No products in the cart.

Global Food Fibers Market

- Brand: DigiRoads

Discover the 100+ page report on the Global Food Fibers Market, providing insights into trends, growth drivers, and the competitive landscape. Available in PDF and Excel formats for easy access to detailed data and analysis.

Category: Food and Beverage

Brand: DigiRoads

Global Food Fibers Market Report | Market Size, Industry Analysis, Growth Opportunities, & Forecast (2025-2030)

Global Food Fibers Market Overview

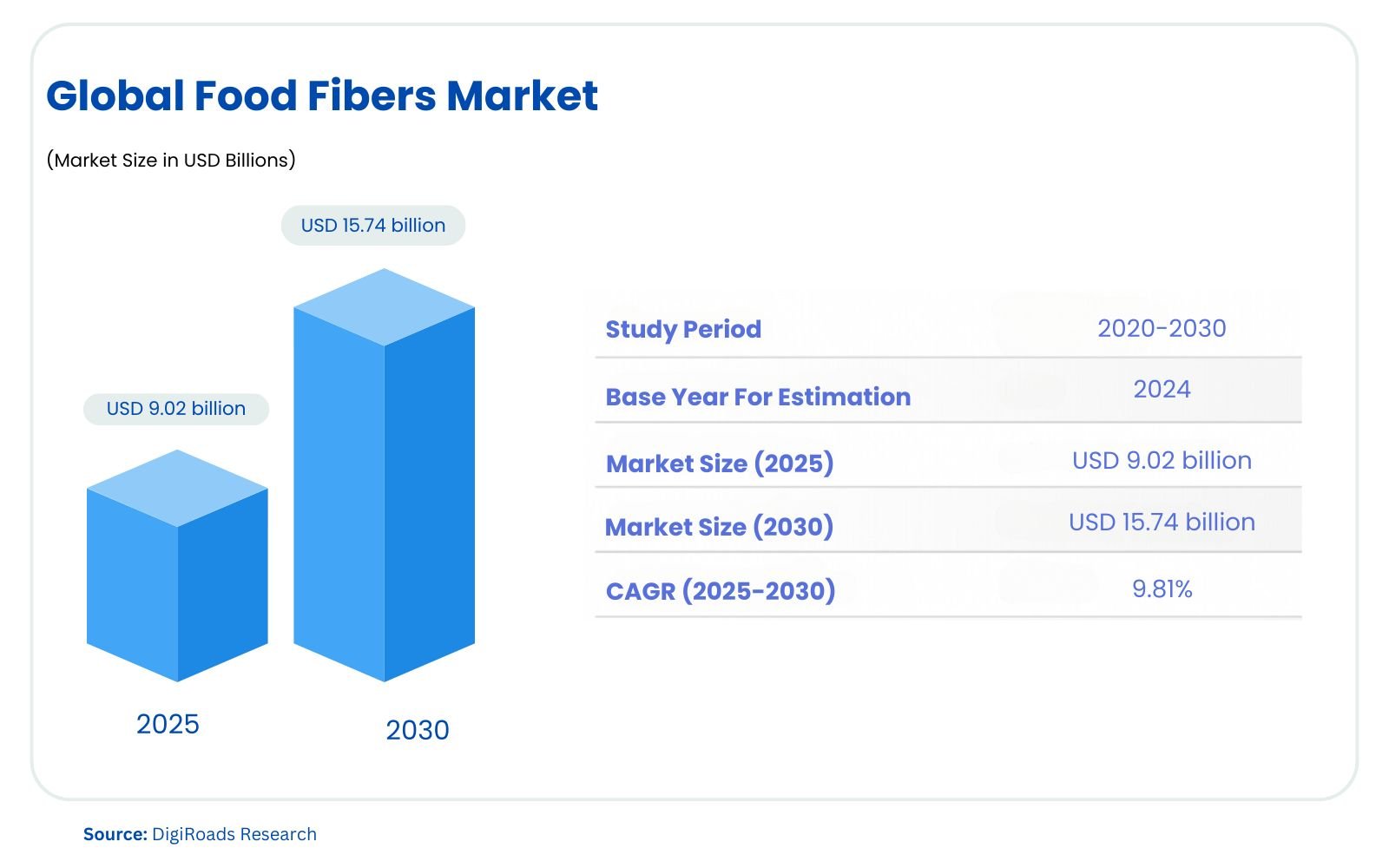

The global food fibers market is on a robust growth trajectory, with an estimated market size of USD 9.02 billion in 2025 and a projected expansion to USD 15.74 billion by 2030, advancing at a CAGR of 9.81% during the forecast period 2025-2030. The Global Food Fibers Market is expected to witness significant growth from 2025 to 2030, driven by rising health awareness and the increasing demand for fiber-rich foods. Food fibers, including soluble and insoluble fibers, offer a range of health benefits such as improved digestive health, weight management, and heart health. Key soluble fibers like inulin, pectin, beta-glucan, and polydextrose, along with insoluble fibers like cellulose and lignin, are used extensively across food and beverage applications, dietary supplements, and pharmaceuticals. The growing trend of fortifying food products with fiber to meet consumer demand for nutritious options is boosting market growth.

The market is segmented by type, application, and geography, with major regions including North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. Leading companies such as Cargill, Tate & Lyle, Ingredion, and Archer Daniels Midland are driving innovation and expanding their portfolios to capitalize on the demand for dietary fibers. As consumers increasingly turn to functional foods, fiber-rich products are expected to play a critical role in enhancing overall wellness.

This report provides an in-depth analysis of market trends, growth drivers, and forecasts, offering valuable insights for businesses and stakeholders.

Market Report Coverage:

The “Global Food Fibers Market Report—Future (2025-2030)” by Digiroads Research & Consulting covers an in-depth analysis of the following segments in the market.

| Type | -Soluble Fibers (Inulin, Pectin, Polydextrose, Beta-glucan) – Insoluble Fibers (Cellulose, Lignin, Hemicellulose, etc.) |

| Application | – Food & Beverage (Bakery, Dairy, Meat, Beverages) – Dietary Supplements – Pharmaceuticals |

| Geography | North America, Europe, Asia-Pacific, South America, MEA |

Study Assumptions and Definitions

The analysis of the Global Food Fibers Market is based on the following assumptions:

