Global Specialty Food Ingredients Market

- Brand: DigiRoads

Discover the 100+ page report on the Global Specialty Food Ingredients Market, offering insights into trends, growth drivers, and the competitive landscape. Available in PDF and Excel formats for convenient access to detailed data and analysis.

Global Specialty Food Ingredients Market Report | Market Size, Industry Analysis, Growth Opportunities, & Forecast (2025-2030)

Global Specialty Food Ingredients Market Overview

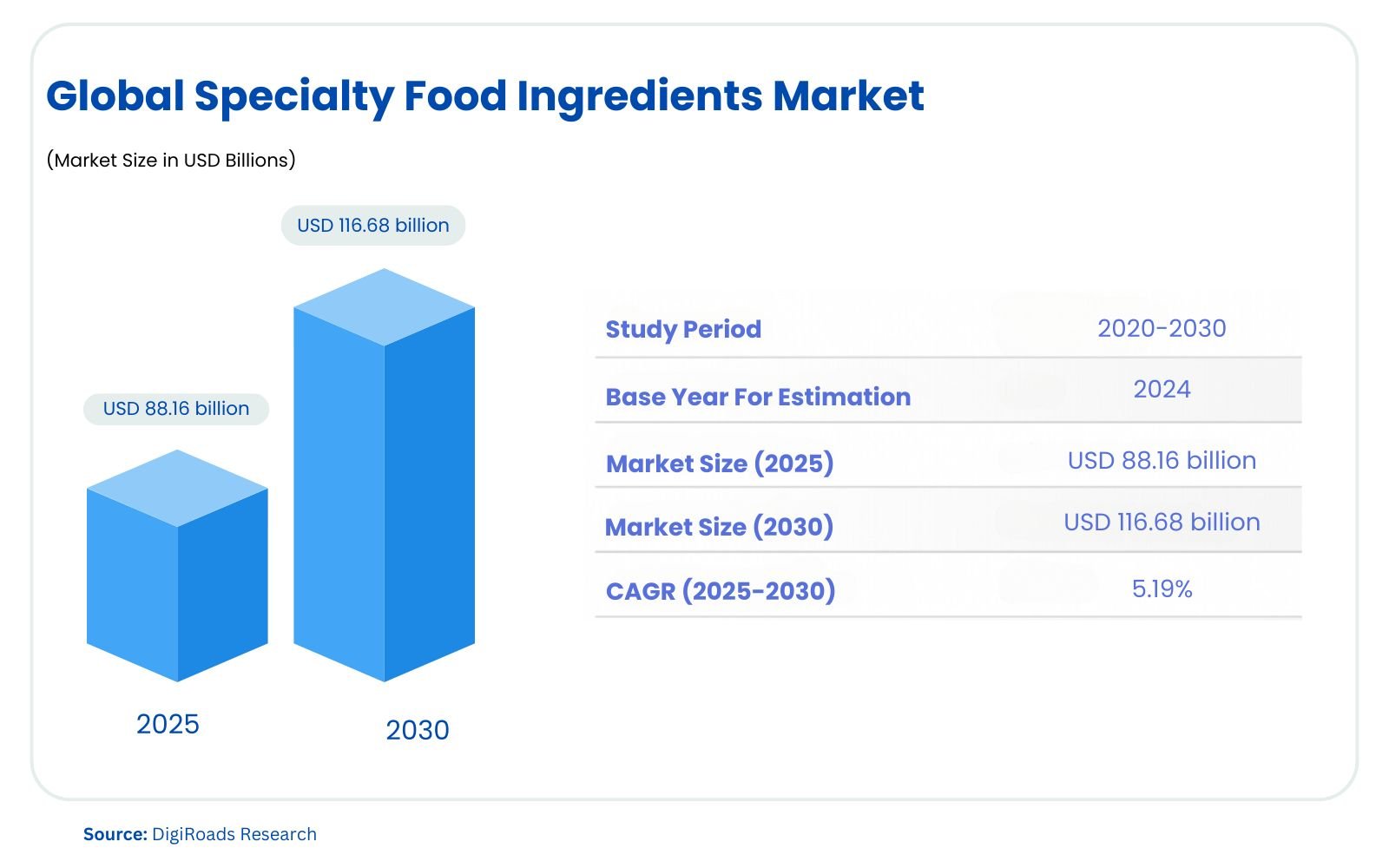

The global Specialty Food Ingredients Market is witnessing significant growth, with an estimated market size of USD 88.16 billion in 2025, and is projected to reach USD 116.68 billion by 2030, expanding at a CAGR of 5.19% during the forecast period 2025-2030. The Global Specialty Food Ingredients Market is poised for significant growth from 2025 to 2030, driven by rising consumer demand for healthier, clean-label, and functional foods. These ingredients, including natural preservatives, emulsifiers, sweeteners, and food flavors, play a vital role in enhancing food products’ taste, texture, and shelf life. Major players in the market, such as Cargill, Kerry Group, DSM, and Archer Daniels Midland Company, are focusing on innovation and product development to meet the evolving consumer preferences for natural and sustainable food solutions.

The market is expected to expand across various segments, including bakery products, beverages, dairy, and plant-based foods. Increasing awareness about the importance of nutrition and clean-label products is further boosting demand for specialty food ingredients. Geographically, Asia-Pacific is expected to emerge as the fastest-growing region, driven by increasing urbanization and changing dietary patterns in countries like China, India, and Japan. In contrast, North America will hold the largest market share due to high consumer demand for processed and functional foods.

This report provides an in-depth analysis of market trends, growth drivers, and challenges, offering valuable insights for businesses and stakeholders in the global specialty food ingredients industry.

Market Report Coverage:

