No products in the cart.

South America Alcoholic Beverage Market

- Brand: DigiRoads

Discover the 100+ page report on the South America Alcoholic Beverage Market, providing insights into trends, growth drivers, and the competitive landscape. Available in PDF and Excel formats for easy access to detailed data and analysis.

Category: Food and Beverage

Brand: DigiRoads

South America Alcoholic Beverage Market Report | Market Size, Industry Analysis, Growth Opportunities, & Forecast (2025-2030)

South America Alcoholic Beverage Market Overview

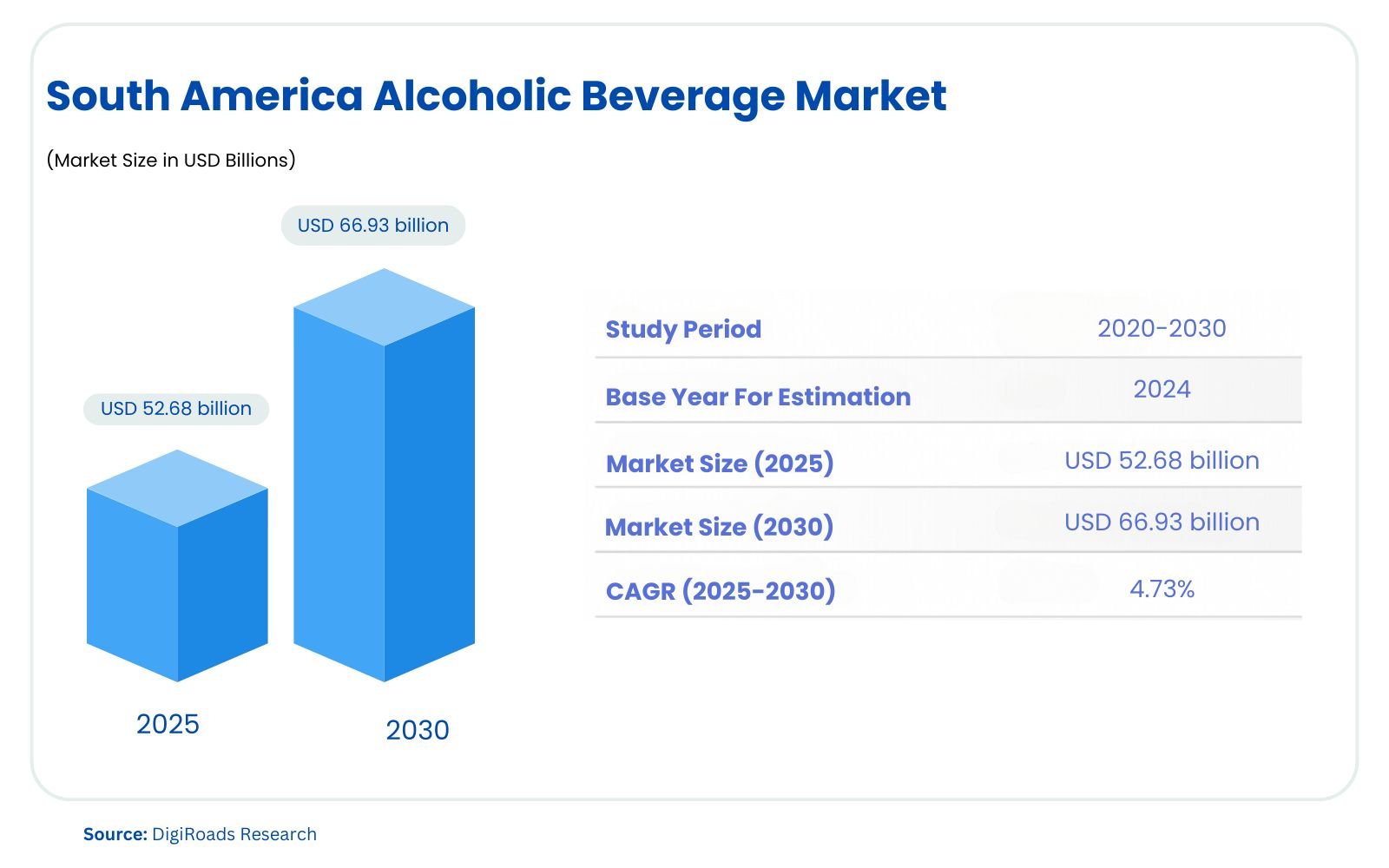

The South America Alcoholic Beverages Market is on a steady growth trajectory, with an estimated market size of USD 52.68 billion in 2025, projected to reach USD 66.93 billion by 2030, expanding at a CAGR of 4.73% during the forecast period 2025-2030. This market is driven by rising consumer demand for premium and craft alcoholic beverages, particularly among the younger demographic. Millennials and Gen Z are increasingly seeking innovative, low-calorie, and low-alcohol options, which has spurred growth in categories such as flavored spirits, whiskey, and vodka. Brazil, being the largest market, leads the region with its growing disposable income and preference for beer. Additionally, the craft beer industry is thriving, with more microbreweries emerging in countries like Brazil and Colombia.

Key players such as Anheuser-Busch InBev, Heineken N.V., Diageo, and Grupo Peñaflor are expanding their portfolios to cater to changing tastes and consumer preferences. The report provides an in-depth analysis of market dynamics, trends, segmentation by product type and distribution channel, and regional insights for Brazil, Argentina, and other South American countries. It also explores the competitive landscape and identifies key opportunities and future trends that will shape the market through 2030.

This report offers valuable insights for industry stakeholders, investors, and market analysts looking to understand the evolving alcoholic beverage market in South America.

Market Report Coverage:

The “South America Alcoholic Beverage Market Report—Future (2025-2030)” by Digiroads Research & Consulting covers an in-depth analysis of the following segments in the market.

| Product Type | Beer, Wine, Spirits |

| Distribution Channel | On-trade, Off-trade |

| Geography | Brazil, Argentina, Rest of South America |

Study Assumptions and Definitions

