No products in the cart.

Global Food Additives Market

- Brand: DigiRoads

Global Food and Beverage Market Report on Food Additives: This 100+ pages report provides in-depth insights into market trends, growth drivers, and competitive landscape. Available in PDF and Excel formats for thorough analysis and easy data access.

Category: Food and Beverage

Brand: DigiRoads

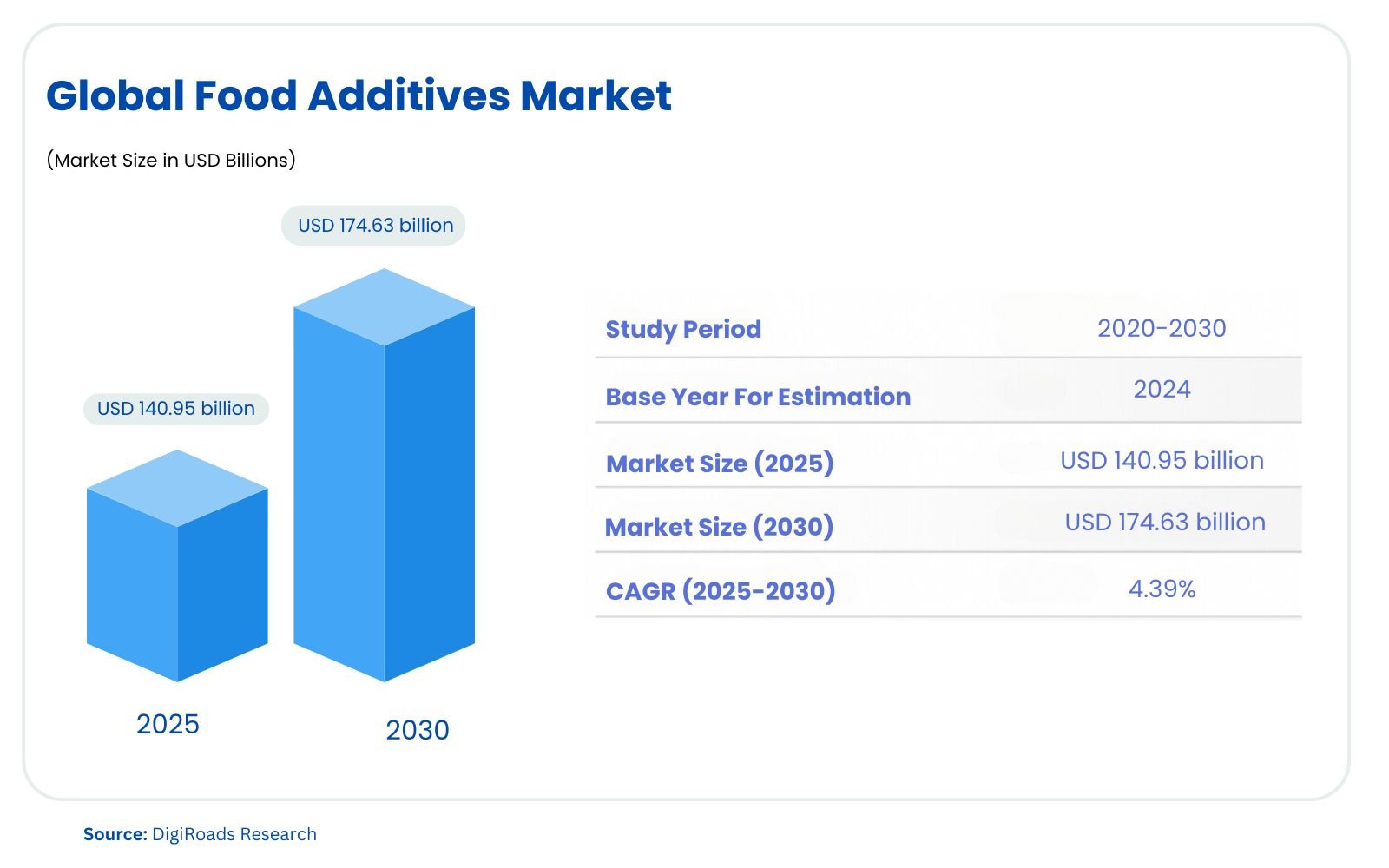

Global Food Additives Market Report | Market Size, Industry Analysis, Growth Opportunities, & Forecast (2025-2030)

