No products in the cart.

Saudi Arabia Commodities Market

- Brand: DigiRoads

The Saudi Arabia commodities Market report is a comprehensive 120-page analysis, offering insights into market trends, growth factors, key players, and future projections. It covers diverse segments such as restaurants, cafes, and delivery services, providing a detailed overview of the region’s evolving food service industry.

Category: Food and Beverage

Brand: DigiRoads

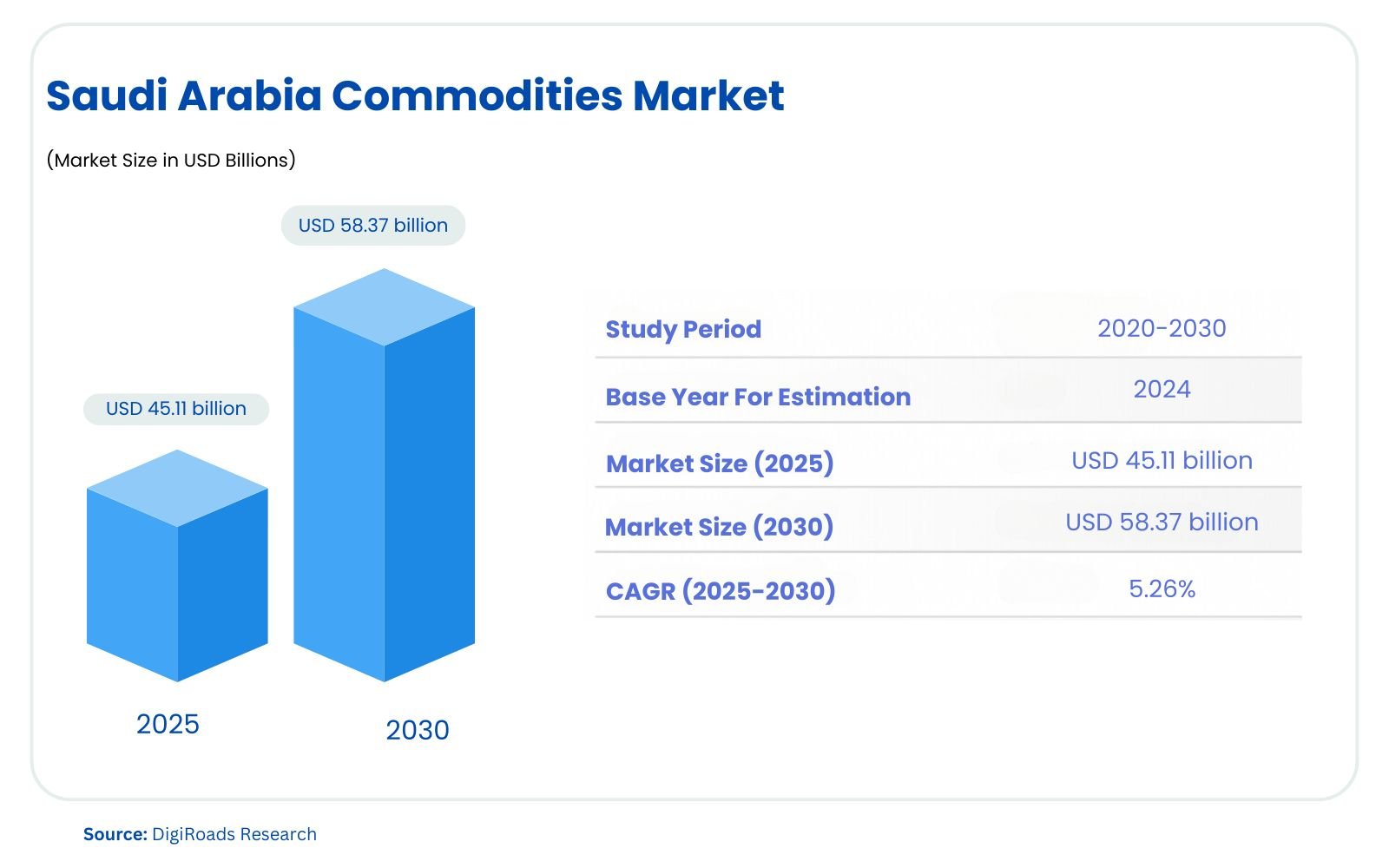

Saudi Arabia Commodities Market Report | Market Size, Industry Analysis, Growth Opportunities, & Forecast (2025-2030)

