Discover the 100+ page report on the South America Alcoholic Beverages Market, providing insights into trends, growth drivers, and the competitive landscape. Available in PDF and Excel formats for easy access to detailed data and analysis.

South America Alcoholic Beverages Market

- Brand: DigiRoads

Category: Food and Beverage

Brand: DigiRoads

South America Alcoholic Beverages Market Report | Market Size, Industry Analysis, Growth Opportunities, & Forecast (2025-2030)

South America Alcoholic Beverages Market Overview

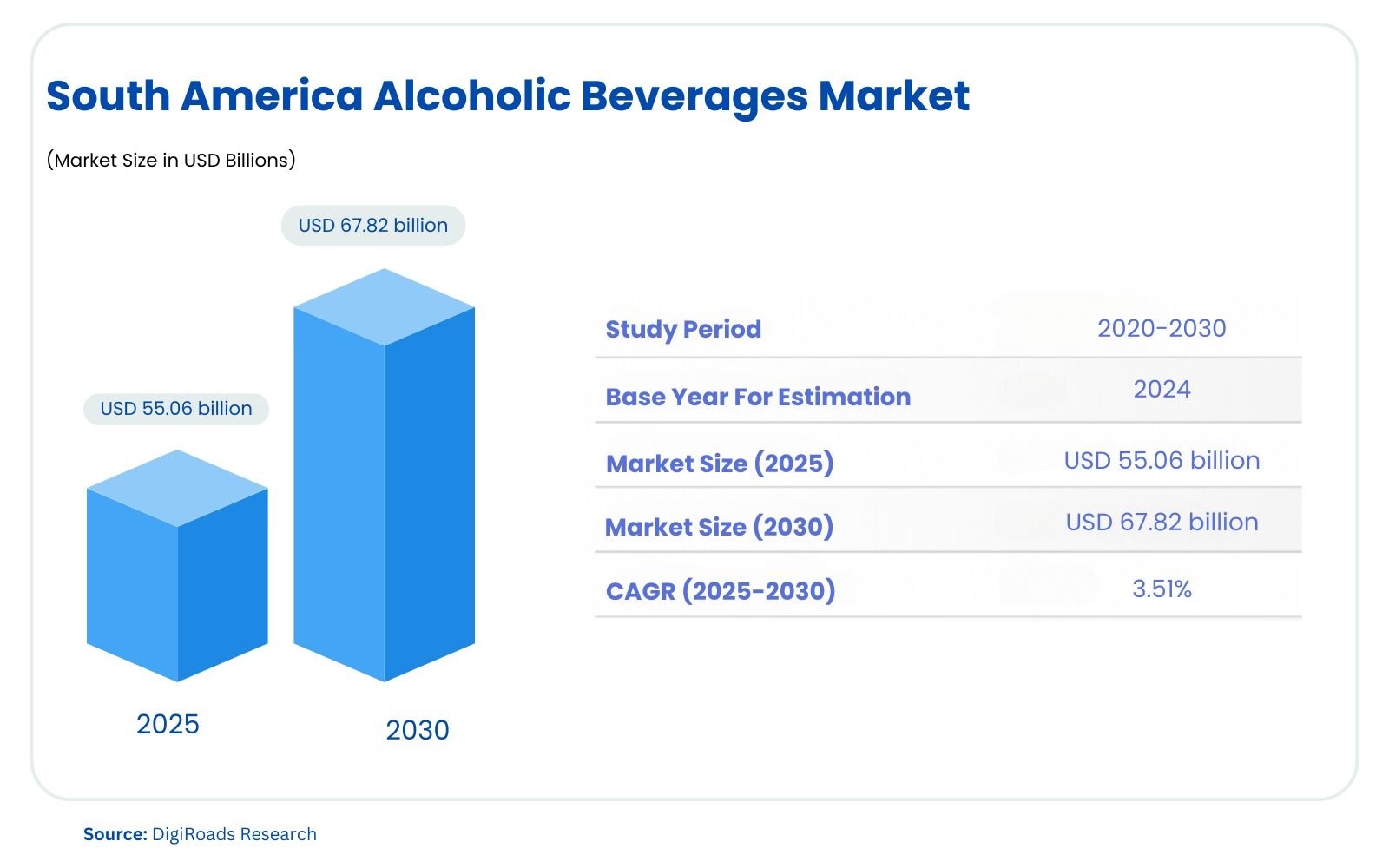

The South America Alcoholic Beverages Market is poised for steady expansion, with an estimated market size of USD 55.06 billion in 2025 and expected to reach USD 67.82 billion by 2030, growing at a CAGR of 3.51% during the forecast period 2025-2030. The South America Alcoholic Beverages Market is set to experience significant growth from 2025 to 2030, driven by evolving consumer preferences and increasing disposable incomes. This market includes a diverse range of alcoholic drinks, such as beer, spirits, wine, and ready-to-drink (RTD) beverages, with beer remaining the dominant category. Changing lifestyles, growing demand for premium products, and a rise in alcohol consumption across the region are key factors contributing to the market’s expansion.