The study on the South America Alcoholic Beverage Market from 2025 to 2030 is based on several key assumptions and definitions to provide accurate and insightful market projections. It is assumed that the market will experience consistent growth driven by the rising demand for premium alcoholic beverages, craft beers, and innovative spirits among younger consumers in the region. This growth is expected to be fueled by increased disposable income, evolving consumer preferences, and the expanding craft beverage industry in countries like Brazil and Colombia.

The market definitions in this report encompass alcoholic beverages such as beer, wine, and spirits, which are the primary product categories under analysis. Beer includes both mass-produced and craft beer, wine covers various types such as red, white, and sparkling wines, and spirits include whiskey, vodka, rum, and flavored spirits. The distribution channels are classified into on-trade (alcoholic beverages sold in bars, restaurants, and clubs) and off-trade (sales through retail stores, supermarkets, and online platforms).

Geographically, the report divides the South American market into three main regions: Brazil, Argentina, and the rest of South America. This segmentation allows for a detailed analysis of market trends, growth drivers, and regional consumer behavior, providing a comprehensive understanding of the market dynamics.

Market Scope

The scope of the South America Alcoholic Beverage Market report covers a comprehensive analysis of the market from 2025 to 2030, focusing on key product types, distribution channels, and geographical segments. It includes detailed insights into the demand for beer, wine, and spirits, which are the primary categories driving the market. The report also examines distribution channels, distinguishing between on-trade (bars, restaurants, clubs) and off-trade (retail stores, supermarkets, online platforms) sales.

Geographically, the report focuses on key markets in Brazil, Argentina, and other countries in the South American region. It evaluates factors such as consumer preferences, income levels, and market trends that influence the demand for alcoholic beverages. The scope also includes a competitive analysis of major industry players, such as Anheuser-Busch InBev, Heineken N.V., and Diageo, among others. By covering market dynamics, trends, opportunities, and challenges, the report provides valuable insights for stakeholders looking to navigate the evolving alcoholic beverage industry in South America.