Global Food Additives Market Overview

The global Food Additives Market is anticipated to grow steadily, reaching an estimated market size of USD 140.95 billion in 2025. It is projected to expand further to USD 174.63 billion by 2030, with a robust CAGR of 4.39% during the forecast period 2025-2030. The global food additives market is poised for significant growth from 2025 to 2030, driven by increasing consumer demand for processed food and beverages. As food manufacturers continue to innovate, the need for additives to enhance flavor, texture, and shelf-life has surged. This market is segmented by product type, including preservatives, sweeteners, emulsifiers, and colorants, and by application across various industries such as bakery, dairy, beverages, and meat products. The food additives market is also influenced by the growing preference for natural and clean-label ingredients, as well as evolving regulatory standards.

In 2025, the market is expected to experience a compound annual growth rate (CAGR) of 4.39%. North America currently holds the largest market share, but the Asia-Pacific region is set to witness the fastest growth due to increasing urbanization and dietary shifts in countries like China and India.

This report offers a comprehensive analysis of market trends, key players, regional dynamics, and growth opportunities. It is an essential resource for stakeholders in the food and beverage sector, providing insights to navigate the competitive landscape and align strategies for future success.

Market Report Coverage:

The “Global Food Additives Market Report—Future (2025-2030)” by Digiroads Research & Consulting covers an in-depth analysis of the following segments in the market.

| Product Type | Preservatives, Bulk Sweeteners, Sugar Substitutes, Emulsifiers, Anti-caking Agents, Enzymes, Hydrocolloids, Food Flavors & Enhancers, Food Colorants, Acidulants |

| By Application | Bakery & Confectionery, Dairy & Desserts, Beverages, Meat & Meat Products, Soups, Sauces & Dressings, Other Applications |

| Geography | North America, Europe, Asia-Pacific, South America, Middle East & Africa |

Study Assumptions and Definitions

The study on the global food additives market is based on several key assumptions to ensure comprehensive analysis and accurate projections for the 2025-2030 forecast period. The market data reflects the performance and growth patterns of food additives across various regions, including North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. The report assumes that the global food industry will continue to expand due to rising consumer demand for processed, convenience, and ready-to-eat foods, as well as the increasing trend of healthy and natural food ingredients.

Additionally, it is assumed that regulatory frameworks for food additives will remain relatively stable across major markets, though shifts in regulations may occur, particularly concerning synthetic additives. Technological advancements in food processing, alongside consumer preferences for natural and clean-label products, are anticipated to influence the market dynamics.

The market definitions provided in this report categorize food additives into various product types, including preservatives, bulk sweeteners, emulsifiers, and flavor enhancers, among others. The application sectors encompass bakery and confectionery, beverages, dairy, meat products, and more. Market trends and forecasts are derived from a mix of historical data, industry reports, and expert insights, with consideration for potential economic, environmental, and regulatory changes.

Market Scope

The global food additives market report provides a detailed analysis of the market trends, drivers, challenges, and opportunities for the forecast period from 2025 to 2030. It covers a wide range of food additive product types, including preservatives, bulk sweeteners, emulsifiers, anti-caking agents, enzymes, hydrocolloids, food flavors and enhancers, food colorants, and acidulants. These additives are used across various applications such as bakery and confectionery, dairy and desserts, beverages, meat and meat products, and soups, sauces, and dressings.

The report examines the market across key regions, including North America, Europe, Asia-Pacific, South America, and the Middle East & Africa, with a focus on the growth potential of emerging markets. Market share, growth trends, and competitive landscape insights are provided, focusing on leading players like Cargill, Ajinomoto, BASF, and others. The scope also includes a detailed analysis of market segmentation, growth forecasts, and strategic insights into future market trends.

MARKET OUTLOOK

Executive Summary

The global food additives market is poised for significant growth from 2025 to 2030, driven by increasing consumer demand for processed and convenience foods, rising health consciousness, and the growing preference for natural and clean-label ingredients.

Food additives are essential ingredients used to preserve food quality, improve taste, texture, and appearance, and extend shelf life. The market is segmented based on product types, including preservatives (both natural and synthetic), bulk sweeteners, emulsifiers, anti-caking agents, enzymes, hydrocolloids, food flavors and enhancers, food colorants, and acidulants. Additionally, the market caters to several industries, such as bakery and confectionery, dairy and desserts, beverages, meat products and soups, sauces, and dressings.