The rise of craft beers, the increasing popularity of wine among millennials, and a growing trend toward low-alcohol and functional beverages are reshaping the market landscape. Additionally, e-commerce and online sales are becoming increasingly important as consumers seek convenience and personalized choices.

This report provides a comprehensive analysis of the South America Alcoholic Beverages Market, covering key trends, growth drivers, challenges, and opportunities in the sector. It also explores market dynamics across major countries like Brazil, Argentina, and Chile, offering valuable insights to stakeholders and industry players for making informed decisions during the forecast period from 2025 to 2030.

This report is tailored to assist businesses in navigating the competitive market, leveraging growth opportunities, and staying ahead of industry shifts.

Market Report Coverage:

The “South America Alcoholic Beverages Market Report—Future (2025-2030)” by Digiroads Research & Consulting covers an in-depth analysis of the following segments in the market.

| Product Type | Beer, Spirits, Wine, Ready-to-Drink (RTD) Beverages |

| Consumption Trends | Craft Beers, Premium Alcoholic Beverages, Low-Alcohol & Functional Beverages |

| Distribution Channels | E-commerce, Online Sales, Retail (Supermarkets, Hypermarkets), Bars, Restaurants |

Study Assumptions and Definitions

This report is based on a set of assumptions and definitions to provide a clear and consistent analysis of the South America Alcoholic Beverages Market over the forecast period of 2025 to 2030. The market includes alcoholic drinks such as beer, spirits, wine, and ready-to-drink (RTD) beverages, which are categorized based on their ingredients, production processes, and consumption patterns.

Assumptions:

- Market Growth: The market is expected to grow steadily due to increased disposable incomes, evolving consumer preferences, and the rising demand for premium alcoholic beverages.

- Consumption Trends: A growing inclination toward craft beers, premium products, and low-alcohol beverages will continue to shape market trends, particularly among younger consumers and health-conscious individuals.

- Geographical Coverage: The study focuses on key countries such as Brazil, Argentina, and Chile, representing the largest markets in South America.

Definitions:

- Alcoholic Beverages: Drinks that contain ethanol (alcohol) and are categorized into beer, wine, spirits, and RTD beverages.

- Craft Beer: Small-scale, independently produced beer often known for unique flavors and higher quality.

- RTD Beverages: Pre-mixed alcoholic drinks designed for convenience and quick consumption.

These assumptions and definitions ensure that the report’s findings are consistent and relevant for the period 2025-2030.

Market Scope

This report covers the South America Alcoholic Beverages Market, focusing on the period from 2025 to 2030. The market scope includes an in-depth analysis of the key product segments: beer, spirits, wine, and ready-to-drink (RTD) beverages, which are forecasted to exhibit varying growth rates during the period. The report examines consumption trends, particularly the rising popularity of craft beers, premium products, and low-alcohol beverages.

It also covers market dynamics across major South American countries, including Brazil, Argentina, and Chile, and explores emerging trends such as the increasing demand for functional beverages and the influence of online sales and e-commerce. The study provides insights into distribution channels like retail, bars, restaurants, and digital platforms.

This report aims to offer valuable insights for stakeholders, manufacturers, and investors to make informed decisions and capitalize on emerging opportunities in the South American alcoholic beverages industry.

MARKET OUTLOOK

Executive Summary

The South America Alcoholic Beverages Market is poised for significant growth from 2025 to 2030, driven by evolving consumer preferences, increasing disposable incomes, and the demand for premium and craft alcoholic products. The market encompasses a wide range of alcoholic drinks, including beer, spirits, wine, and ready-to-drink (RTD) beverages, with beer holding a dominant share. However, shifts in consumer behavior, particularly among younger generations, are contributing to the growing popularity of craft beers, wine, and low-alcohol beverages.

