No products in the cart.

United States Frozen Bakery Products Market

- Brand: DigiRoads

United States Food and Beverage Market Report on Frozen Bakery Products: This 100+ pages report offers comprehensive insights into market trends, key drivers, and competitive landscape. Available in PDF and Excel formats for in-depth analysis and data accessibility.

Category: Food and Beverage

Brand: DigiRoads

United States Frozen Bakery Products Market Report | Market Size, Industry Analysis, Growth Opportunities, & Forecast (2025-2030)

United States Frozen Bakery Products Market Overview

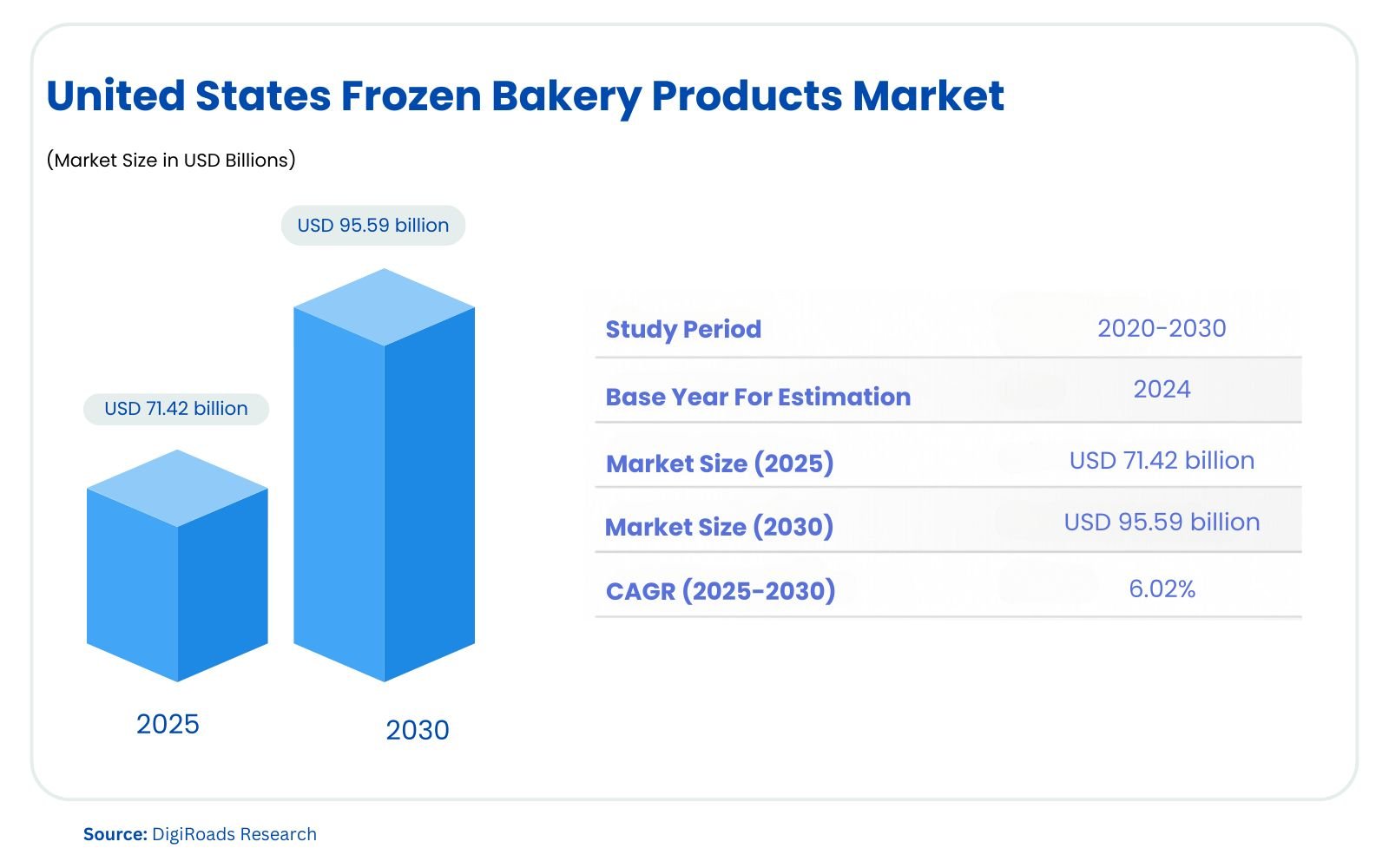

The United States Frozen Bakery Products Market is on a steady growth trajectory, with an estimated market size of USD 71.42 billion in 2025. Driven by evolving consumer preferences and increasing demand for convenience foods, the market is projected to reach USD 95.59 billion by 2030, expanding at a CAGR of 6.02% during the forecast period 2025-2030. This market encompasses a wide range of frozen bakery goods, including bread, pizza bases, cakes, cookies, and batters, tailored to meet the diverse dietary preferences of the U.S. population.

Changing consumer lifestyles, a growing demand for convenient food options, and the increasing adoption of gluten-free and sugar-free products are key drivers for market expansion. Additionally, advancements in freezing technology, such as Individual Quick-Freezing (IQF), ensure extended shelf life and product quality, further boosting demand.

The market benefits from robust distribution channels, including supermarkets, bakery stores, and online services, ensuring accessibility to consumers. However, challenges such as ingredient-related allergies and environmental concerns regarding refrigerants and transportation persist.

Leading players like Tyson Foods, General Mills, and Flowers Foods are innovating with allergen-free and nutrient-enriched products to capture evolving consumer trends. The report offers a comprehensive analysis of market dynamics, trends, segmentation, and competitive landscapes, serving as a valuable resource for stakeholders seeking to understand and leverage this growing market.

Market Report Coverage:

The “United States Frozen Bakery Products Market Report—Future (2025-2030)” by Digiroads Research & Consulting covers an in-depth analysis of the following segments in the market.