MARKET OUTLOOK

Executive Summary

The South America Alcoholic Beverage Market is poised for steady growth from 2025 to 2030, with a projected CAGR of 4.73%. This growth is driven by evolving consumer preferences, a growing younger demographic, and increasing disposable incomes in key markets like Brazil and Argentina. Premium alcoholic beverages, particularly craft beers, flavored spirits, whiskey, and vodka, are becoming increasingly popular, particularly among Millennials and Gen Z consumers. These consumers are opting for low-calorie and low-alcohol drinks, which has spurred innovation in the market.

Brazil remains the dominant market in the region, accounting for a significant share due to its strong beer consumption culture and rising demand for premium alcoholic beverages. The craft beer market in Brazil and Colombia is also expanding, as consumers increasingly seek unique flavors and high-quality, small-batch products. Major international players such as Anheuser-Busch InBev, Heineken N.V., Diageo, and Grupo Peñaflor are strengthening their presence in South America through product innovations and geographical expansion.

The report segments the market by product type, including beer, wine, and spirits, and by distribution channel, with on-trade (bars, restaurants) and off-trade (retail stores, online) sales channels. The geographical segmentation includes Brazil, Argentina, and other parts of South America.

Key trends include the rise in demand for premium spirits, craft beers, and flavored alcoholic drinks, driven by health-conscious and adventurous consumers. The market is also witnessing increasing mergers and acquisitions as companies look to strengthen their portfolios and expand into emerging markets.

This report provides a comprehensive analysis of market dynamics, opportunities, and challenges, offering valuable insights for businesses and stakeholders looking to navigate the South American alcoholic beverage market.

COMPETITIVE LANDSCAPE

The South America Alcoholic Beverage Market is moderately fragmented, with regional and multinational players competing fiercely for market share.

Key Market Players

- Anheuser-Busch InBev

- Heineken N.V.

- Cervejaria Petropolis S/A

- Grupo Peñaflor

- Diageo Plc

- CCU S.A.

- Brown-Forman

- Companhia Muller de Bebidas

- Pernod Ricard

- Molson Coors Beverage Company

Market Share Analysis

The South America Alcoholic Beverage Market is highly competitive, with a mix of global and local players shaping the industry landscape. The market is fragmented, and several major companies dominate the region. Anheuser-Busch InBev and Heineken N.V. are the leading global players, holding significant market shares in beer production. Both companies have a strong presence in Brazil, the largest market in the region, with extensive distribution networks and brand recognition. Cervejaria Petropolis S/A and Grupo Peñaflor, two major local players, also hold substantial shares, benefiting from their regional expertise and strong foothold in Brazil and Argentina.

Diageo, a key player in the spirits sector, leads the premium and super-premium spirits segment in South America. The company has capitalized on the increasing demand for high-quality whiskey, vodka, and flavored spirits. Similarly, Pernod Ricard and Brown-Forman are important contributors to the spirits market, focusing on premium products and expanding their portfolios through strategic acquisitions and new product launches.

Smaller players, including local microbreweries and craft beverage producers, are gaining ground, especially in Brazil and Colombia, by catering to the growing demand for unique and artisanal alcoholic beverages. The market is expected to witness further consolidation as large players expand their portfolios through mergers, acquisitions, and partnerships, strengthening their competitive position in the region.

MARKET DYNAMICS

Market Drivers and Key Innovations

Market Drivers

The South America Alcoholic Beverage Market is being driven by several key factors. Firstly, the increasing disposable income in countries like Brazil, Argentina, and Colombia has led to higher consumption of premium and super-premium alcoholic beverages. The growing middle class, particularly in urban areas, has enhanced the demand for quality products, especially spirits and craft beers. Additionally, changing consumer preferences are playing a significant role, with younger generations shifting towards low-alcohol, low-calorie, and flavored alcoholic drinks due to health concerns and a preference for lighter options. The rise in casual and social drinking occasions, such as office parties and casual gatherings, has further contributed to this growth.

