Global Halal Food and Beverages Market

- Brand: DigiRoads

Discover the 100+ page report on the Global Halal Food and Beverages Market, providing insights into trends, growth drivers, and the competitive landscape. Available in PDF and Excel formats for easy access to detailed data and analysis.

Global Halal Food And Beverages Market Report | Market Size, Industry Analysis, Growth Opportunities, & Forecast (2025-2030)

Global Halal Food And Beverages Market Overview

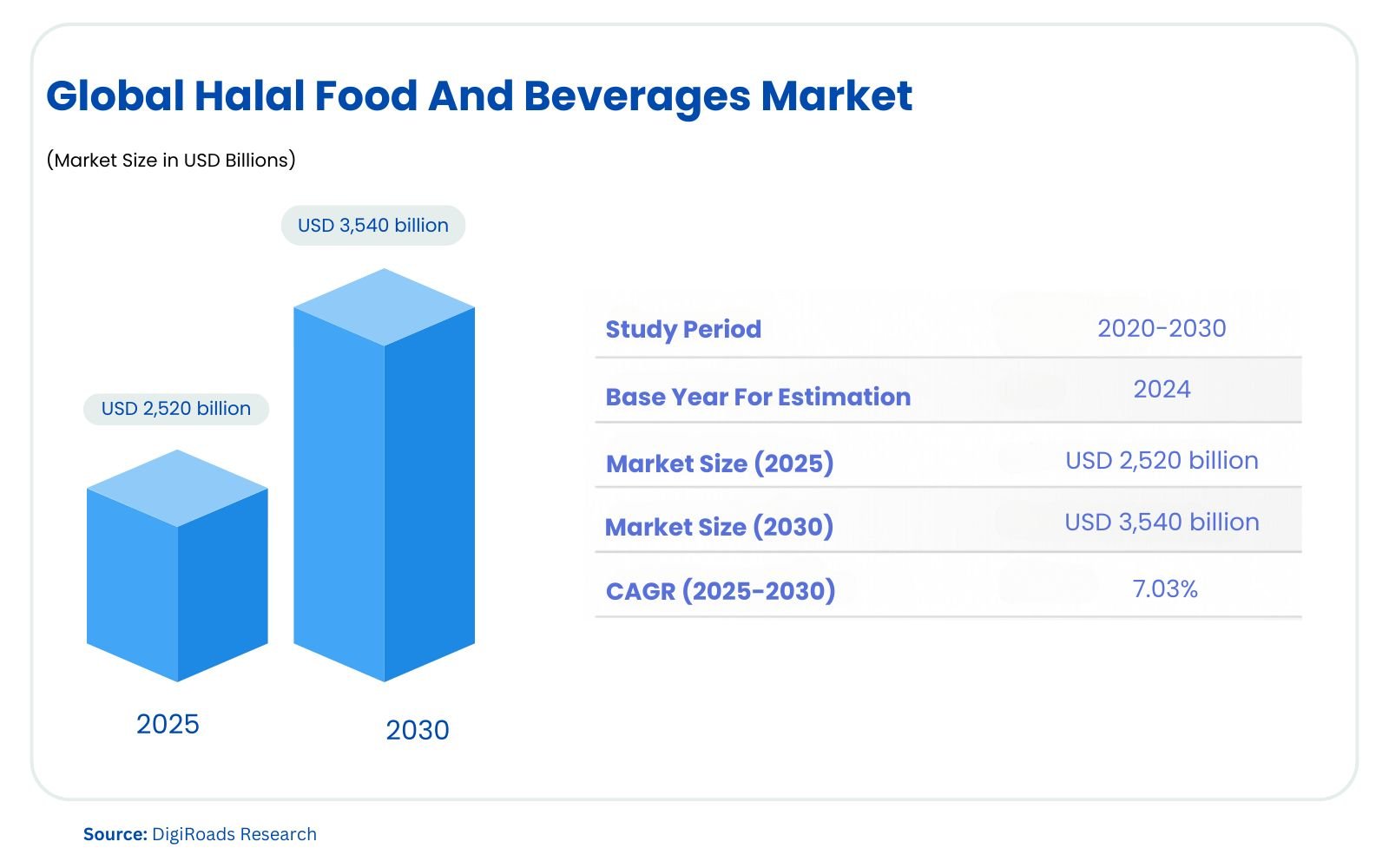

The global Halal Food and Beverages Market is poised for significant expansion, with an estimated market size of USD 2,520 billion in 2025, projected to reach USD 3,540 billion by 2030, growing at a CAGR of 7.03% during the forecast period 2025-2030. This growth reflects the increasing demand for halal-certified products worldwide, fueled by rising consumer awareness and evolving market trends.

