No products in the cart.

United Arab Emirates Poultry Meat Market

- Brand: DigiRoads

Discover the 100+ page report on the United Arab Emirates Poultry Meat Market, providing insights into trends, growth drivers, and the competitive landscape. Available in PDF and Excel formats for easy access to detailed data and analysis.

Category: Food and Beverage

Brand: DigiRoads

United Arab Emirates Poultry Meat Market Report | Market Size, Industry Analysis, Growth Opportunities, & Forecast (2025-2030)

United Arab Emirates Poultry Meat Market Overview

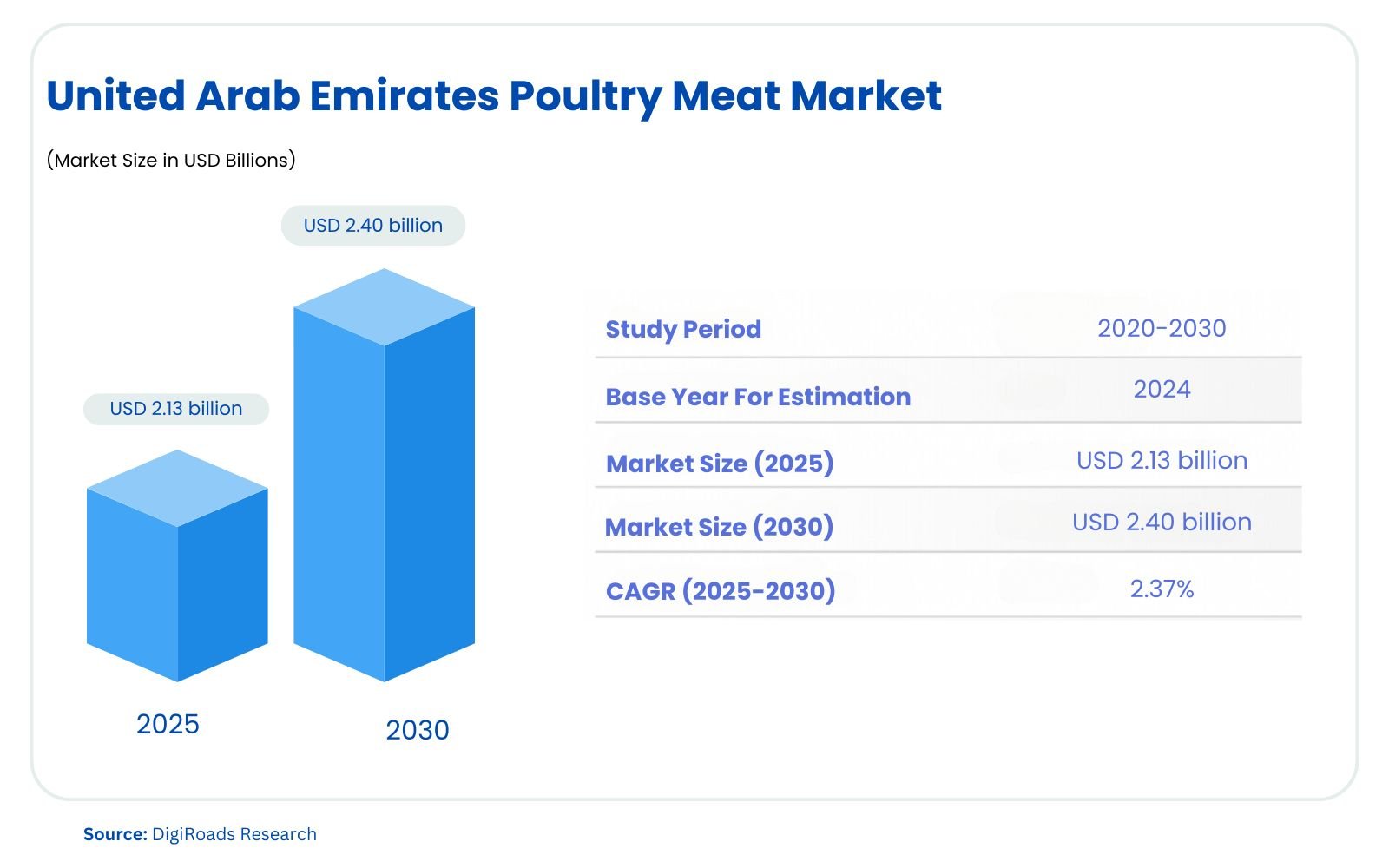

The United Arab Emirates Poultry Meat Market is poised for steady growth, with an estimated market size of USD 2.13 billion in 2025, projected to reach USD 2.40 billion by 2030, expanding at a CAGR of 2.37% during the forecast period 2025-2030. The United Arab Emirates (UAE) poultry meat market is expected to witness significant growth from 2025 to 2030, driven by increasing consumer demand, rising health consciousness, and expanding food service sectors. As a major part of the UAE’s food industry, poultry meat consumption is on the rise due to its affordability, versatility, and nutritional value. The market is dominated by key players involved in both domestic production and imports, with significant imports coming from countries like Brazil and the United States.

The growing trend towards ready-to-eat (RTE) and ready-to-cook (RTC) poultry products is shaping the market dynamics. Additionally, the increasing focus on halal-certified poultry products caters to the region’s dietary preferences. The rise of quick-service restaurants, hotels, and cafes within the HoReCa sector is further boosting demand for poultry meat.

This market research report delves into the current market scenario, emerging trends, key drivers, and challenges affecting the UAE poultry meat industry from 2025 to 2030. It offers valuable insights into market share analysis, consumer preferences, and forecasts to help stakeholders make informed decisions.

Market Report Coverage:

The “United Arab Emirates Poultry Meat Market Report—Future (2025-2030)” by Digiroads Research & Consulting covers an in-depth analysis of the following segments in the market.

| Type of Poultry Meat | Broilers, turkey, ducks, geese |

| Product Forms | Fresh, frozen, processed poultry meat |

| Geography | Domestic production, imports (Brazil, US, etc.) |

Study Assumptions and Definitions

The study on the United Arab Emirates (UAE) poultry meat market considers several assumptions and definitions to provide a comprehensive analysis. The market primarily focuses on poultry meat types such as broilers, turkey, ducks, and geese. It includes both fresh and frozen products, with processed poultry meat also being a key segment. The analysis spans the forecast period from 2025 to 2030, reflecting trends and growth potential in the coming years.