The “Global Specialty Food Ingredients Market Report—Future (2025-2030)” by Digiroads Research & Consulting covers an in-depth analysis of the following segments in the market.

| Product Type | Functional Food Ingredients, Specialty Starch and Texturants, Sweeteners, Food Flavors and Enhancers, Acidulants, Preservatives, Emulsifiers, Colorants, Enzymes, Proteins, Specialty Fats and Oils, Food Hydrocolloids and Polysaccharides, Anti-Caking Agents, Yeast, Food-Grade Glycerin |

| Application | Bakery Products, Beverages, Meat, Poultry, and Seafood, Dairy Products, Confectionery, Fats and Oils, Dressings/Condiments/Sauces/Marinades, Pasta, Soup and Noodles, Prepared Food, Plant-based Food & Beverage, Other Applications |

| Geography | North America, Europe, Asia-Pacific, South America, Middle East & Africa |

Study Assumptions and Definitions

The data in this report is based on extensive research and analysis of the Global Specialty Food Ingredients Market, with a focus on the forecast period from 2025 to 2030. The study assumes that the market will experience steady growth driven by factors such as increasing consumer demand for healthier and clean-label food products, as well as advancements in food technology and ingredient innovation. The report also assumes that the market players will continue focusing on sustainable sourcing, natural ingredients, and the development of functional food ingredients to meet evolving consumer preferences.

Definitions used in the study include:

- Specialty Food Ingredients: Ingredients used in the food industry that provide specific technological, nutritional, or sensory benefits, such as flavors, preservatives, emulsifiers, sweeteners, and functional ingredients.

- Clean Label: Products that contain natural, minimally processed ingredients with clear, understandable labeling.

- Functional Food Ingredients: Ingredients that provide additional health benefits beyond basic nutrition, including probiotics, fiber, and other bioactive components.

- Market Segmentation: The division of the market into distinct groups based on product types, applications, and geographic regions.

The assumptions and definitions presented here are intended to guide the analysis and projections outlined in the report.