Geographically, North America holds the largest share, but the Asia-Pacific region is expected to experience the highest growth due to the increasing urban population and rising demand for processed foods. Countries like China, India, and Japan are expected to contribute significantly to the market expansion. Europe and South America also present substantial growth opportunities.

Key players dominating the market include Cargill, Ajinomoto, BASF, Eastman Chemical, and Tate and Lyle, who are focusing on product innovations and strategic acquisitions to gain a competitive edge.

The global food additives market is set to witness a shift towards natural and clean-label solutions, with increasing awareness about health and sustainability. Consumers are demanding additives with fewer synthetic ingredients, which is steering product innovation and market evolution. This trend, coupled with the expanding food and beverage industry, will be crucial drivers for the market growth through 2030.

COMPETITIVE LANDSCAPE

The Global Food Additives Market is moderately fragmented, with regional and multinational players competing fiercely for market share.

Key Market Players

- Cargill, Incorporated

- Archer Daniels Midland Company

- International Flavors and Fragrances Inc.

- Kerry Group

- Givaudan SA

Market Share Analysis

The global food additives market is highly competitive and fragmented, with major players competing through innovation, product differentiation, and geographic expansion. In 2025, North America holds the largest market share, driven by the region’s advanced food processing industry and high consumer demand for convenience and fortified food products. Meanwhile, Asia-Pacific is projected to register the fastest growth rate during the forecast period (2025-2030) due to rising population, increasing disposable incomes, and expanding food and beverage sectors in emerging economies such as India and China.

Key players like Cargill, Archer Daniels Midland (ADM), Givaudan SA, Kerry Group, and International Flavors and Fragrances Inc. dominate the market through extensive product portfolios and strong global distribution networks. These companies focus on R&D to develop natural and clean-label additives to meet evolving consumer preferences.

Natural food additives, such as natural colorants and flavors, are gaining prominence, contributing to market share shifts. Synthetic additives, while widely used, face regulatory scrutiny, impacting their market penetration. Consolidation trends, strategic partnerships, and acquisitions further shape the competitive landscape, as companies aim to enhance their global reach and cater to a diverse consumer base. The market remains poised for steady growth fueled by innovation and sustainability trends.

MARKET DYNAMICS

Market Drivers and Key Innovations

The global food additives market is driven by multiple factors, including the rising demand for processed and convenience foods, growing awareness about food safety, and a shift towards healthier and fortified food products. Rapid urbanization and changing lifestyles have significantly increased the consumption of ready-to-eat and on-the-go food items, creating a substantial demand for food additives that enhance taste, shelf life, and nutritional value. Additionally, the increasing focus on clean-label and natural products is driving the demand for natural food additives such as natural flavors, colorants, and preservatives.

Health-conscious consumers are pushing manufacturers to innovate, leading to the development of sugar substitutes, low-sodium additives, and fat replacers. The growing trend of plant-based and vegan diets has further spurred innovation in the market, with companies developing plant-derived emulsifiers, hydrocolloids, and enzymes.

Key innovations in the industry include advancements in encapsulation technology to improve the stability and effectiveness of additives. Natural flavor and color extraction methods have also become more sustainable and efficient, driven by technological progress and the need for environmentally friendly practices. Furthermore, the rise of biotechnology has enabled the development of enzyme-based solutions that improve food quality while reducing processing costs.

Digitalization and data analytics are being increasingly employed to optimize formulations and meet regional regulatory standards. These innovations, coupled with the rising focus on sustainability, are expected to shape the future of the food additives market, catering to the diverse and dynamic needs of consumers worldwide.

Market Challenges

- Regulatory Compliance: Strict regulations across different regions for food additives, especially for new or unapproved ingredients, can hinder market growth and innovation.

- Health Concerns: Growing concerns about the potential health risks of artificial additives, such as preservatives and synthetic sweeteners, may lead to consumer reluctance, particularly in markets with rising health consciousness.

- Cost of Natural Additives: Natural and organic additives are generally more expensive than synthetic alternatives, posing a challenge for manufacturers to keep costs low while maintaining product quality.

- Sustainability Issues: The environmental impact of sourcing and producing certain food additives, such as colorants and preservatives, is a growing concern, requiring companies to adopt more sustainable practices and ingredients.

- Supply Chain Disruptions: Global supply chain disruptions, especially in raw material procurement, can lead to increased costs, delays, and limited availability of specific additives.

- Consumer Preferences for Clean Labels: The increasing demand for clean-label products, which feature minimal additives or none at all, presents a challenge for manufacturers in balancing quality and ingredient transparency.