The global halal food and beverages market is driven by a surge in the global Muslim population and increasing consumer demand for certified halal products. Halal food and beverages are governed by Islamic dietary laws, ensuring that products are both lawful and hygienic. This market is segmented into halal food, beverages, and supplements, with each category experiencing substantial growth.

The market’s growth is further supported by the increasing adoption of halal certification across various regions, which bolsters consumer trust and widens the market’s appeal. Distribution channels such as supermarkets, hypermarkets, convenience stores, and online retail platforms play a crucial role in the widespread availability of halal products. Geographically, the Middle East and Africa dominate the market, followed by strong growth in the Asia-Pacific region, particularly in countries like Indonesia, Malaysia, and India. Key market players, including Nestlé SA, Al Islami Foods, and BRF SA, are leveraging brand loyalty and geographic expansion to secure market leadership.

This report provides valuable insights into market trends, challenges, opportunities, and key players, helping stakeholders navigate the competitive landscape from 2025 to 2030.

Market Report Coverage:

The “Global Halal Food And Beverages Market Report—Future (2025-2030)” by Digiroads Research & Consulting covers an in-depth analysis of the following segments in the market.

| By Type | Halal Food, Halal Beverages, Halal Supplements |

| By Distribution Channel | Supermarkets, Convenience Stores, Online Retail, Other Channels |

| By Geography | North America (US, Canada, Mexico, Rest), Europe (Germany, UK, Spain, Rest), Asia-Pacific (China, Japan, India, Rest), South America (Brazil, Argentina, Rest), Middle East & Africa (South Africa, Egypt, Saudi Arabia, UAE, Oman, Rest) |

Study Assumptions and Definitions

The study of the Global Halal Food and Beverages Market (2025-2030) is based on several key assumptions and definitions that provide clarity on the scope and methodology of the market analysis.

Assumptions:

- Market growth projections are based on historical data and current trends, factoring in various influences such as economic conditions, demographic shifts, and technological advancements.

- The study assumes that the global demand for halal-certified products will continue to rise due to increasing Muslim populations, growing awareness, and expanding distribution channels.

- It also considers that consumer preferences and regulatory changes, particularly in the food safety and certification standards, will have a significant impact on market dynamics.

- The market forecast assumes continued growth in key regions, especially in Asia-Pacific and the Middle East, with varying rates of adoption in different countries.

Definitions:

- Halal Foods: Products prepared in compliance with Islamic dietary laws.

- Halal Beverages: Beverages that adhere to halal certification standards.

- Halal Supplements: Dietary supplements that meet halal certification.

- Distribution Channels: Supermarkets, convenience stores, online retail stores, and others.

- Geographies: Market segments defined by regions such as North America, Europe, Asia-Pacific, South America, and Middle East & Africa.

These assumptions and definitions guide the study’s analysis, ensuring accurate and consistent market insights.

Market Scope

The Global Halal Food and Beverages Market report covers a comprehensive analysis of the market from 2025 to 2030, focusing on key market segments, growth trends, and regional insights. The scope of the market includes halal foods, beverages, and supplements, with detailed analysis of product types, distribution channels, and geographical regions.

The market is segmented by product type into halal food, halal beverages, and halal supplements, catering to a broad range of consumer needs. It also examines distribution channels such as supermarkets and hypermarkets, convenience stores, online retail, and others, highlighting the various platforms through which halal products reach consumers.

Geographically, the report covers North America, Europe, Asia-Pacific, South America, and the Middle East & Africa, providing insights into regional dynamics and growth opportunities. The study explores key trends, challenges, and opportunities across these regions, with a focus on the growing demand for halal-certified products in emerging markets.