Market Scope

This report provides a comprehensive analysis of the Global Specialty Food Ingredients Market, focusing on its growth trajectory from 2025 to 2030. The scope of the study includes a detailed examination of market dynamics, trends, and competitive landscape across various product segments such as functional food ingredients, preservatives, emulsifiers, sweeteners, and food flavors. The report also covers a wide range of applications, including bakery products, beverages, dairy, meat, and plant-based foods.

Geographically, the market is segmented into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. Key countries within these regions are analyzed for their contribution to market growth and trends. Additionally, the report highlights key players and their strategies, such as product innovation, mergers, and acquisitions, aimed at capturing market share.

The scope of this study is designed to help businesses and stakeholders gain valuable insights into the market’s current and future outlook, guiding investment and strategic decisions.

MARKET OUTLOOK

Executive Summary

The Global Specialty Food Ingredients Market is expected to witness substantial growth from 2025 to 2030, driven by increasing consumer demand for healthier, clean-label, and functional food products. Specialty food ingredients, such as preservatives, emulsifiers, food flavors, sweeteners, and functional ingredients, are essential in enhancing food products’ taste, texture, and shelf life. As consumers shift towards more natural, minimally processed foods, the market for these ingredients is expanding rapidly.

The market is segmented by product type, including functional food ingredients, specialty starches, food flavors and enhancers, sweeteners, preservatives, and others. Each product segment plays a critical role in meeting the evolving demands of the food industry, offering nutritional benefits and improved sensory qualities. Functional food ingredients, in particular, are gaining popularity due to their added health benefits, such as probiotics, fibers, and antioxidants.

Geographically, North America is anticipated to maintain the largest market share due to the high demand for processed and functional foods. However, Asia-Pacific is expected to exhibit the highest growth rate during the forecast period, driven by increasing urbanization, changing dietary habits, and a rising preference for processed and convenience foods in countries like China, India, and Japan.

Key market players, including Cargill, Kerry Group, DSM, and Archer Daniels Midland Company, are focusing on innovation, strategic acquisitions, and partnerships to expand their product offerings and strengthen their market position. Companies are also investing in sustainable sourcing and production methods to meet consumer demand for clean-label and environmentally friendly products.

Overall, the Global Specialty Food Ingredients Market is set to experience significant growth, with emerging trends like plant-based foods and functional ingredients shaping its future direction. Businesses and stakeholders can leverage this growth by capitalizing on the increasing demand for healthy, sustainable, and innovative food solutions.

COMPETITIVE LANDSCAPE

The Global Specialty Food Ingredients Market is moderately fragmented, with regional and multinational players competing fiercely for market share.

Key Market Players

- Cargill, Incorporated

- Kerry Group PLC

- International Flavors & Fragrances Inc.

- Koninklijke DSM NV

- Archer Daniels Midland Company

- Ingredion Incorporated

- Sensient Technologies

- Tate & Lyle PLC

- Axiom Foods Inc.

- Novozymes A/S

Market Share Analysis

The Global Specialty Food Ingredients Market is moderately fragmented, with several key players holding significant market share. In 2025, North America is expected to account for the largest share of the market, driven by the region’s established food industry, high demand for processed foods, and a growing preference for functional and clean-label ingredients. Leading companies such as Cargill, Incorporated, Kerry Group PLC, and International Flavors & Fragrances Inc. dominate the market with extensive product portfolios and strong distribution networks.

Europe also holds a considerable market share, with demand for natural and organic food ingredients on the rise. Koninklijke DSM NV and Tate & Lyle PLC have a strong presence in this region, focusing on innovative, sustainable ingredient solutions.

Asia-Pacific is poised for the highest growth rate during the forecast period, with increased urbanization, rising disposable incomes, and evolving consumer preferences in countries like China, India, and Japan. Companies are expanding their footprint in the region through strategic partnerships and local production facilities.