The UAE poultry meat market is shaped by both domestic production and imports, with key suppliers from countries like Brazil and the United States. The consumption of poultry meat in the UAE is influenced by various factors, including rising disposable incomes, an increasing demand for protein-rich diets, and shifts in consumer preferences towards healthier and convenience-oriented options.

Additionally, the study assumes steady economic growth, with continued demand for both high-quality fresh products and processed forms of poultry meat. Consumer preferences for certified, halal-certified poultry products are also expected to shape the market dynamics. The research further assumes the impact of key factors such as food service sector growth, regulatory developments, and technological advancements in production and distribution will be critical in shaping the market landscape during the forecast period.

Market Scope

The scope of this report on the United Arab Emirates (UAE) poultry meat market covers an in-depth analysis of market trends, growth drivers, challenges, and competitive dynamics from 2025 to 2030. It examines the poultry meat types, including broiler meat, turkey, duck, and goose, along with both fresh and frozen products, along with processed poultry meat. The report includes a detailed analysis of the market’s production, consumption patterns, distribution channels, and key import/export dynamics, offering insights into the domestic and international supply chains.

Key market segments such as retail, foodservice, and institutional sectors are explored, with a focus on consumer behavior, health-conscious trends, and rising demand for halal-certified products. The report also considers the influence of government policies, technological advancements in poultry production, and food safety regulations on market growth. Market forecasts, along with a competitive landscape, highlight the major players operating in the UAE poultry meat sector and their strategies to capture a larger share of the market.

MARKET OUTLOOK

Executive Summary

The United Arab Emirates (UAE) poultry meat market is projected to experience significant growth from 2025 to 2030, driven by factors such as a rising population, increasing demand for protein-rich foods, and a growing preference for poultry over red meat. The market is influenced by evolving consumer preferences toward healthier, convenient, and halal-certified products. As a major import hub for poultry, the UAE’s poultry market is experiencing a steady increase in demand, both domestically and from neighboring countries.

The key segments within the poultry meat market in the UAE include broiler meat, turkey, duck, and goose. Broiler meat holds the largest market share due to its affordability, availability, and versatility in both retail and food service applications. Turkey and duck are also gaining popularity, especially in the food service and institutional sectors, driven by their premium quality and health benefits. The rise in health-conscious consumers is fueling the demand for fresh and frozen poultry products with lower fat content.