MARKET OUTLOOK

Executive Summary

The Global Halal Food and Beverages Market is poised for significant growth from 2025 to 2030, driven by increasing consumer demand for halal-certified products across the globe. In 2025, the market is expected to reach a valuation of USD 2.52 trillion, growing at a compound annual growth rate (CAGR) of 7.03%, with projections to reach USD 3.54 trillion by 2030. This growth is attributed to the rising Muslim population, increasing awareness about halal food regulations, and a growing number of non-Muslim consumers choosing halal products due to their perceived quality and safety standards.

The market is segmented into halal food, beverages, and supplements, with halal food dominating the largest share. Halal food products range from meat and poultry to ready-to-eat meals, catering to a diverse consumer base. Halal beverages, such as juices, soft drinks, and energy drinks, have also seen a surge in demand, particularly in non-Muslim markets. Halal supplements, offering nutritional and health benefits, are growing in popularity, especially in health-conscious segments.

By distribution channel, supermarkets and hypermarkets continue to lead, followed by convenience stores, online retail, and other channels. Geographically, the Middle East and Africa currently account for the largest market share, with substantial growth in regions such as Asia-Pacific, where demand for halal food and beverages is accelerating due to population growth and urbanization.

Key players in the market include Nestlé SA, JBS SA, BRF SA, and Ferrero International SA, among others, who are expanding their product portfolios and adopting innovative strategies to meet the evolving consumer preferences for halal products. The report identifies emerging market opportunities and highlights trends in packaging, product innovation, and sustainability, which will shape the market’s future trajectory.

COMPETITIVE LANDSCAPE

The Global Halal Food And Beverages Market is moderately fragmented, with regional and multinational players competing fiercely for market share.

Key Market Players

- Nestlé SA

- JBS SA

- BRF SA

- Ferrero International SA

- Midamar Corporation

- Crescent Foods Inc.

- Tahira Foods Ltd

- Tanmiah Food Company

- American Foods Group LLC

Market Share Analysis

The Global Halal Food and Beverages Market is highly competitive, with key players holding significant shares in the market. The market is primarily driven by consumer demand for products that adhere to Islamic dietary laws, offering growth opportunities across various regions.

In 2025, the Middle East and Africa region is expected to hold the largest share, driven by high demand for halal products, especially in countries like Saudi Arabia, the UAE, and Egypt. These markets are characterized by a strong cultural preference for halal food, which fuels market growth.

Asia Pacific is projected to be the fastest-growing region, with countries such as Indonesia, Malaysia, and India driving demand for halal food and beverages. The increasing Muslim population, coupled with rising disposable income, supports market expansion in this region.

North America and Europe also present substantial market opportunities, with an expanding Muslim population and growing consumer interest in halal-certified products. Companies in these regions are focusing on expanding their product lines to cater to both the halal and mainstream markets.

Overall, large players like Nestlé, BRF, and JBS SA dominate the market, but regional players are also making significant strides by localizing their products to meet the demands of different cultures and preferences, increasing competition in the global market.

MARKET DYNAMICS

Market Drivers and Key Innovations

The Global Halal Food and Beverages Market is driven by several key factors, contributing to its rapid growth.

Market Drivers:

- Increasing Muslim Population: The growing Muslim population, especially in regions like Asia Pacific, the Middle East, and Africa, is a significant driver. As the global Muslim population continues to expand, demand for halal-certified food and beverages is rising.

- Rising Health Consciousness: Halal products are often perceived as healthier options due to their strict quality and hygiene standards, attracting not only Muslim consumers but also health-conscious non-Muslims, further driving market growth.

- Growing Consumer Awareness: There is increasing awareness about halal certification, with consumers becoming more discerning about the food they consume. This trend is evident across both Muslim-majority countries and regions with diverse populations.

- Expansion of Halal Food Availability: Halal products are becoming more widely available across supermarkets, hypermarkets, and online platforms. This increased accessibility boosts market reach, especially in non-Muslim-majority regions.

Key Innovations:

- Plant-based Halal Foods: With the growing demand for plant-based diets, many companies are introducing halal-certified plant-based meat alternatives to cater to both vegan and halal consumers, tapping into a new segment of the market.

- Halal Certification Technology: Advancements in halal certification technology, such as blockchain for traceability and transparency, are enhancing consumer trust in halal products.

- Premium Halal Products: The rise of premium halal products, such as gourmet halal foods and beverages, is becoming a key innovation, appealing to a wider range of consumers seeking high-quality, authentic products.