Saudi Arabia Commodities Market Overview

The Saudi Arabia commodities market is set to expand steadily, with an estimated market size of USD 45.11 billion in 2025 and projected to reach USD 58.37 billion by 2030, growing at a CAGR of 5.26% during the forecast period 2025-2030. The Saudi Arabia commodities market plays a pivotal role in the nation’s economy, offering a diverse range of products and opportunities for investors, traders, and businesses. As one of the world’s leading producers of oil, Saudi Arabia heavily influences global energy markets. The country’s vast reserves and strategic initiatives, such as Vision 2030, have propelled investments in non-oil sectors, including agriculture, minerals, and metals.

Key commodities in Saudi Arabia include crude oil, petrochemicals, gold, aluminum, and wheat. The government’s focus on diversifying the economy has boosted exploration and production activities across various sectors. Infrastructure development, technological advancements, and favorable trade policies have further fueled market growth.

Understanding the Saudi Arabia commodities market is essential for stakeholders aiming to navigate the evolving landscape. This report delves into market trends, major players, and emerging opportunities. It also highlights challenges, such as fluctuating prices and geopolitical factors, that influence market dynamics.

Whether you’re an investor, policymaker, or researcher, this comprehensive overview provides valuable insights to make informed decisions. Explore the Saudi Arabia commodities market to uncover its vast potential.

Market Report Coverage:

The “Saudi Arabia Commodities Market Report—Future (2025-2030)” by Digiroads Research & Consulting covers an in-depth analysis of the following segments in the market.

| Energy | crude oil, natural gas, and petrochemicals, |

| Metals | gold, aluminum, and other minerals |

| Agriculture | wheat, dates, and other agricultural products |

| Industrial Goods | steel, fertilizers, and raw materials |

| By Region | Western and Central regions, |

Study Assumptions and Definitions

This study on the Saudi Arabia commodities market is based on several key assumptions and standardized definitions to ensure clarity and relevance. The primary assumption is that the market will continue to grow, driven by ongoing economic diversification efforts under Vision 2030. The report presumes stability in regulatory frameworks, trade policies, and government initiatives aimed at enhancing non-oil sectors. Additionally, global economic trends, including shifts in energy demand and sustainability goals, are considered pivotal factors influencing the market.

Key definitions include:

- Commodities: Raw materials or primary agricultural products that can be traded, such as oil, metals, and grains.

- Market Segments: Specific sectors categorized based on commodities, including energy, agriculture, metals, and industrial goods.

- Geography: Regional analysis within Saudi Arabia, highlighting contributions from areas like the Eastern Province for oil and Neom for renewable energy.

- Sustainability: Practices aimed at reducing environmental impact, particularly in energy and mining sectors.

Market Scope

The Saudi Arabia commodities market encompasses a wide range of sectors, including energy, metals, agriculture, industrial goods, and emerging renewable energy. This report examines the production, trade, and investment activities within these segments, highlighting their contribution to the national and global economy.

Energy remains the dominant sector, driven by Saudi Arabia’s position as a leading oil producer and exporter. Metals such as gold and aluminum are gaining prominence, supported by government initiatives to boost mining activities. The agricultural sector focuses on essential crops like wheat and dates, addressing domestic food security. Industrial goods, including steel and fertilizers, support the country’s infrastructure development.