Market share distribution is influenced by product innovation, geographical expansion, and sustainability efforts. The focus on plant-based food solutions, clean-label ingredients, and functional food formulations is driving market dynamics, with leading players investing heavily in these areas to capture a larger share of the market. The competitive landscape is likely to intensify as new entrants and established players seek to meet the growing demand for specialty ingredients in the food industry.

MARKET DYNAMICS

Market Drivers and Key Innovations

The Global Specialty Food Ingredients Market is driven by several key factors that align with evolving consumer preferences and industry trends. One of the primary drivers is the increasing demand for health-conscious food products, including functional ingredients that offer health benefits such as probiotics, antioxidants, and fibers. As consumers become more aware of the link between diet and health, the preference for clean-label, natural, and minimally processed ingredients has surged. This shift is fueling the demand for specialty food ingredients that enhance the nutritional value and safety of food products.

Another significant driver is the growing trend of plant-based diets. With rising interest in vegan, vegetarian, and flexitarian lifestyles, the demand for plant-based food ingredients such as plant proteins and dairy alternatives is increasing. Specialty food ingredients play a crucial role in providing the texture, taste, and nutritional profile needed for these products.

Convenience is also driving market growth. Busy lifestyles and the increasing preference for ready-to-eat and packaged foods are pushing manufacturers to use specialty ingredients like preservatives, emulsifiers, and stabilizers to enhance the shelf life, flavor, and texture of these products.

Key innovations in the market include the development of functional sweeteners like erythritol, natural preservatives such as rosemary extract, and the creation of innovative emulsifiers that improve food texture while reducing artificial additives. Companies like Tate & Lyle and Kerry Group are pioneering advancements in healthier, low-calorie, and sugar-reduced formulations, meeting the demand for functional, sustainable, and clean-label products.

Market Challenges

- High Costs of Specialty Ingredients: Specialty food ingredients, especially natural and functional ones, often come at a higher cost compared to traditional ingredients. This increases the overall production cost for manufacturers, which can affect pricing strategies and market competitiveness.

- Regulatory Compliance: Stringent regulations regarding food safety and labeling standards across various regions can create challenges for manufacturers. Compliance with local regulations, including those related to clean-label and natural ingredients, can be time-consuming and costly.

- Supply Chain Disruptions: The availability and sourcing of raw materials for specialty ingredients are susceptible to disruptions, such as climatic conditions or geopolitical issues. This can lead to inconsistent supply and price volatility, affecting the production timelines and stability of the market.

- Consumer Skepticism: While demand for clean-label and natural ingredients is growing, some consumers remain skeptical about the effectiveness and safety of certain specialty food ingredients, particularly new innovations. Overcoming this skepticism requires significant consumer education and trust-building.

- Intense Competition: The specialty food ingredients market is becoming increasingly competitive with both established players and new entrants. Companies are under constant pressure to innovate and offer unique products to maintain market share.

- Sustainability Concerns: As consumers and businesses alike focus on sustainability, the sourcing and production of specialty ingredients must align with environmentally friendly practices. Manufacturers face the challenge of balancing sustainability with product quality and cost.

- Limited Consumer Awareness: Although the market is expanding, many consumers are still unaware of the functional benefits and uses of specialty food ingredients. Companies need to invest in educating consumers to drive adoption.

Market Opportunities

- Growing Demand for Plant-Based Products: With the rise in plant-based diets, there is a significant opportunity for specialty food ingredients that cater to plant-based meat, dairy alternatives, and other vegan products. This trend is expected to continue growing, providing ample market opportunities.

- Health-Conscious Consumer Trends: The increasing focus on health and wellness is driving the demand for functional ingredients, such as probiotics, prebiotics, and natural sweeteners. Manufacturers can capitalize on this trend by innovating and developing healthier food options with added nutritional benefits.

- Clean-Label and Natural Ingredient Demand: The growing consumer preference for clean-label products, which are free from artificial additives and preservatives, presents an opportunity for companies to develop and supply natural, non-GMO, and minimally processed specialty ingredients.