Key Innovations

Innovation is a critical driver of market growth, as companies introduce new products and enhance consumer experience. For instance, the launch of Johnnie Walker Blonde by Diageo in 2022 exemplifies the trend towards lighter and smoother alcoholic beverages, catering to the tastes of younger consumers. Similarly, Grupo Peñaflor’s entry into the hard seltzer market with Mingo Hard Seltzer, a product with unique flavor combinations and a lower ABV, reflects the growing demand for healthier and more diverse alcoholic options.

Furthermore, the increasing number of microbreweries in South America, particularly in Brazil and Colombia, has led to innovation in beer offerings, with new brewing techniques and exotic flavors attracting local consumers. These innovations are not only responding to evolving consumer preferences but also stimulating competition in the market, prompting established players to diversify and introduce new product lines to stay relevant.

Market Challenges

- Regulatory Constraints

Stringent government regulations on alcohol production, distribution, and advertising in South American countries can limit market growth and create barriers to entry for new players. - Economic Uncertainty

Fluctuating economic conditions in key markets like Brazil and Argentina impact consumer purchasing power, affecting the demand for premium and super-premium alcoholic beverages. - Taxation and Pricing

High excise taxes and tariffs on alcoholic beverages increase retail prices, discouraging consumers from purchasing premium products. - Health and Wellness Trends

Growing awareness of the health risks associated with alcohol consumption has led to a decline in traditional beer and spirits sales, with consumers opting for non-alcoholic or low-alcohol alternatives. - Counterfeit Products

The proliferation of counterfeit and low-quality alcoholic beverages undermines consumer trust and hampers the sales of genuine premium products. - Logistical and Distribution Challenges

Inefficient supply chains, particularly in remote and rural areas, pose challenges in ensuring the availability of alcoholic beverages across South America. - Cultural Diversity

The region’s diverse cultures and preferences require brands to tailor their products and marketing strategies for different countries, increasing operational complexity. - Competition from Local Players

Strong competition from established local breweries and distilleries affects the market share of global players entering the region.

Market Opportunities

- Rising Demand for Craft and Premium Beverages

Increasing consumer preference for handcrafted, small-batch alcoholic beverages presents an opportunity for companies to introduce unique, high-quality products. - Growth in Health-Conscious Offerings

The demand for low-calorie, low-alcohol, and flavored beverages is growing as consumers prioritize health and wellness, encouraging innovation in product development. - Expansion of Distribution Channels

Strengthening on-trade and off-trade distribution networks, including e-commerce platforms, offers significant opportunities to reach wider consumer bases. - Emergence of Millennial and Gen Z Consumers

Younger demographics, with a penchant for experimenting with new flavors and premium products, provide a lucrative target market for innovative offerings. - Urbanization and Rising Disposable Incomes

Economic growth and increasing urbanization in countries like Brazil and Argentina are driving higher disposable incomes, enabling consumers to purchase premium alcoholic beverages. - Regional and Cultural Diversity

Catering to South America’s diverse cultures with tailored product lines, such as ethnic spirits and regional flavors, can create niche opportunities for growth. - Collaborations and Mergers

Strategic alliances, mergers, and acquisitions with local breweries and distilleries can help global players strengthen their presence and expand their portfolios. - Adoption of Digital Marketing

Leveraging digital marketing and social media platforms to engage with tech-savvy consumers can drive brand visibility and sales. - Sustainability Trends

Offering eco-friendly packaging and sustainable production practices appeals to environmentally conscious consumers, fostering brand loyalty. - Innovation in Ready-to-Drink (RTD) Beverages

The growing popularity of RTD cocktails and hard seltzers presents an opportunity for market players to diversify their offerings.

