and supply chain integrity, especially with the rise of food fraud risks during the crisis.

- Companies like SGS SA have expanded their testing services to include COVID-19-related supply chain certifications, enhancing their role in pandemic-related food safety testing.

KEY BENEFITS FOR STAKEHOLDERS

Enhanced Product Integrity and Consumer Trust:

- Food authenticity testing helps stakeholders, including manufacturers, suppliers, and retailers, ensure the integrity of their products, which strengthens consumer trust. This is particularly important for businesses focusing on premium products such as organic or non-GMO foods.

Compliance with Regulatory Standards:

- Food manufacturers and suppliers can ensure compliance with global food safety regulations by implementing robust food authentication testing. This mitigates the risk of regulatory fines and legal repercussions, especially with the growing scrutiny from regulatory bodies in markets such as Europe and North America.

Mitigation of Food Fraud Risks:

- By investing in food authenticity testing, stakeholders can prevent food fraud, such as mislabeling or contamination, which can damage their brand reputation and lead to costly recalls.

Improved Market Positioning:

- Companies that adopt food authenticity testing early can position themselves as industry leaders in food safety, distinguishing their brand in a highly competitive market. This is especially beneficial for businesses targeting consumers concerned about food transparency.

Increased Consumer Confidence in Products:

- When stakeholders provide verifiable evidence of the authenticity of their food products, it enhances consumer confidence. This can lead to increased sales, particularly in markets where consumers demand higher quality and transparency.

Expansion into Emerging Markets:

- The growing demand for food authenticity testing, especially in regions like Asia-Pacific and Latin America, offers opportunities for stakeholders to expand their market reach. This is crucial for companies looking to tap into the rapidly developing food safety regulations in these regions.

Adoption of Advanced Testing Technologies:

- Stakeholders benefit from adopting cutting-edge technologies like PCR, DNA sequencing, and mass spectrometry, which provide more accurate and faster results. This can lead to cost savings and operational efficiency.

Reduction in Supply Chain Risks:

- For stakeholders involved in the supply chain, such as distributors and logistics companies, food authentication testing helps ensure that products meet quality standards and reduces risks associated with fraudulent or counterfeit products entering the market.

Opportunities for Strategic Partnerships:

- Companies that invest in food authentication testing can form strategic partnerships with regulatory bodies, testing labs, and technology providers, creating opportunities for collaboration and innovation within the food safety ecosystem.

At DigiRoads Research, we emphasize reliability by employing robust market estimation and data validation methodologies. Our insights are further enhanced by our proprietary data forecasting model, which projects market growth trends up to 2030. This forward-thinking approach ensures our analysis not only captures the current market landscape but also anticipates future developments, equipping stakeholders with actionable foresight.

We go a step further by offering an exhaustive set of regional and country-level data points, supplemented by over 60 detailed charts at no additional cost. This commitment to transparency and accessibility allows stakeholders to gain a deep understanding of the industry’s structural and operational dynamics. By providing exclusive and hard-to-access data, DigiRoads Research empowers businesses to make informed strategic decisions with confidence.

In essence, our methodology and data delivery foster a collaborative and data-driven decision-making environment, enabling businesses to navigate industry challenges and capitalize on opportunities effectively.

Contact Us For More Inquiry.

Table of Contents

-

INTRODUCTION

- Market Overview

- Years Considered for Study

- Market Segmentation

- Study Assumptions and Definitions

- Market Scope

-

RESEARCH METHODOLOGY

-

MARKET OUTLOOK

- Executive Summary

- Market Snapshot

- Market Segments

- By Technology:

- PCR, DNA Sequencing/Barcoding, Next-Generation Sequencing, ELISA, NMR/Molecular Spectrometry,

- By Geography:

- North America, Europe, Asia-Pacific, South America, Middle-East & Africa

- By Technology:

-

COMPETITIVE LANDSCAPE

- Recent Strategies (Key Strategic Moves)

- Market Share Analysis

- Company Profiles

- Eurofins Scientific

- Intertek Group PLC

- SGS SA

- NSF International

- EMSL Analytical Inc.

- Merieux NutriSciences Corporation

- Thermo Fisher Scientific Inc.

- Danaher Corporation (AB SCIEX LLC)

- ALS Limited

-

MARKET DYNAMICS

- Market Drivers

- Market Challenges

- Market Opportunities

- Porter’s Five Forces’ Analysis

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Threat of New Entrant

- Threat of Substitutes

- Competitive Rivalry

-

GLOSSARY OF PROMINENT SECONDARY SOURCES

-

DISCLAIMER

-

ABOUT US