- Market Scope: The report focuses on food fibers, which are plant-based compounds that aid in digestion and offer numerous health benefits. These fibers are segmented into soluble and insoluble fibers, derived from sources such as fruits, vegetables, and grains.

- Geographical Coverage: The study covers key regions including North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. Data is collected from countries within these regions, with particular emphasis on the United States, UK, Germany, China, and Brazil.

- Market Segments: The market is segmented by type (soluble and insoluble fibers), application (food & beverages, dietary supplements, pharmaceuticals), and geography. The food & beverage sector includes further sub-segments such as bakery, dairy, and beverages.

- Historical Data and Forecasts: Historical data from 2020-2024 is considered for market analysis. Forecasts for 2025-2030 are based on industry growth trends, consumer behavior, regulatory developments, and technological innovations.

- Market Growth Factors: Assumptions include growing consumer awareness of health benefits, increased demand for functional foods, and rising fiber fortification in food products.

Market Scope

The Global Food Fibers Market analysis covers a comprehensive study of the global market, focusing on the consumption, production, and growth of dietary fibers derived from plant-based sources. The market includes soluble and insoluble fibers, with applications across multiple industries, including food & beverages, dietary supplements, and pharmaceuticals. The report evaluates both the consumption patterns and the supply chain dynamics of these fibers in various regions, including North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

Key food & beverage applications include bakery products, dairy, meat, beverages, and snacks, all of which are incorporating higher fiber content to meet the growing consumer demand for healthier food options. The study also considers dietary supplements and pharmaceuticals, where fibers are used to promote digestive health and overall wellness.

MARKET OUTLOOK

Executive Summary

The global Food Fibers Market is experiencing significant growth due to increasing consumer awareness of the health benefits associated with dietary fibers. With a projected CAGR of 9.81% from 2025 to 2030, the market is set to expand as more individuals adopt fiber-rich diets to improve digestive health, metabolic wellness, and overall well-being. The increasing demand for functional and clean-label food products is contributing to this surge, with manufacturers incorporating fibers like inulin, pectin, and beta-glucan into a wide variety of food items.