- Technological Advancements in Ingredient Production: Innovations in food technology, such as fermentation, enzymatic processes, and sustainable sourcing of raw materials, present opportunities for manufacturers to create more cost-effective and environmentally friendly specialty food ingredients.

- Rising Popularity of Functional Beverages: As demand for functional beverages (e.g., energy drinks, plant-based milks, and probiotic-rich drinks) grows, there is an increasing need for ingredients that enhance taste, texture, and nutritional value. This creates opportunities for specialized ingredients in the beverage sector.

- Expanding Market for Convenience Foods: The demand for ready-to-eat and convenient packaged foods continues to rise. Specialty food ingredients that extend shelf life, enhance flavor, and improve texture can benefit from this growing sector.

- Sustainability and Eco-friendly Ingredient Solutions: As consumers and brands prioritize sustainability, there is an opportunity for manufacturers to develop eco-friendly specialty food ingredients. This includes sustainably sourced ingredients, plant-based alternatives, and ingredients with minimal environmental impact.

- Emerging Markets: Expanding into emerging markets in Asia-Pacific, Latin America, and the Middle East presents growth opportunities. As these regions experience economic growth and urbanization, there is an increasing demand for processed and packaged foods, driving the need for specialty ingredients.

RECENT STRATEGIES & DEVELOPMENTS IN THE MARKET

Expansion of Product Portfolios:

- Tate & Lyle: In November 2022, Tate & Lyle launched Erytesse erythritol, a new sweetener to cater to the growing demand for healthier, sugar- and calorie-reduced products. This innovation was made possible through a strategic partnership with a leading erythritol supplier. The expansion of their product portfolio addresses the increasing demand for low-calorie ingredients in the market.

Strategic Investments in Innovation Centers:

- International Flavors & Fragrances Inc. (IFF): In October 2022, IFF invested USD 30 million in the expansion of its innovation center in Singapore. This new center integrates multiple business divisions, including Nourish, Health & Biosciences, and Scent. This facility aims to support the development of new products and technologies, enhancing the company’s competitive edge in the specialty food ingredients market.

Acquisitions to Strengthen Market Position:

- Royal DSM: In September 2022, DSM acquired First Choice Ingredients, a leading supplier of dairy-based savory flavorings, for USD 453 million. This acquisition strengthens DSM’s position in clean-label dairy and savory ingredients, which are in demand for various food applications such as snacks and ready-to-eat meals.

Sustainability Initiatives:

- Kerry Group: Kerry has made significant strides in sustainability, focusing on reducing carbon emissions and improving sourcing practices for natural ingredients. The company has committed to sourcing 100% of its raw materials sustainably by 2025, aligning with growing consumer interest in sustainable food production.

Partnerships for Expansion in Emerging Markets:

- Archer Daniels Midland Company (ADM): In December 2022, ADM entered into a partnership with a local distributor in Southeast Asia to expand its market reach for plant-based proteins. This move capitalizes on the growing demand for plant-based food ingredients in the region, particularly in markets like India and China, where plant-based diets are becoming more popular.

Focus on Health-Conscious and Clean-Label Products:

- Ingredion Incorporated: Ingredion’s focus on clean-label ingredients has been evident in its recent product launches, including its range of natural sweeteners and texturants. In 2023, the company launched a line of plant-based emulsifiers to cater to the demand for dairy alternatives and vegan foods.

Enhancement of Functional Ingredient Offerings:

- Sensient Technologies: Sensient Technologies has been investing in the development of functional ingredients that offer health benefits beyond basic nutrition. In 2023, the company introduced a new range of antioxidants and nutraceutical ingredients to cater to the growing demand for products that support immunity, gut health, and overall wellness.

KEY BENEFITS FOR STAKEHOLDERS

- Market Growth Opportunities: Stakeholders can capitalize on the growing demand for healthier, sustainable, and clean-label food ingredients. The market is expected to expand due to increased consumer focus on health and wellness.