| By Product | Bread, Pizza Base, Cakes, Batters, Cookies, Others |

| By Source | Wheat, Rye, Barley, Others |

| By Distribution Channel | Supermarkets & Hypermarkets, Bakery Stores, Online Services, Others |

| By Geography | California, Texas, New York, Florida, Illinois, Pennsylvania, Ohio, Georgia, North Carolina, Michigan, and other U.S. states |

Study Assumptions and Definitions

This study on the United States Frozen Bakery Products Market is based on a comprehensive analysis of market trends, dynamics, and historical data. The assumptions guiding this research are derived from credible sources and industry insights to ensure accuracy and relevance.

- Time Frame: The base year for the study is 2024, with projections spanning 2025 to 2030. Historical data till 2024 has been utilized to establish trends.

- Market Metrics: The study focuses on key metrics such as market size, revenue, growth rate, and market share across various segments.

- Economic Stability: The research assumes a stable economic environment in the United States during the forecast period, barring significant disruptions.

- Consumer Behavior: It is assumed that consumer preferences for convenience, dietary awareness (e.g., gluten-free, sugar-free), and frozen food products will continue to drive market growth.

- Definitions:

- Frozen Bakery Products: Baked goods like bread, cakes, pizza bases, batters, and cookies that are frozen to extend shelf life.

- Gluten-Free: Products free of gluten to cater to individuals with gluten intolerance or celiac disease.

- Sugar-Free: Products without added sugars, aimed at health-conscious and diabetic consumers.

- Technological Advancements: The adoption of Individual Quick-Freezing (IQF) technology is considered a constant growth enabler.

Market Scope

The United States Frozen Bakery Products Market focuses on analyzing the production, distribution, and consumption of frozen bakery goods across the country. This includes bread, pizza bases, cakes, cookies, batters, and other bakery items with extended shelf lives through advanced freezing technologies like Individual Quick Freezing (IQF). The study encompasses various segments based on product type, source (wheat, rye, barley, etc.), category (gluten-free, sugar-free, conventional), consumption type (ready-to-eat, ready-to-bake, raw materials), and distribution channels (supermarkets, bakery stores, online services, others).