Soluble fibers, including inulin and polydextrose, are particularly sought after due to their benefits in improving gut health, lowering cholesterol levels, and supporting weight management. On the other hand, insoluble fibers like cellulose and resistant starch are gaining traction for their role in enhancing digestive health. These fibers are increasingly being fortified into processed foods such as cereals, bars, snacks, and beverages, contributing to the rise in fiber consumption.

The food & beverage industry, especially bakery and dairy sectors, holds the largest share of the market, with fiber-enriched products becoming a staple in the health-conscious consumer’s diet. The dietary supplements and pharmaceutical applications of food fibers are also seeing growth, driven by increasing demand for products that support immune function and gut health.

Regionally, Europe remains a key market, with the rising preference for plant-based and functional foods. North America follows closely, with substantial investments in fiber innovation by leading players such as Cargill, Ingredion, and Tate & Lyle. The Asia-Pacific region is expected to witness rapid growth as consumer awareness regarding health and wellness continues to increase.

Overall, the food fibers market is poised for strong growth, driven by health-conscious trends and an increasing shift toward functional, fiber-enriched foods.

COMPETITIVE LANDSCAPE

The Global Food Fibers Market is moderately fragmented, with regional and multinational players competing fiercely for market share.

Key Market Players

- Ingredion Incorporated

- Cargill, Incorporated

- Tate & Lyle PLC

- Archer Daniels Midland Company

- Roquette Freres SA

- Kerry Group PLC

- Süddeutsche Zuckerrübenverwertungs-Genossenschaft eG (Beneo Remy NV)

- International Flavors & Fragrances Inc.

- J. Rettenmaier & Söhne GmbH + Co. KG

- Nexira Inc.

Market Share Analysis

The global food fibers market is highly competitive, with several key players vying for market share. Leading companies such as Ingredion Incorporated, Cargill, Tate & Lyle, and Archer Daniels Midland Company dominate the market, each focusing on expanding their product offerings and strengthening distribution channels to capture a larger share. These companies have a strong market presence due to their diverse portfolios of soluble and insoluble fibers, which cater to the food and beverage, dietary supplements, and pharmaceutical industries.

Ingredion, Tate & Lyle, and Cargill lead in the soluble fibers segment, offering products like inulin, pectin, and beta-glucan, widely used in functional foods, beverages, and dietary supplements. On the other hand, Roquette Freres SA and Kerry Group have a notable presence in the insoluble fibers market, particularly in cellulose and hemicellulose.

As demand for clean-label, plant-based, and functional food ingredients grows, companies are adopting strategies such as acquisitions, product innovations, and geographical expansion. Tate & Lyle’s acquisition of Quantum Hi-Tech and Cargill’s investments are examples of such initiatives, helping to capture the growing fiber consumption trend globally.

Overall, the market remains fragmented but is witnessing rapid consolidation as companies align their strategies to cater to the increasing consumer demand for fiber-enriched and health-conscious food products.

MARKET DYNAMICS

Market Drivers and Key Innovations

The global food fibers market is driven by several key factors:

- Health and Wellness Trends: Increased consumer awareness of the health benefits of dietary fibers, including improved digestion, weight management, heart health, and immunity, is driving demand. A significant portion of consumers is shifting towards fiber-enriched products, seeking preventive health measures.

- Nutritional Labeling and Regulatory Support: Governments and organizations like the World Health Organization are promoting higher fiber intake, with recommendations to consume at least 25-38g of fiber per day. The adoption of fiber labeling in countries like the UK further boosts consumer confidence in fiber-enriched foods.

- Clean-Label Movement: As consumers increasingly demand transparency in ingredients, the clean-label trend is growing. Consumers prefer natural, plant-based fibers, which are seen as healthier and more sustainable options. This has fueled the rise of plant-based fibers like inulin and beta-glucan in products.

- Growing Demand for Functional Foods: With the rising popularity of functional foods and supplements, manufacturers are incorporating fibers into products such as snacks, protein bars, and dairy items to cater to the growing segment of health-conscious consumers.

Key Innovations:

- Soluble Fiber Development: Companies like Cargill and Tate & Lyle are innovating in soluble fibers, developing ingredients like soluble corn fiber and prebiotic fibers that not only offer functional benefits but also improve the texture and flavor of food.

- Plant-Based Fiber Sources: Innovations in sourcing fibers from plants like hemp, pea, and potato are gaining traction. These fibers are considered more sustainable and are increasingly incorporated into a variety of foods and beverages.