Brazil, Argentina, and Chile are the key countries driving market growth, with Brazil leading the market due to its large population and established alcohol culture. Additionally, the rising trend of functional beverages, which combine alcohol with health-conscious ingredients, is gaining momentum in the region. Premium alcoholic products, especially in the spirits and wine categories, are seeing increased demand as consumers seek higher quality options.

Distribution channels are also evolving, with e-commerce and online sales becoming more prominent as consumers embrace convenience and personalized choices. Retail outlets, including supermarkets and hypermarkets, alongside bars and restaurants, remain significant in the traditional distribution landscape.

Key factors influencing the market include rising health consciousness, the popularity of artisanal products, and the expanding influence of social media and influencer marketing. Furthermore, the increasing number of alcohol consumption regulations in some countries will drive innovation in product formulations and packaging.

This report provides a comprehensive analysis of the South America Alcoholic Beverages Market, examining growth drivers, key trends, challenges, and opportunities, along with insights into market dynamics across major regional markets. It serves as a valuable resource for industry stakeholders, manufacturers, and investors seeking to understand the market and capitalize on emerging opportunities in the forecast period from 2025 to 2030.

COMPETITIVE LANDSCAPE

The South America Alcoholic Beverages Market is moderately fragmented, with regional and multinational players competing fiercely for market share.

Key Market Players

- Ambev S.A. (Brazil)

- Grupo Modelo (AB InBev) (Mexico)

- Heineken N.V. (Netherlands)

- Diageo Plc (United Kingdom)

- Pernod Ricard S.A. (France)

- Molson Coors Beverage Company (USA)

- The Constellation Brands, Inc. (USA)

- Bodegas Salentein (Argentina)

- Vina Concha y Toro (Chile)

Market Share Analysis

The South America Alcoholic Beverages Market is highly competitive, with key players dominating across various product categories. As of the forecast period from 2025 to 2030, Ambev S.A., a subsidiary of Anheuser-Busch InBev, holds a substantial market share, particularly in the beer segment, due to its strong brand presence and extensive distribution network in Brazil and other South American countries. Heineken N.V. follows closely, commanding a significant share in the premium beer market and expanding its presence in emerging markets.

In the spirits category, Diageo Plc and Pernod Ricard S.A. are the leading players, with their diverse portfolios of premium and mass-market spirits, including whiskey, vodka, and rum. Diageo, in particular, has a strong foothold in Brazil, Argentina, and Chile, where it continues to innovate in response to the growing demand for premium products.

Wine producers such as Vina Concha y Toro and Bodegas Salentein dominate the wine market, especially in Chile and Argentina, the two largest wine-producing countries in South America.

The ready-to-drink (RTD) beverages segment is experiencing rapid growth, with major players like The Coca-Cola Company and regional breweries expanding their portfolios to include RTD products.

Overall, the market is characterized by consolidation among large multinational corporations, alongside the growing influence of local craft breweries and emerging premium alcohol brands, contributing to a dynamic and competitive market landscape.

MARKET DYNAMICS

Market Drivers and Key Innovations

The South America Alcoholic Beverages Market is driven by several key factors, contributing to its growth from 2025 to 2030. One of the primary drivers is the increasing disposable income across the region, especially in key markets like Brazil, Argentina, and Chile. Rising incomes enable consumers to explore premium and craft alcoholic products, contributing to the demand for higher-quality beverages.

Another major driver is the evolving consumer preferences, particularly among millennials and Gen Z, who seek unique and innovative products. This has led to the growth of craft beer, organic wines, and low-alcohol beverages as consumers become more health-conscious and inclined toward functional drinks. The increasing popularity of premium spirits, especially whiskey, tequila, and rum, is another important trend, with consumers preferring high-quality, aged, or artisanal products.

In terms of key innovations, the market has seen the rise of functional and low-alcohol beverages that offer added benefits, such as hydration or nutritional value. Ready-to-drink (RTD) beverages have also gained significant traction due to their convenience and accessibility. Manufacturers are focusing on new flavor combinations and packaging innovations to cater to changing consumer preferences, such as sustainable, eco-friendly packaging solutions.

E-commerce and digital sales channels are rapidly expanding, providing consumers with more personalized experiences and greater access to a wide range of products. Additionally, the growth of social media and influencer marketing is reshaping the way alcoholic beverages are marketed, enabling brands to reach a broader audience.

These drivers and innovations are poised to fuel the South American alcoholic beverages market through 2030.

Market Challenges

- Competition from OTT Platforms: Regulatory Restrictions: Many South American countries impose strict regulations on alcohol consumption, advertising, and sales, which can limit market growth and create compliance challenges for manufacturers.