Processed poultry, such as ready-to-cook and ready-to-eat products, is gaining traction due to the convenience factor. These products cater to busy urban lifestyles, where time efficiency is a priority. Distribution channels such as supermarkets, hypermarkets, and online platforms are increasingly important in reaching consumers, with an expanding focus on e-commerce and home delivery services.

The market is also influenced by government regulations on food safety and halal certification, which are critical for ensuring consumer trust and meeting market demand. Major players in the UAE poultry meat market are adopting strategic collaborations, technological innovations in production, and expanding their portfolios to offer diverse poultry products.

Overall, the UAE poultry meat market is poised for substantial growth, underpinned by favorable demographics, changing dietary habits, and innovations in the poultry industry.

COMPETITIVE LANDSCAPE

The United Arab Emirates Poultry Meat Market is moderately fragmented, with regional and multinational players competing fiercely for market share.

Key Market Players

- Al Islami Foods

- Al Ain Poultry Farm

- Hudaibiyah Poultry Farms

- Al Kabeer Group

- Baqer Mohebi Enterprises

- Juhayna Food Industries

- Kouser Poultry

- Oman Foodstuff Company (Sohar Poultry)

- Fujairah Poultry

- Al Ghurair Foods

Market Share Analysis

The United Arab Emirates poultry meat market is characterized by a competitive landscape with several key players. As of the 2025-2030 forecast period, the market is dominated by both local and international companies, with a significant share held by major brands like Al Islami Foods, Al Ain Poultry Farm, and Al Kabeer Group. These players benefit from strong brand recognition, extensive distribution networks, and consumer trust in their quality standards.

Al Islami Foods holds a leading position, benefiting from its well-established reputation and diverse poultry product range, including frozen and fresh poultry offerings. Al Ain Poultry Farm also maintains a significant share due to its high-quality production and local sourcing, ensuring freshness and reliability. Additionally, Al Kabeer Group has a strong presence due to its diverse product portfolio and longstanding market presence.

The increasing demand for halal-certified products and a growing focus on convenience in food preparation are influencing market dynamics. As a result, several players are introducing value-added products and expanding their offerings through retail and food service channels to cater to evolving consumer preferences.

Overall, while the market remains competitive, the largest players dominate due to their extensive supply chains, customer loyalty, and product diversity, contributing to their substantial market shares.

MARKET DYNAMICS

Market Drivers and Key Innovations

Market Drivers

The United Arab Emirates poultry meat market is driven by several factors that contribute to its growth from 2025-2030. One of the key drivers is the increasing demand for high-quality, protein-rich food due to the growing population and rising health consciousness among consumers. Poultry meat, being a lean source of protein, is favored over other meats, especially in urban areas. Additionally, the preference for halal-certified meat aligns with the cultural and religious practices of the UAE, providing a strong market base for poultry products.

Urbanization, along with changing lifestyles, has also led to higher demand for convenience foods. Ready-to-eat and ready-to-cook poultry products are gaining popularity, especially among busy professionals and young consumers. This shift towards convenience food is a significant driver of growth in the market.

Key Innovations

Innovations in the United Arab Emirates poultry meat market are focused on improving product quality, shelf life, and convenience. One major trend is the development of value-added poultry products such as marinated, pre-cooked, and ready-to-eat options, which cater to the growing demand for convenience. Advances in packaging technology, such as vacuum-sealed and retort packaging, help preserve the freshness and extend the shelf life of poultry products, making them more appealing to both retailers and consumers.

Additionally, sustainable farming practices and animal welfare standards are becoming more important. Innovations in production techniques, such as antibiotic-free and hormone-free poultry farming, are being introduced by companies to meet the increasing demand for healthier and more ethically produced meat. These innovations are key to attracting health-conscious consumers and maintaining brand loyalty in a competitive market.

Market Challenges

- Price Fluctuations: The United Arab Emirates poultry meat market faces challenges related to price volatility due to factors such as feed costs, seasonal variations, and geopolitical influences. These fluctuations impact both production and retail prices, which can affect consumer purchasing behavior.