Market Challenges

- High Cost of Fiber Ingredients: The extraction and processing of certain fibers, especially plant-based fibers like inulin, require advanced technology, making them expensive. This could limit the accessibility of fiber-enriched products to a broader consumer base, especially in price-sensitive markets.

- Limited Consumer Awareness in Emerging Markets: Despite the growing awareness in developed regions, consumer knowledge of the benefits of dietary fibers is still limited in many emerging markets. This hampers the adoption of fiber-rich products in regions like Asia-Pacific and parts of Latin America.

- Processing Challenges: Incorporating fibers into food products without compromising taste, texture, and shelf life remains a significant challenge. Many fibers can affect the sensory attributes of food, which may deter manufacturers from using them in certain products.

- Regulatory Hurdles: Variations in regulatory standards across different regions can hinder market expansion. For example, some countries do not allow fibers like inulin to be labeled as dietary fibers, which could limit consumer adoption and complicate market entry for manufacturers.

- Sustainability Concerns: The growing demand for plant-based fibers raises sustainability concerns regarding resource consumption and agricultural practices. Ensuring a sustainable and reliable supply of these fibers is an ongoing challenge for manufacturers.

Market Opportunities

- Rising Health Consciousness: Increasing consumer awareness regarding the health benefits of dietary fibers, such as improved digestive health, heart health, and weight management, presents a significant growth opportunity for fiber-based food products.

- Product Fortification and Innovation: The trend of fortifying food products with fibers, including snacks, beverages, and functional foods, is gaining momentum. Companies can innovate by incorporating fibers into new and diverse product categories, such as plant-based and clean-label foods.

- Growth of E-commerce: The growing popularity of online grocery shopping and health-focused platforms offers a channel for manufacturers to reach health-conscious consumers directly, expanding their market presence and consumer base.

- Rising Demand for Functional Foods and Supplements: As consumers seek foods that offer additional health benefits, the demand for functional foods and dietary supplements enriched with fibers, such as prebiotics and fiber-based meal replacements, is increasing.

- Sustainability and Clean-Label Trend: With increasing consumer preference for clean-label, natural, and sustainable ingredients, food fibers derived from plant-based sources present an opportunity for manufacturers to meet the growing demand for transparent and ethical products.

- Regulatory Support for Fiber Enrichment: The growing acceptance and regulation of fibers like inulin and oligofructose in food labeling (e.g., in the EU and the U.S.) provide opportunities for manufacturers to market fiber-rich products more effectively.

RECENT STRATEGIES & DEVELOPMENTS IN THE MARKET

Expansion of Soluble Fiber Ingredients:

- Cargill (2022) announced the introduction of a soluble corn fiber ingredient with at least 80% fiber content. This product is marketed as low-calorie and minimally affects the food’s texture and color. It supports the trend toward high-fiber, low-calorie foods.

Acquisitions to Strengthen Market Position:

- Tate & Lyle (2022) acquired Quantum Hi-Tech (Guangdong) Biological for USD 237 million, enhancing its presence in the prebiotic and dietary fiber market in Asia, especially in China. This acquisition aligns with the company’s goal to lead in the growing fiber segment.

Facility Expansion for Global Presence:

- Kerry Group (2022) unveiled a new 21,500 sq. ft. state-of-the-art facility in Jeddah, Saudi Arabia, as part of its USD 90 million investment in the region. This strategic expansion will help meet the rising demand for sustainable and nutritious food ingredients across the Middle East, North Africa, and Turkey.

Introduction of Fiber-Fortified Products:

- Nestlé (2021) launched several fiber-enriched products under its Action on Fiber initiative, aiming to help increase fiber consumption in the UK. The company highlighted fiber-rich options on packaging to guide consumers.

New Fiber Sources and Ingredient Innovations:

- Roquette Frères (2022) introduced innovative fibers sourced from plants like pea and hemp, catering to the growing demand for plant-based, clean-label foods. This helps to diversify their fiber portfolio and meet consumer preferences for sustainability and natural ingredients.

Investment in Fiber Supply Chain:

- Ingredion (2021) announced an investment to scale up its fiber production capacity, focusing on clean-label and functional fiber products like inulin, which has seen increasing demand for digestive health products.