- Economic Instability: Economic volatility in key markets, such as Brazil and Argentina, can negatively impact consumer spending on non-essential products like premium alcoholic beverages, affecting market demand.

- Health Consciousness: Growing health awareness among consumers is driving demand for low-alcohol and alcohol-free beverages, which may challenge traditional alcoholic product categories.

- Intense Competition: The market is highly competitive with both global and local players vying for market share. New entrants, especially craft breweries and local producers, increase pressure on established brands to innovate and differentiate.

- Supply Chain Disruptions: Global supply chain challenges, including the rising costs of raw materials like barley and sugar, along with transportation disruptions, can increase production costs and affect product availability.

- Changing Consumer Preferences: The shift toward healthier, low-calorie, and functional beverages requires companies to constantly adapt their product offerings to meet these evolving demands.

- Cultural Differences: Diverse consumer preferences and consumption patterns across different South American countries can pose challenges in terms of product offerings and marketing strategies.

Market Opportunities

- Immersive Technologies: Growth of Craft Beer: The increasing popularity of craft beer presents significant opportunities for small and independent breweries to cater to the demand for unique, locally produced products, offering niche flavors and styles.

- Premium Product Demand: As disposable incomes rise, there is growing consumer interest in premium alcoholic beverages, particularly high-quality spirits like whiskey, rum, and tequila, creating opportunities for luxury brands to expand in the region.

- Ready-to-Drink (RTD) Beverages: The convenience and accessibility of RTD products are gaining popularity, especially among younger consumers. This trend offers opportunities for innovation in new flavors, packaging, and product formulations.

- Health-Conscious and Functional Beverages: With a rising focus on health and wellness, there is growing demand for low-alcohol, alcohol-free, and functional beverages, such as those with added vitamins or minerals, catering to health-conscious consumers.

- E-commerce Growth: The rise of online sales and e-commerce platforms provides a direct channel to reach consumers, offering personalized experiences and expanding market reach, especially in regions where traditional retail is limited.

- Sustainable Packaging: Increasing demand for eco-friendly packaging solutions presents an opportunity for brands to differentiate themselves by using sustainable materials, aligning with the growing trend of environmental consciousness.

- Emerging Middle-Class Population: A growing middle class in key South American countries offers a significant consumer base, particularly in Brazil and Argentina, for alcohol products catering to different tastes and preferences.

RECENT STRATEGIES & DEVELOPMENTS IN THE MARKET

Expansion of Craft Beer Offerings:

- Many regional and international breweries are expanding their craft beer portfolios to cater to growing demand. For instance, Ambev S.A. introduced a range of craft beers under the “Brahma” brand, responding to the increasing popularity of artisanal beers in Brazil.

- Data: Craft beer consumption in Brazil has grown by approximately 30% annually over the last 3 years.

Focus on Premium Products:

- Leading players like Diageo and Pernod Ricard are investing heavily in premium spirits and limited-edition products. For example, Diageo expanded its Johnnie Walker range with exclusive releases in Brazil and Argentina, targeting higher-income consumers.

- Data: Premium alcohol products are projected to account for over 40% of the market share by 2030 in Brazil and Argentina.

Investing in E-Commerce and Online Sales:

- Companies are increasingly focusing on digital transformation, enhancing their online presence through e-commerce platforms. Heineken, for example, partnered with local e-commerce platforms in Brazil and Argentina to offer direct-to-consumer sales and personalized delivery options.

- Data: Online sales of alcoholic beverages in Brazil grew by 15% in 2024 and are expected to maintain double-digit growth through 2030.

Sustainability Initiatives:

- Several companies are incorporating sustainability into their operations. For example, Ambev has committed to using 100% recyclable packaging for its products by 2025 and reducing water usage in its breweries.

- Data: Ambev has reduced its water consumption by 20% in the past five years across its South American facilities.

Introduction of Functional and Low-Alcohol Beverages:

- In response to health trends, several manufacturers have launched low-alcohol and functional beverages. Pernod Ricard’s launch of “Absolut Zero,” a low-alcohol version of its flagship vodka, is one example.

- Data: The low-alcohol beverage segment is expected to grow by 15% annually from 2025 to 2030, particularly among younger consumers in Brazil and Argentina.

Strategic Acquisitions and Mergers:

- Multinational companies are increasingly acquiring local breweries and distilleries to tap into emerging markets. Heineken acquired the local craft brewery “Cervejaria Colorado” in Brazil to expand its footprint in the craft beer sector.