These drivers and innovations are shaping the future of the global halal food and beverages market, ensuring its growth and diversification.

Market Challenges

- Lack of Standardization in Halal Certification: The absence of universally recognized halal certification standards across regions can lead to confusion and lack of trust among consumers, affecting the credibility of products.

- High Production Costs: Halal certification processes, sourcing of halal ingredients, and adherence to stringent production practices can increase production costs, which may result in higher prices for consumers.

- Limited Awareness in Non-Muslim Majority Regions: While the demand for halal products is growing globally, awareness remains limited in some non-Muslim-majority regions, hindering the market’s full potential in these areas.

- Supply Chain Complexity: Ensuring the integrity of halal products throughout the supply chain is challenging, especially with the growing demand for halal-certified food. Maintaining halal certification from production to distribution requires rigorous processes and monitoring.

- Cultural and Regional Barriers: Different cultural interpretations of halal requirements across regions can lead to inconsistencies and may limit market penetration, particularly in markets with a diverse population.

- Competition from Non-Halal Products: The halal food industry faces competition from non-halal food products, particularly in regions where the halal market is still emerging, making it harder to attract non-Muslim consumers.

- Regulatory Barriers: In some countries, complex or restrictive regulations around halal certification and labeling can create hurdles for market growth and expansion.

Market Opportunities

- Growing Muslim Population: The increasing Muslim population globally presents a significant opportunity for halal food and beverage products, especially in regions with a high proportion of Muslim consumers.

- Rising Demand in Non-Muslim Countries: Growing awareness and acceptance of halal food among non-Muslim consumers, due to health and quality considerations, offer untapped market potential in non-Muslim-majority regions.

- Expansion of E-commerce: The growth of online retail channels and e-commerce platforms provides a convenient way to distribute halal products globally, expanding market reach and accessibility.

- Diversification of Product Offerings: Manufacturers have the opportunity to diversify and innovate halal food and beverage products, such as halal-certified plant-based foods and beverages, catering to evolving consumer preferences and trends.

- Halal Certification in Emerging Markets: With the rising demand for halal products in emerging markets such as Asia-Pacific, Africa, and Latin America, there is a growing opportunity to expand halal certification and product offerings in these regions.

- Health-Conscious Consumer Trends: The increasing global trend towards healthy eating and food safety provides opportunities for halal products, as they are perceived to be hygienic, natural, and in accordance with ethical standards.

- Collaborations with Retailers and Food Chains: Strategic partnerships with supermarkets, convenience stores, and fast-food chains can help boost halal product availability and visibility in mainstream markets.

- Government Support for Halal Industry: Governments in Muslim-majority countries are increasingly supporting the halal industry through favorable policies and initiatives, creating a conducive environment for market growth.

RECENT STRATEGIES & DEVELOPMENTS IN THE MARKET

Product Innovation and Diversification:

- Companies are focusing on diversifying their halal product offerings, especially with plant-based and health-conscious food options.

- Example: Nestlé launched its “Häagen-Dazs” halal-certified ice cream in several markets, responding to the growing demand for halal-certified frozen desserts.

Geographical Expansion:

- Key players are expanding their reach into new markets, particularly in regions with growing Muslim populations, such as Southeast Asia, Africa, and Latin America.

- Example: BRF SA, a leading Brazilian food company, has expanded its halal-certified products to Southeast Asia and the Middle East, tapping into the growing demand for halal meat products.

Collaborations and Strategic Partnerships:

- Companies are collaborating with retailers, foodservice providers, and e-commerce platforms to improve distribution and increase product visibility.

- Example: Al Islami Foods has partnered with major grocery retailers and fast-food chains in the Middle East to increase its halal product offerings.

Focus on Halal Certification and Compliance:

- Brands are investing in obtaining halal certifications and ensuring compliance with international halal standards to cater to a wider audience.

- Example: BRF SA received certification from recognized halal certification bodies for its meat products, enabling it to access markets like Indonesia and the Middle East.

Mergers and Acquisitions:

- Strategic mergers and acquisitions are being pursued to enhance market share and product offerings in the halal food sector.

- Example: JBS SA acquired a leading halal meat processing company to strengthen its position in the Middle East and North Africa.

Enhanced Marketing and Brand Positioning:

- Companies are increasingly focusing on digital marketing strategies and leveraging social media to promote their halal products to a broader audience.