KEY BENEFITS FOR STAKEHOLDERS

Key Benefits for Stakeholders in the Food Fibers Market:

- Increased Consumer Demand:

- Stakeholders benefit from growing consumer awareness about health and wellness, particularly the importance of fiber in the diet. With an increase in demand for high-fiber foods, manufacturers, suppliers, and retailers can capitalize on this trend by expanding their product portfolios.

- Innovation Opportunities:

- Food manufacturers and ingredient suppliers can develop new, innovative fiber-based products, especially those with clean labels and plant-based fibers, which are highly sought after in the market. This opens avenues for differentiation and brand loyalty.

- Regulatory Support:

- Regulatory changes, such as the UK Food Standards Agency’s approval of inulin and oligofructose as dietary fibers, create a favorable environment for stakeholders by offering new labeling and marketing opportunities for fiber-enriched products.

- Market Expansion:

- Key players can expand into emerging markets like Asia-Pacific, where dietary fiber demand is increasing, especially in countries such as China and India. With investments in local manufacturing and distribution networks, companies can tap into the growing demand for functional foods and dietary supplements.

- Partnership and Acquisition Opportunities:

- Mergers, acquisitions, and strategic partnerships (e.g., Tate & Lyle’s acquisition of Quantum Hi-Tech) provide opportunities to enhance product offerings, diversify fiber sources, and strengthen market presence in key regions.

- Health & Wellness Trend Alignment:

- By focusing on fiber-rich, sustainable, and functional foods, stakeholders align with global trends in health, sustainability, and clean-label products, appealing to the increasing number of health-conscious consumers. This can result in increased market share and long-term profitability.

- Supply Chain Efficiency:

- With investments in fiber production and processing, stakeholders can benefit from improved supply chain efficiency, cost reduction, and better product availability, ensuring a stable supply of dietary fiber ingredients for food production.

By capitalizing on these benefits, stakeholders can strengthen their competitive position and contribute to the growing global focus on fiber consumption and its health benefits.

At DigiRoads Research, we emphasize reliability by employing robust market estimation and data validation methodologies. Our insights are further enhanced by our proprietary data forecasting model, which projects market growth trends up to 2030. This forward-thinking approach ensures our analysis not only captures the current market landscape but also anticipates future developments, equipping stakeholders with actionable foresight.

We go a step further by offering an exhaustive set of regional and country-level data points, supplemented by over 60 detailed charts at no additional cost. This commitment to transparency and accessibility allows stakeholders to gain a deep understanding of the industry’s structural and operational dynamics. By providing exclusive and hard-to-access data, DigiRoads Research empowers businesses to make informed strategic decisions with confidence.

In essence, our methodology and data delivery foster a collaborative and data-driven decision-making environment, enabling businesses to navigate industry challenges and capitalize on opportunities effectively.

Contact Us For More Inquiry.

Table of Contents

INTRODUCTION

- Market Overview

- Years Considered for Study

- Market Segmentation

- Study Assumptions and Definitions

- Market Scope

RESEARCH METHODOLOGY

MARKET OUTLOOK

- Executive Summary

- Market Snapshot

- Market Segments

- By Type

- Soluble Fibers (Inulin, Pectin, Polydextrose, Beta-glucan)

- Insoluble Fibers (Cellulose, Lignin, Hemicellulose, etc.)

- By Region:

- North America, Europe, Asia-Pacific, South America, MEA

- By Type

COMPETITIVE LANDSCAPE

- Recent Strategies (Key Strategic Moves)

- Market Share Analysis

- Company Profiles

- AMC Entertainment Holdings, Inc.

- B&B Theatres

- CGR Cinemas

- Cinemark Holdings, Inc.

- Cinemex

- Cineplex Inc.

- Cinepolis

- Cineworld Group plc.

- CJ CGV

- Odeon Cinemas Group

- PVR INOX Ltd

- UGC

- Vue International

- Wanda Film Holding Co.

- Yelmo Cines

MARKET DYNAMICS

- Market Drivers

- Market Challenges

- Market Opportunities

- Porter’s Five Forces’ Analysis

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Threat of New Entrant

- Threat of Substitutes

- Competitive Rivalry

GLOSSARY OF PROMINENT SECONDARY SOURCES

DISCLAIMER

ABOUT US