- Dependence on Imports: The UAE is heavily reliant on poultry meat imports, particularly from countries like Brazil and the US. This dependence makes the market vulnerable to supply chain disruptions, trade restrictions, and global price increases, which can affect local availability and pricing.

- Food Safety and Quality Concerns: Ensuring high standards of food safety and maintaining the quality of poultry meat are critical concerns. Any incidents of contamination or health-related issues can damage consumer confidence, leading to market instability.

- Stringent Regulations: Compliance with strict halal certifications, food safety standards, and veterinary regulations can increase operational costs for poultry producers and suppliers. Meeting these regulatory requirements is essential but can present a barrier to entry for new market participants.

- Sustainability Issues: The growing emphasis on sustainability and ethical farming practices poses challenges for poultry producers in terms of adopting eco-friendly practices. The need for more sustainable farming methods, water conservation, and reducing carbon footprints can increase production costs.

- Health Concerns: Rising health consciousness among consumers has led to a preference for healthier alternatives, such as plant-based proteins or organic meat options. This shift presents a challenge for traditional poultry producers to adapt their offerings to meet these changing consumer preferences.

Market Opportunities

- Rising Health Consciousness: Increasing health awareness presents an opportunity for poultry producers to offer healthier, leaner cuts of meat, along with organic, antibiotic-free, or hormone-free poultry products to cater to health-conscious consumers.

- Growing Demand for Processed Poultry Products: The increasing popularity of ready-to-eat, frozen, and value-added processed poultry products offers significant growth potential in the UAE market. As busy lifestyles increase, there is greater demand for convenient and pre-cooked poultry options.

- Expansion of Halal Meat Offerings: The growing Muslim population and increasing international demand for halal-certified products create an opportunity for poultry producers to expand their halal meat offerings, positioning themselves to meet religious dietary requirements.

- E-commerce and Online Sales Growth: The rise of e-commerce and online grocery shopping in the UAE offers poultry meat companies a platform to reach a wider audience, particularly in urban areas where online shopping is increasingly popular.

- Investments in Sustainable Farming Practices: There is an opportunity for poultry producers to invest in sustainable and eco-friendly farming practices, such as reducing water consumption, minimizing waste, and implementing renewable energy solutions, to meet the growing consumer demand for environmentally conscious products.

- Rising Disposable Incomes and Urbanization: With the increasing disposable income and urbanization in the UAE, there is a growing demand for premium and diverse poultry meat products. This opens up opportunities for producers to cater to affluent consumers seeking higher-quality options.

- Increasing Tourism and Foodservice Demand: The growing tourism sector in the UAE, along with a thriving food service industry, presents opportunities for poultry suppliers to expand their reach through hotels, restaurants, catering services, and other food service outlets.

RECENT STRATEGIES & DEVELOPMENTS IN THE MARKET

- Expansion of Halal Product Lines: Poultry producers in the UAE are increasingly focusing on expanding their range of halal-certified products to meet the growing demand from both local and international consumers. This has become essential as the UAE is a significant market for halal food, with halal food sales estimated to reach around 2 trillion by 2025.

- Investing in Automation & Technology: Major poultry producers are adopting automated technologies in processing and packaging to increase efficiency, reduce labor costs, and ensure product consistency. For example, companies like Al Ain Farms have implemented cutting-edge poultry processing technology to streamline operations.

- Focus on Healthier Poultry Options: With rising consumer health consciousness, companies are shifting towards offering healthier poultry products. This includes reducing the use of antibiotics and hormones, as well as launching organic and free-range poultry lines. This strategy aligns with the growing preference for clean-label products in the UAE market, which is projected to grow rapidly from 2025-2030.

- Partnerships with Retail Chains: Poultry suppliers are entering into strategic partnerships with major retail chains like Carrefour and Lulu Hypermarket to enhance their market reach. This collaboration helps in broadening the availability of fresh and processed poultry products across the UAE, tapping into the large consumer base.

- Sustainability Initiatives: Companies like Al Wadi Group are investing in sustainability initiatives, such as sourcing feed locally, improving energy efficiency, and using eco-friendly packaging. These efforts cater to the increasing demand for environmentally friendly products in the UAE market, where consumers are becoming more conscious of sustainability.

- E-commerce Growth: As e-commerce continues to rise in the UAE, poultry companies are developing online platforms for direct consumer sales. This includes partnerships with local food delivery services like Talabat and Zomato to cater to a tech-savvy and convenience-seeking population. The UAE’s online grocery market is also expected to grow at a high CAGR from 2025-2030.