- Example: Crescent Foods Inc. has enhanced its social media marketing efforts to target younger, health-conscious consumers interested in halal-certified, sustainable food options.

Focus on Sustainability:

- Sustainable sourcing and ethical practices are becoming key components of halal food production.

- Example: Tanmiah Food Company emphasizes environmentally friendly practices in its halal chicken production, promoting ethical sourcing and animal welfare.

KEY BENEFITS FOR STAKEHOLDERS

Market Growth Opportunities:

- Stakeholders, including investors and manufacturers, can capitalize on the expanding demand for halal food and beverages in diverse regions, especially in Asia-Pacific, the Middle East, and Africa. The market is expected to grow significantly by 2030, offering lucrative opportunities for long-term growth.

Access to a Large Consumer Base:

- Companies and retailers gain access to a vast and growing consumer base, particularly among Muslim populations. The halal certification provides a competitive edge, increasing market appeal and brand loyalty.

Expansion of Product Portfolio:

- Food and beverage companies can diversify their product offerings to cater to both halal and non-halal consumers, allowing for expansion into new segments such as plant-based, organic, and health-conscious food products.

Improved Brand Image:

- Obtaining halal certification enhances a brand’s reputation by demonstrating compliance with ethical and religious dietary standards, fostering consumer trust and loyalty, particularly in Muslim-majority countries.

Partnerships and Collaborations:

- Stakeholders can forge strategic partnerships with retailers, foodservice providers, and online platforms to enhance distribution channels and expand market reach for halal products.

Increased Profit Margins:

- With a growing consumer preference for halal food and beverages, stakeholders have the potential for higher profit margins by tapping into premium segments, such as halal-certified organic and sustainable products.

Regulatory Support:

- Many governments, especially in the Middle East and Southeast Asia, are promoting halal food markets through favorable regulations and certification standards, providing stakeholders with a supportive environment for growth.

At DigiRoads Research, we emphasize reliability by employing robust market estimation and data validation methodologies. Our insights are further enhanced by our proprietary data forecasting model, which projects market growth trends up to 2030. This forward-thinking approach ensures our analysis not only captures the current market landscape but also anticipates future developments, equipping stakeholders with actionable foresight.

We go a step further by offering an exhaustive set of regional and country-level data points, supplemented by over 60 detailed charts at no additional cost. This commitment to transparency and accessibility allows stakeholders to gain a deep understanding of the industry’s structural and operational dynamics. By providing exclusive and hard-to-access data, DigiRoads Research empowers businesses to make informed strategic decisions with confidence.

In essence, our methodology and data delivery foster a collaborative and data-driven decision-making environment, enabling businesses to navigate industry challenges and capitalize on opportunities effectively.

Contact Us For More Inquiry.

Table of Contents

-

INTRODUCTION

- Market Overview

- Years Considered for Study

- Market Segmentation

- Study Assumptions and Definitions

- Market Scope

-

RESEARCH METHODOLOGY

-

MARKET OUTLOOK

- Executive Summary

- Market Snapshot

- Market Segments

- By Type:

- Halal Food, Halal Beverages, Halal Supplements

- By Distribution Channel:

- Supermarkets, Convenience Stores, Online Retail, Other Channels

- By Geography:

- North America (US, Canada, Mexico, Rest), Europe (Germany, UK, Spain, Rest), Asia-Pacific (China, Japan, India, Rest), South America (Brazil, Argentina, Rest), Middle East & Africa (South Africa, Egypt, Saudi Arabia, UAE, Oman, Rest)

- By Type:

-

COMPETITIVE LANDSCAPE

- Recent Strategies (Key Strategic Moves)

- Market Share Analysis

- Company Profiles

- Nestlé SA

- JBS SA

- BRF SA

- Ferrero International SA

- Midamar Corporation

- Crescent Foods Inc.

- Tahira Foods Ltd

- Tanmiah Food Company

- American Foods Group LLC

-

MARKET DYNAMICS

- Market Drivers

- Market Challenges

- Market Opportunities

- Porter’s Five Forces’ Analysis

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Threat of New Entrant

- Threat of Substitutes

- Competitive Rivalry

-

GLOSSARY OF PROMINENT SECONDARY SOURCES

-

DISCLAIMER

-

ABOUT US