RECENT STRATEGIES & DEVELOPMENTS IN THE MARKET

- Diageo’s Product Innovation

In October 2022, Diageo Plc launched Johnnie Walker Blonde, a sweeter, smoother version of their iconic product, targeting young consumers in Brazil and other countries. - Grupo Peñaflor’s Hard Seltzer Entry

In February 2022, Grupo Peñaflor entered the hard seltzer category with Mingo Hard Seltzer, a low-calorie RTD beverage in unique flavors, catering to health-conscious consumers. - Coca-Cola FEMSA’s Acquisition

In August 2021, Coca-Cola FEMSA acquired the Brazilian specialty beer brand Therezópolis to strengthen its beer portfolio and expand in the Brazilian market. - Grupo Petrópolis Premium Beer Launch

In November 2021, Grupo Petrópolis launched a new premium beer, Itaipava 100% Malt, highlighting innovation in product development for the premium beer segment. - AB InBev’s Craft Brewery Expansion

AB InBev expanded its craft beer portfolio with brands like Cervejaria Colorado in Brazil and Bogota Beer Company in Colombia, capitalizing on the growing craft beer demand. - Sustainability Initiatives

Many players are adopting eco-friendly practices, such as sustainable packaging and energy-efficient brewing processes, to align with consumer environmental concerns.

KEY BENEFITS FOR STAKEHOLDERS

- Rising Consumer Preferences

Increased demand for premium and flavored alcoholic beverages drives market growth. Millennials and Gen Z favor innovative, low-alcohol, and low-calorie drinks, ensuring steady expansion. - Craft and Premium Alcohol

The growing interest in craft spirits and premium drinks provides opportunities for companies to offer unique products with high profit margins. - Economic Growth in South America

Rising disposable incomes in key markets like Brazil and Argentina enable consumers to explore premium options and increase overall market value. - Health-Conscious Trends

Consumers are opting for beverages with health benefits or lower alcohol content, creating opportunities for product diversification.

At DigiRoads Research, we emphasize reliability by employing robust market estimation and data validation methodologies. Our insights are further enhanced by our proprietary data forecasting model, which projects market growth trends up to 2030. This forward-thinking approach ensures our analysis not only captures the current market landscape but also anticipates future developments, equipping stakeholders with actionable foresight.

We go a step further by offering an exhaustive set of regional and country-level data points, supplemented by over 60 detailed charts at no additional cost. This commitment to transparency and accessibility allows stakeholders to gain a deep understanding of the industry’s structural and operational dynamics. By providing exclusive and hard-to-access data, DigiRoads Research empowers businesses to make informed strategic decisions with confidence.

In essence, our methodology and data delivery foster a collaborative and data-driven decision-making environment, enabling businesses to navigate industry challenges and capitalize on opportunities effectively.

Contact Us For More Inquiry.

Table of Contents

INTRODUCTION

- Market Overview

- Years Considered for Study

- Market Segmentation

- Study Assumptions and Definitions

- Market Scope

RESEARCH METHODOLOGY

MARKET OUTLOOK

- Executive Summary

- Market Snapshot

- Market Segments

- Product Type:

- Beer, Wine, Spirits

- Distribution Channel:

- On-trade, Off-trade

- Geography:

- Brazil, Argentina, Rest of South America

- Product Type:

COMPETITIVE LANDSCAPE

- Recent Strategies (Key Strategic Moves)

- Market Share Analysis

- Company Profiles

- Anheuser-Busch InBev

- Heineken N.V.

- Cervejaria Petropolis S/A

- Grupo Peñaflor

- Diageo Plc

- CCU S.A.

- Brown-Forman

- Companhia Muller de Bebidas

- Pernod Ricard

- Molson Coors Beverage Company

MARKET DYNAMICS

- Market Drivers

- Market Challenges

- Market Opportunities

- Porter’s Five Forces’ Analysis

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Threat of New Entrant

- Threat of Substitutes

- Competitive Rivalry

GLOSSARY OF PROMINENT SECONDARY SOURCES

DISCLAIMER

ABOUT US