- Supply Chain Enhancements: Poultry companies are focusing on strengthening their supply chains to ensure the availability of fresh products throughout the year. This includes expanding cold storage capabilities and increasing their logistics networks across key urban centers in the UAE.

KEY BENEFITS FOR STAKEHOLDERS

- Market Growth Opportunities: Stakeholders, including investors and producers, can capitalize on the growing demand for poultry meat in the UAE. The market is expected to grow steadily due to the rising population and increasing demand for halal and healthy meat options.

- Access to Emerging Consumer Trends: By understanding evolving consumer preferences, such as the shift towards organic, antibiotic-free, and halal-certified poultry, stakeholders can align their product offerings to meet these demands, ensuring a competitive edge in the market.

- Strategic Partnerships and Expansions: Retailers and distributors benefit from strategic collaborations with poultry producers, enhancing their product portfolios and increasing market reach. Expanding distribution channels through e-commerce and hypermarket chains allows businesses to tap into wider consumer segments.

- Sustainability and Eco-friendly Practices: With an increasing focus on sustainability, stakeholders can invest in environmentally friendly practices, such as sustainable packaging and local sourcing, which not only appeal to conscious consumers but also contribute to long-term cost savings.

- Improved Supply Chain and Efficiency: Stakeholders involved in logistics and supply chain management stand to benefit from innovations in cold storage facilities and efficient distribution networks, which reduce product spoilage and enhance profitability.

- Regulatory Compliance: Poultry producers and suppliers adhering to stringent regulatory standards, such as halal certification and food safety regulations, gain consumer trust and open opportunities for export to other Middle Eastern markets, further expanding their business.

- Technology Integration: The integration of automation and advanced processing technologies allows stakeholders to enhance operational efficiency, reduce costs, and improve product quality, resulting in better margins and customer satisfaction.

- Consumer Loyalty and Brand Strength: By offering high-quality, sustainable, and health-conscious poultry products, companies can build strong brand loyalty, ensuring long-term growth and market leadership.

At DigiRoads Research, we emphasize reliability by employing robust market estimation and data validation methodologies. Our insights are further enhanced by our proprietary data forecasting model, which projects market growth trends up to 2030. This forward-thinking approach ensures our analysis not only captures the current market landscape but also anticipates future developments, equipping stakeholders with actionable foresight.

We go a step further by offering an exhaustive set of regional and country-level data points, supplemented by over 60 detailed charts at no additional cost. This commitment to transparency and accessibility allows stakeholders to gain a deep understanding of the industry’s structural and operational dynamics. By providing exclusive and hard-to-access data, DigiRoads Research empowers businesses to make informed strategic decisions with confidence.

In essence, our methodology and data delivery foster a collaborative and data-driven decision-making environment, enabling businesses to navigate industry challenges and capitalize on opportunities effectively.

Contact Us For More Inquiry.

Table of Contents

INTRODUCTION

- Market Overview

- Years Considered for Study

- Market Segmentation

- Study Assumptions and Definitions

- Market Scope

RESEARCH METHODOLOGY

MARKET OUTLOOK

- Executive Summary

- Market Snapshot

- Market Segments

- Type of Poultry Meat:

- Broilers, turkey, ducks, geese

- Product Forms:

- Fresh, frozen, processed poultry meat

- Geography:

- Domestic production, imports (Brazil, US, etc.)

- Type of Poultry Meat:

COMPETITIVE LANDSCAPE

- Recent Strategies (Key Strategic Moves)

- Market Share Analysis

- Company Profiles

- Al Islami Foods

- Al Ain Poultry Farm

- Hudaibiyah Poultry Farms

- Al Kabeer Group

- Baqer Mohebi Enterprises

- Juhayna Food Industries

- Kouser Poultry

- Oman Foodstuff Company (Sohar Poultry)

- Fujairah Poultry

- Al Ghurair Foods

MARKET DYNAMICS

- Market Drivers

- Market Challenges

- Market Opportunities

- Porter’s Five Forces’ Analysis

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Threat of New Entrant

- Threat of Substitutes

- Competitive Rivalry

GLOSSARY OF PROMINENT SECONDARY SOURCES

DISCLAIMER

ABOUT US