Geographical coverage includes key regions such as the Eastern Province for energy, the Najd region for agriculture, and Neom for renewable energy projects. This comprehensive scope offers valuable insights into market trends, growth drivers, and challenges shaping the Saudi Arabia commodities market.

MARKET OUTLOOK

Executive Summary

The Saudi Arabia commodities market stands as a cornerstone of the nation’s economy, driven by its vast energy resources and expanding non-oil sectors. As the world’s leading oil producer, Saudi Arabia’s dominance in the global energy market remains unmatched. However, the government’s Vision 2030 initiative has spurred economic diversification, promoting investments in mining, agriculture, industrial goods, and renewable energy.

This report provides a comprehensive analysis of key commodities such as crude oil, natural gas, gold, aluminum, wheat, and solar energy. The energy sector continues to lead, with the Eastern Province playing a pivotal role in production and export. Metals and mining activities, concentrated in the western and central regions, are gaining traction due to favorable policies. Agriculture, focusing on staple crops, supports food security, while industrial goods contribute to infrastructure projects in cities like Jubail and Yanbu.

Emerging renewable energy projects in regions such as Neom signal a transformative shift, aligning with global sustainability goals. Additionally, the market benefits from strategic trade policies, technological advancements, and foreign investments, further strengthening its position.

Challenges include fluctuating commodity prices, geopolitical uncertainties, and the need for sustainable practices in resource utilization. Despite these hurdles, Saudi Arabia’s commodities market presents significant opportunities for investors, policymakers, and businesses.

This executive summary highlights market trends, regional dynamics, and growth drivers, providing actionable insights for stakeholders. The Saudi Arabia commodities market is poised for substantial growth, underpinned by government support and a strategic focus on innovation and diversification. This report serves as a vital resource for understanding the market’s current landscape and future potential.

COMPETITIVE LANDSCAPE

The Saudi Arabia Commodities Market is moderately fragmented, with regional and multinational players competing fiercely for market share.

Key Market Players

- Saudi Aramco

- SABIC

- Ma’aden

- Alcoa Corporation

- Albilad Gold

- Barrick Gold Corporation

- Almarai

- NADEC

- Savola Group

- Al Rajhi Steel Industries

Market Share Analysis

The Saudi Arabia commodities market is dominated by the energy sector, which accounts for a substantial portion of the country’s GDP and export revenues. Saudi Aramco leads the market with its unparalleled share in crude oil production and exports, contributing significantly to the global energy supply. The petrochemicals segment, spearheaded by SABIC, also holds a strong position, with its products catering to domestic and international markets.

The metals and mining sector is steadily gaining market share, driven by Ma’aden’s leadership in gold, aluminum, and phosphate production. Investments in mining exploration and strategic partnerships, such as the Ma’aden-Alcoa joint venture, have bolstered the sector’s contribution.

In agriculture, companies like Almarai and NADEC dominate the local market for dairy, wheat, and other essential crops, supporting domestic food security initiatives. The renewable energy segment, though still emerging, is growing rapidly, with ACWA Power and Desert Technologies spearheading solar and wind energy projects.

Industrial goods, including steel and cement, maintain a stable share, driven by infrastructure developments in cities like Jubail and Yanbu. With diversification efforts under Vision 2030, non-oil sectors are poised for significant growth, gradually reducing the energy sector’s overwhelming dominance in the market.

MARKET DYNAMICS

Market Drivers and Key Innovations

The Saudi Arabia commodities market is driven by several factors, primarily government initiatives under Vision 2030, which aim to diversify the economy beyond oil dependence. The country’s vast natural resources, strategic location, and robust infrastructure form the backbone of its thriving commodities sectors.

Key market drivers include:

- Economic Diversification: Vision 2030 has catalyzed investments in mining, agriculture, and renewable energy, expanding the market scope.

- Global Energy Demand: Saudi Arabia’s role as a leading oil producer ensures steady demand for its energy exports.