- Access to Innovative Solutions: With continuous product innovations and technological advancements, stakeholders can stay competitive by offering new and unique products that meet consumer preferences, such as plant-based or sugar-reduced ingredients.

- Sustainability Advantages: As the industry shifts towards sustainability, stakeholders can benefit by aligning with eco-friendly practices, which can attract environmentally-conscious consumers and enhance brand value.

- Diverse Product Offerings: The wide range of specialty food ingredients, such as sweeteners, emulsifiers, and functional food ingredients, offers stakeholders the ability to diversify their product portfolios and cater to various consumer needs across different food sectors.

- Enhanced Market Reach: Strategic partnerships, acquisitions, and expansions into emerging markets provide stakeholders with opportunities to increase market penetration and expand their geographical reach, especially in high-growth regions like Asia-Pacific.

- Regulatory Compliance: As clean-label products become a significant trend, stakeholders who align with regulatory standards can gain consumer trust, leading to improved brand loyalty and market share.

- Health-Conscious Consumer Base: Catering to the demand for functional and health-promoting ingredients provides stakeholders with the opportunity to target health-conscious consumers, creating new revenue streams.

At DigiRoads Research, we emphasize reliability by employing robust market estimation and data validation methodologies. Our insights are further enhanced by our proprietary data forecasting model, which projects market growth trends up to 2030. This forward-thinking approach ensures our analysis not only captures the current market landscape but also anticipates future developments, equipping stakeholders with actionable foresight.

We go a step further by offering an exhaustive set of regional and country-level data points, supplemented by over 60 detailed charts at no additional cost. This commitment to transparency and accessibility allows stakeholders to gain a deep understanding of the industry’s structural and operational dynamics. By providing exclusive and hard-to-access data, DigiRoads Research empowers businesses to make informed strategic decisions with confidence.

In essence, our methodology and data delivery foster a collaborative and data-driven decision-making environment, enabling businesses to navigate industry challenges and capitalize on opportunities effectively.

Contact Us For More Inquiry.

Table of Contents

-

INTRODUCTION

- Market Overview

- Years Considered for Study

- Market Segmentation

- Study Assumptions and Definitions

- Market Scope

-

RESEARCH METHODOLOGY

-

MARKET OUTLOOK

- Executive Summary

- Market Snapshot

- Market Segments

- Product Type:

- Functional Food Ingredients, Specialty Starch and Texturants, Sweeteners, Food Flavors and Enhancers, Acidulants, Preservatives, Emulsifiers, Colorants, Enzymes, Proteins, Specialty Fats and Oils, Food Hydrocolloids and Polysaccharides, Anti-Caking Agents, Yeast, Food-Grade Glycerin

- Application:

- Bakery Products, Beverages, Meat, Poultry, and Seafood, Dairy Products, Confectionery, Fats and Oils, Dressings/Condiments/Sauces/Marinades, Pasta, Soup and Noodles, Prepared Food, Plant-based Food & Beverage, Other Applications

- Geography:

- North America, Europe, Asia-Pacific, South America, Middle East & Africa

- Product Type:

-

COMPETITIVE LANDSCAPE

- Recent Strategies (Key Strategic Moves)

- Market Share Analysis

- Company Profiles

- Cargill, Incorporated

- Kerry Group PLC

- International Flavors & Fragrances Inc.

- Koninklijke DSM NV

- Archer Daniels Midland Company

- Ingredion Incorporated

- Sensient Technologies

- Tate & Lyle PLC

- Axiom Foods Inc.

- Novozymes A/S

-

MARKET DYNAMICS

- Market Drivers

- Market Challenges

- Market Opportunities

- Porter’s Five Forces’ Analysis

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Threat of New Entrant

- Threat of Substitutes

- Competitive Rivalry

-

GLOSSARY OF PROMINENT SECONDARY SOURCES

-

DISCLAIMER

-

ABOUT US