- Data: Heineken’s market share in Brazil grew by 5% following the acquisition in 2023.

KEY BENEFITS FOR STAKEHOLDERS

Market Expansion Opportunities:

- Stakeholders, including manufacturers and distributors, can capitalize on the growing demand for premium products, craft beer, and low-alcohol beverages. As the middle class expands, especially in Brazil and Argentina, new market opportunities arise for both domestic and international players.

- Data: Premium alcoholic beverages are expected to account for over 40% of the market share by 2030.

Diversified Consumer Preferences:

- The increasing variety of consumer tastes, from health-conscious low-alcohol beverages to functional drinks, offers stakeholders the chance to diversify their product offerings and cater to niche segments. This helps in capturing a broader consumer base and building brand loyalty.

- Data: The low-alcohol and alcohol-free beverages segment is projected to grow by 15% annually through 2030.

E-Commerce Growth:

- E-commerce platforms are providing stakeholders with direct access to consumers. This opens up new revenue channels and enables brands to expand their reach, particularly in regions with limited retail presence. Through digital sales, stakeholders can also offer personalized experiences, enhancing customer satisfaction.

- Data: Online sales in Brazil grew by 18% in 2023 and are expected to continue growing rapidly.

Sustainability Initiatives:

- Stakeholders can benefit from the growing consumer preference for eco-friendly products. By adopting sustainable practices such as recyclable packaging and reducing water usage, companies can enhance their brand image, align with global trends, and attract environmentally-conscious consumers.

- Data: Ambev aims for 100% recyclable packaging by 2025, setting a precedent for the industry.

Strategic Acquisitions and Partnerships:

- Stakeholders can benefit from mergers and acquisitions that allow them to access new markets, enhance product portfolios, and leverage local expertise. For example, Heineken’s acquisition of local craft breweries enables deeper market penetration and brand recognition.

- Data: Heineken’s market share in Brazil increased by 5% post-acquisition of Cervejaria Colorado in 2023.

At DigiRoads Research, we emphasize reliability by employing robust market estimation and data validation methodologies. Our insights are further enhanced by our proprietary data forecasting model, which projects market growth trends up to 2030. This forward-thinking approach ensures our analysis not only captures the current market landscape but also anticipates future developments, equipping stakeholders with actionable foresight.

We go a step further by offering an exhaustive set of regional and country-level data points, supplemented by over 60 detailed charts at no additional cost. This commitment to transparency and accessibility allows stakeholders to gain a deep understanding of the industry’s structural and operational dynamics. By providing exclusive and hard-to-access data, DigiRoads Research empowers businesses to make informed strategic decisions with confidence.

In essence, our methodology and data delivery foster a collaborative and data-driven decision-making environment, enabling businesses to navigate industry challenges and capitalize on opportunities effectively.

Contact Us For More Inquiry.

Table of Contents

-

INTRODUCTION

- Market Overview

- Years Considered for Study

- Market Segmentation

- Study Assumptions and Definitions

- Market Scope

-

RESEARCH METHODOLOGY

-

MARKET OUTLOOK

- Executive Summary

- Market Snapshot

- Market Segments

- Product Type:

- Beer, Spirits, Wine, Ready-to-Drink (RTD) Beverages

- Consumption Trends:

- Craft Beers, Premium Alcoholic Beverages, Low-Alcohol & Functional Beverages

- Distribution Channels:

- E-commerce, Online Sales, Retail (Supermarkets, Hypermarkets), Bars, Restaurants

- Product Type:

-

COMPETITIVE LANDSCAPE

- Recent Strategies (Key Strategic Moves)

- Market Share Analysis

- Company Profiles

- Ambev S.A. (Brazil)

- Grupo Modelo (AB InBev) (Mexico)

- Heineken N.V. (Netherlands)

- Diageo Plc (United Kingdom)

- Pernod Ricard S.A. (France)

- Molson Coors Beverage Company (USA)

- The Constellation Brands, Inc. (USA)

- Bodegas Salentein (Argentina)

- Vina Concha y Toro (Chile)

-

MARKET DYNAMICS

- Market Drivers

- Market Challenges

- Market Opportunities

- Porter’s Five Forces’ Analysis

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Threat of New Entrant

- Threat of Substitutes

- Competitive Rivalry

-

GLOSSARY OF PROMINENT SECONDARY SOURCES

-

DISCLAIMER

-

ABOUT US