- Infrastructure Development: Large-scale projects such as Neom and the Red Sea Project are boosting demand for metals, industrial goods, and renewable energy.

- Sustainability Goals: A growing focus on renewable energy and eco-friendly practices is reshaping market dynamics, particularly in energy and mining sectors.

Key innovations shaping the market include:

- Technological Advancements: Digitalization and AI are improving efficiency in mining and energy operations.

- Renewable Energy Projects: ACWA Power’s solar and wind projects mark significant progress in clean energy initiatives.

- Sustainable Agriculture: Modern irrigation and crop management techniques are improving agricultural output.

- Value-Added Products: Innovations in refining and processing are enhancing the competitiveness of petrochemicals and metals.

Market Challenges

Dependence on Oil Revenue

- The economy remains heavily reliant on oil, making it vulnerable to global price fluctuations.

Geopolitical Risks

- Regional instability and geopolitical tensions can disrupt supply chains and trade dynamics.

Resource Depletion

- Over-reliance on finite natural resources like oil and minerals poses long-term sustainability challenges.

Climate Change and Environmental Concerns

- Increasing pressure to adopt sustainable practices and reduce carbon emissions affects traditional industries.

Economic Diversification Hurdles

- Transitioning from an oil-dependent economy to diversified sectors is a complex and lengthy process.

Fluctuating Commodity Prices

- Volatility in global commodity prices impacts revenue and investment planning.

Regulatory Challenges

- Evolving policies and regulations can create uncertainties for domestic and foreign investors.

Technological Gaps

- Despite advancements, certain sectors lag in adopting cutting-edge technology, affecting efficiency.

Water Scarcity

- Limited water resources hinder agricultural expansion and industrial processes.

Global Competition

- Competing with established markets in mining, agriculture, and renewable energy presents a challenge for growth.

Market Opportunities

Economic Diversification

- Vision 2030 opens new avenues for investment in non-oil sectors like mining, agriculture, and renewable energy.

Renewable Energy Expansion

- The growing focus on solar and wind energy projects presents significant opportunities for clean energy investments.

Mining Sector Growth

- Untapped reserves of gold, phosphate, and other minerals offer potential for exploration and production.

Agriculture Modernization

- Technological advancements in irrigation and crop management can enhance productivity and food security.

Industrial Goods Demand

- Infrastructure mega-projects such as Neom and the Red Sea Project are driving demand for steel, cement, and construction materials.

Global Energy Market Influence

- Saudi Arabia’s position as a top oil producer provides opportunities to strengthen its global energy trade network.

Foreign Investments

- Favorable policies and incentives attract international investors to various commodities sectors.

Sustainability Initiatives

- Eco-friendly practices in energy and mining align with global trends, boosting market appeal.

Advanced Technologies

- AI, IoT, and automation can revolutionize operations across energy, mining, and agriculture sectors.

Regional Trade Partnerships

- Enhanced collaboration with GCC countries and global markets expands trade opportunities.

RECENT STRATEGIES & DEVELOPMENTS IN THE MARKET

Expansion of Mining Investments

- Over $9 billion worth of agreements have been signed to develop facilities for essential minerals like copper, zinc, and lithium, aimed at bolstering the mining sector.

Strategic Resource Acquisitions

- Advanced negotiations are underway for acquiring stakes in international mines, ensuring access to critical resources for economic growth.

Oil Market Stabilization

- Ongoing adjustments in oil production align with global output reduction strategies to stabilize prices and maintain market equilibrium.

Economic Diversification Policies

- Initiatives under Vision 2030 prioritize reducing dependence on hydrocarbons, with increasing focus on agriculture, industrial goods, and renewable energy.

Food Security Enhancement

- Dual strategies are being implemented to boost domestic agricultural output and secure international supply chains for essential commodities.

Renewable Energy Commitments

- Large-scale investments in solar and wind energy aim to achieve 50% reliance on renewables by 2030, supporting sustainability goals.