- Competition from Natural Substitutes: The rise in popularity of plant-based or whole-food alternatives, such as natural flavorings and preservatives, may lead to competition for traditional synthetic additives in certain applications.

- Technological Barriers: While innovation is crucial, technological barriers such as high development costs and complex production processes for new additives can limit the ability of smaller players to compete in the market.

Market Opportunities

- Rising Demand for Clean-label Products: With consumers increasingly seeking transparency in ingredients, there is an opportunity for companies to develop food additives that align with clean-label trends, focusing on natural and minimal ingredients.

- Growth in Plant-Based Food Products: As plant-based food products continue to gain popularity, there is an expanding need for food additives that enhance the texture, flavor, and preservation of plant-based alternatives.

- Health-Conscious Consumer Trends: The growing preference for healthier, low-calorie, low-sugar, and low-fat products opens doors for food additives that offer functional benefits, such as natural sweeteners, fat replacers, and preservatives with minimal health risks.

- Innovation in Natural and Organic Additives: The increasing demand for natural and organic food additives presents opportunities for manufacturers to innovate and offer clean, eco-friendly, and sustainable alternatives to synthetic additives.

- Expanding Food and Beverage Industry in Emerging Markets: Rapid urbanization and the growth of the middle-class population in emerging markets like Asia-Pacific, Latin America, and Africa create new opportunities for food additive suppliers to meet the demand for processed and packaged foods.

- Technological Advancements: Innovations in food processing technologies, such as fermentation and encapsulation, provide opportunities for new additive developments with enhanced functionality, taste, and preservation capabilities.

- Growing Popularity of Functional Foods: The increasing trend toward functional foods and nutraceuticals, which incorporate health-promoting additives, creates opportunities for the development of additives that improve the nutritional profile of food products.

- Sustainability and Eco-friendly Additives: As sustainability becomes a key focus, there is an opportunity for companies to invest in biodegradable, renewable, and environmentally friendly additives, catering to eco-conscious consumers.

RECENT STRATEGIES & DEVELOPMENTS IN THE MARKET

Strategic Acquisitions and Mergers:

- Cargill, Incorporated acquired Ferrostaal Food Ingredients to expand its product portfolio and enhance its market presence in the food additives sector.

- Givaudan acquired Diana Food, a leader in natural ingredients, aiming to strengthen its position in the natural food additives market.

Focus on Natural and Clean Label Products:

- Kerry Group introduced a range of clean-label additives that cater to the increasing consumer demand for transparent, natural ingredients in food and beverages.

- DSM launched new food additives such as MaxaGlo, a natural antioxidant derived from plants, to support the clean-label trend.

Expansion in Emerging Markets:

- Archer Daniels Midland Company (ADM) has been expanding its presence in emerging markets, especially in Asia-Pacific, through regional production facilities and strategic partnerships. This move aims to tap into the growing demand for food additives in regions like India, China, and Southeast Asia.

- Chr. Hansen has increased its investments in Latin American and Asia-Pacific regions to support the growth of functional foods and natural additives.

Investment in Research and Development:

- International Flavors & Fragrances Inc. (IFF) has been focusing on R&D to create innovative food additives that cater to healthier, more sustainable, and functional foods. Their recent research includes plant-based flavors and ingredients, which are expected to grow in demand.

- ADM invested in new R&D capabilities to develop plant-based, sugar-reduction, and clean-label food additives.

Sustainability Initiatives:

- Givaudan has committed to reducing the environmental impact of its food additives production by investing in sustainable sourcing practices and eco-friendly additives.

- Kerry Group has focused on achieving carbon neutrality in its operations and has implemented sustainable sourcing of raw materials for food additives, contributing to a more sustainable food supply chain.

Product Innovation in Functional Food Additives:

- DuPont launched Danisco Powerfibre, a novel dietary fiber, to enhance food and beverage products targeting digestive health and gut microbiome. This development meets the growing demand for functional and health-promoting additives.

Regional Expansion through Partnerships:

- BASF partnered with Syngenta to create food additives that address the need for natural food preservation and clean-label formulations. This partnership focuses on sustainability and improving food safety standards across global markets.

KEY BENEFITS FOR STAKEHOLDERS

Increased Market Opportunities:

- Stakeholders can capitalize on the growing demand for food additives, particularly in emerging markets such as Asia-Pacific, Latin America, and Africa. These regions present vast opportunities for expansion and higher revenue potential.