Industrial Sector Growth

- The National Industrial Strategy promotes non-oil industries with incentives and infrastructure to diversify economic outputs.

Geopolitical Adaptation

- Market strategies are being adapted to navigate geopolitical challenges and competitive pressures from non-traditional markets.

KEY BENEFITS FOR STAKEHOLDERS

Economic Growth and Diversification

- Stakeholders benefit from increased opportunities across diversified sectors such as mining, agriculture, and renewable energy, reducing reliance on oil.

Investment Opportunities

- Favorable policies and incentives attract local and foreign investments, enabling stakeholders to participate in high-growth sectors.

Technological Advancements

- Adoption of advanced technologies like AI and automation enhances operational efficiency and productivity for industry players.

Sustainability and Global Alignment

- Stakeholders gain from Saudi Arabia’s commitment to renewable energy and eco-friendly practices, aligning with global sustainability trends.

Infrastructure Development

- Major projects like Neom and industrial hubs create demand for commodities, providing stakeholders with long-term growth prospects.

Global Market Integration

- Enhanced trade relationships and market access expand opportunities for stakeholders to tap into international markets.

Regulatory Support

- Clear and favorable regulatory frameworks ensure a stable environment for business operations and investments.

Resource Security

- Focus on strategic resource acquisitions and domestic production assures supply stability for stakeholders.

Enhanced Market Stability

- Efforts to stabilize commodity prices reduce uncertainties, improving planning and risk management for stakeholders.

Job Creation and Skill Development

- Growth in various sectors generates employment opportunities and fosters workforce development, benefiting the community at large.

At DigiRoads Research, we emphasize reliability by employing robust market estimation and data validation methodologies. Our insights are further enhanced by our proprietary data forecasting model, which projects market growth trends up to 2030. This forward-thinking approach ensures our analysis not only captures the current market landscape but also anticipates future developments, equipping stakeholders with actionable foresight.

We go a step further by offering an exhaustive set of regional and country-level data points, supplemented by over 60 detailed charts at no additional cost. This commitment to transparency and accessibility allows stakeholders to gain a deep understanding of the industry’s structural and operational dynamics. By providing exclusive and hard-to-access data, DigiRoads Research empowers businesses to make informed strategic decisions with confidence.

In essence, our methodology and data delivery foster a collaborative and data-driven decision-making environment, enabling businesses to navigate industry challenges and capitalize on opportunities effectively.

Contact Us For More Inquiry.

Table of Contents

INTRODUCTION

- Market Overview

- Years Considered for Study

- Market Segmentation

- Study Assumptions and Definitions

- Market Scope

RESEARCH METHODOLOGY

MARKET OUTLOOK

- Executive Summary

- Market Snapshot

- Market Segments

- Energy

- crude oil

- natural gas

- petrochemicals

- Metals

- gold

- aluminum

- minerals

- By Region:

- Eastern Province

- Najd Region

- Western Region

- Neom (Northwestern Region)

- Riyadh Region

- Energy

COMPETITIVE LANDSCAPE

- Recent Strategies (Key Strategic Moves)

- Market Share Analysis

- Company Profiles

- Saudi Aramco

- SABIC

- Ma’aden

- Alcoa Corporation

- Albilad Gold

- Barrick Gold Corporation

- Almarai

- NADEC

- Savola Group

- Al Rajhi Steel Industries

- Saudi Cement Company

- ACWA Power

- Saudi Electric Company

- Desert Technologies

- Tadawul

- Public Investment Fund (PIF)

- Riyad Bank

MARKET DYNAMICS

- Market Drivers

- Market Challenges

- Market Opportunities

- Porter’s Five Forces’ Analysis

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Threat of New Entrant

- Threat of Substitutes

- Competitive Rivalry

GLOSSARY OF PROMINENT SECONDARY SOURCES

DISCLAIMER

ABOUT US