- The rising preference for clean-label, natural, and functional food additives opens up new markets for businesses to explore and grow.

Diversification and Innovation:

- By introducing innovative and sustainable products, stakeholders can differentiate their offerings, allowing for brand loyalty and enhanced market share. For instance, investments in plant-based additives and health-enhancing ingredients are critical in meeting consumer trends.

- Continuous product development and diversification enable companies to cater to various sectors, including bakery, dairy, beverages, and meat, enhancing their portfolio.

Competitive Advantage:

- Stakeholders who invest in research and development (R&D) can lead in terms of product innovation and market differentiation. R&D enables businesses to offer additives with improved functionality, such as preservatives with better shelf life or natural sweeteners with less environmental impact.

- Companies with a robust supply chain, backed by sustainable and ethical sourcing practices, can enhance their competitive position in the market, appealing to the growing base of conscious consumers.

Cost Efficiency:

- Adopting advanced technologies and production processes in food additives manufacturing can help stakeholders achieve cost efficiency through better resource management, reduced waste, and increased operational efficiency.

- Strategic partnerships and acquisitions allow stakeholders to benefit from economies of scale, optimize production processes, and lower costs while maintaining high product quality.

Regulatory Compliance and Safety:

- Stakeholders who align their operations with stringent food safety regulations and certifications can ensure product quality and enhance consumer trust. This also reduces the risks of non-compliance penalties or product recalls.

- In addition, staying ahead of evolving regulations on sustainability and environmental practices gives stakeholders a long-term edge in the market.

Sustainability and Environmental Benefits:

- The shift towards sustainable food production methods and eco-friendly additives offers stakeholders the opportunity to position their products as environmentally responsible, which is a growing concern among consumers and regulatory bodies alike.

- Sustainability initiatives, such as reducing carbon footprints and using renewable resources, allow stakeholders to contribute to global environmental goals, potentially increasing market appeal and consumer loyalty.

Increased Consumer Trust:

- Companies that focus on delivering clean, safe, and effective food additives contribute to higher consumer confidence. Stakeholders who prioritize transparency and product labeling (e.g., non-GMO, organic) will benefit from growing consumer demand for trustworthy food products.

At DigiRoads Research, we emphasize reliability by employing robust market estimation and data validation methodologies. Our insights are further enhanced by our proprietary data forecasting model, which projects market growth trends up to 2030. This forward-thinking approach ensures our analysis not only captures the current market landscape but also anticipates future developments, equipping stakeholders with actionable foresight.

We go a step further by offering an exhaustive set of regional and country-level data points, supplemented by over 60 detailed charts at no additional cost. This commitment to transparency and accessibility allows stakeholders to gain a deep understanding of the industry’s structural and operational dynamics. By providing exclusive and hard-to-access data, DigiRoads Research empowers businesses to make informed strategic decisions with confidence.

In essence, our methodology and data delivery foster a collaborative and data-driven decision-making environment, enabling businesses to navigate industry challenges and capitalize on opportunities effectively.

Contact Us For More Inquiry.

Table of Contents

INTRODUCTION

- Market Overview

- Years Considered for Study

- Market Segmentation

- Study Assumptions and Definitions

- Market Scope

RESEARCH METHODOLOGY

MARKET OUTLOOK

- Executive Summary

- Market Snapshot

- Market Segments

- Product Type:

- Preservatives, Bulk Sweeteners, Sugar Substitutes, Emulsifiers, Anti-caking Agents, Enzymes, Hydrocolloids, Food Flavors and Enhancers, Food Colorants, Acidulants

- Application:

- Bakery, Dairy, Beverages, Meat, Soups/Sauces/Dressings, Other

- Geography:

- North America, Europe, Asia-Pacific, South America, Middle East and Africa

- Product Type:

COMPETITIVE LANDSCAPE

- Recent Strategies (Key Strategic Moves)

- Market Share Analysis

- Company Profiles

- Cargill, Incorporated

- Archer Daniels Midland Company

- International Flavors and Fragrances Inc.

- Kerry Group

- Givaudan SA

MARKET DYNAMICS

- Market Drivers

- Market Challenges

- Market Opportunities

- Porter’s Five Forces’ Analysis

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Threat of New Entrant

- Threat of Substitutes

- Competitive Rivalry

GLOSSARY OF PROMINENT SECONDARY SOURCES

DISCLAIMER

ABOUT US