Geographically, the report covers all U.S. states, highlighting regional market trends and state-specific dynamics. It examines the market drivers, such as rising demand for convenient food options and dietary-specific products, along with restraints like ingredient-related allergies and environmental concerns. The report also provides insights into key players, technological advancements, and market opportunities, making it a valuable resource for stakeholders across the frozen bakery industry.

MARKET OUTLOOK

Executive Summary

The United States Frozen Bakery Products Market is a rapidly growing sector, projected to reach USD 95.59 billion by 2030, expanding at a CAGR of 6.02% during the forecast period. This market caters to a wide range of consumer preferences, offering products like bread, pizza bases, cakes, cookies, and batters, with extended shelf lives made possible by advanced freezing technologies like Individual Quick Freezing (IQF).

Key Drivers:

The increasing demand for convenient food options, driven by busy lifestyles, is a significant market driver. Rising consumer awareness about dietary needs has fueled the adoption of gluten-free, sugar-free, and allergen-free products. Additionally, innovations in nutritional enrichment, such as the inclusion of whole grains, Omega-3 and -6 fatty acids, and probiotics, have bolstered market growth.

Challenges:

The market faces challenges from growing health-consciousness, ingredient-related allergies, and environmental concerns over refrigerants. High transportation costs due to temperature-sensitive products and competition among retail, commercial bakeries, and online platforms also pose hurdles.

Segmentation and Trends:

The market is segmented by product type, source, category, consumption type, and distribution channel. Bread leads the product segment, while supermarkets and hypermarkets dominate the distribution channel. Gluten-free and sugar-free categories are experiencing robust growth due to increasing health concerns, particularly among diabetic and overweight populations.

Geographic Coverage:

The market spans all U.S. states, with key trends and demand patterns analyzed regionally. States like California, Texas, and New York are significant contributors due to their population size and evolving consumer preferences.

Key Players:

Prominent companies such as Tyson Foods, General Mills, and Flowers Foods are investing in innovations to meet consumer demands, particularly in allergen-free and nutrient-rich frozen bakery products.

COMPETITIVE LANDSCAPE

The United States Frozen Bakery Products Market is moderately fragmented, with regional and multinational players competing fiercely for market share.

Key Market Players

- Tyson Foods Inc.

- General Mills Inc.

- Rich Products Corporation

- Aryzta AG

- Lancaster Colony Corporation

- J&J Snack Foods Corp.

- Dawn Food Products Inc.

- Harlan Bakeries LLC

- Turano Baking Co.

- Gonnella Baking Company

Market Share Analysis

The U.S. Frozen Bakery Products Market is highly competitive and fragmented, with a mix of established corporations and regional players contributing to its growth. Major companies such as Tyson Foods Inc., General Mills Inc., and Flowers Foods Inc. hold significant shares due to their extensive product portfolios, strong distribution networks, and focus on innovation. These players dominate segments like bread, pizza bases, and ready-to-eat bakery products.

Rich Products Corporation and Aryzta AG are leaders in premium and specialty frozen bakery products, focusing on high-quality offerings, including allergen-free and gluten-free options. Mid-sized players like J&J Snack Foods Corp. and Dawn Food Products Inc. cater to niche markets, emphasizing customized solutions and regional preferences.

Supermarkets and hypermarkets are the leading distribution channels, accounting for the largest share of sales due to the availability of diverse product options and consumer trust in physical stores. However, online services are rapidly gaining traction, driven by growing digitalization and the convenience of home delivery.

Regional players hold a smaller yet vital market share by catering to local tastes and preferences. As consumer demand for healthier and specialty products grows, the market share is likely to shift toward companies offering gluten-free, sugar-free, and nutrient-enriched frozen bakery goods.

MARKET DYNAMICS

Market Drivers and Key Innovations

Market Drivers:

The growth of the U.S. Frozen Bakery Products Market is driven by several key factors:

- Convenience and Lifestyle Changes: The increasing demand for quick, easy-to-prepare meals due to busy lifestyles is a primary driver. Ready-to-eat and ready-to-bake frozen bakery products offer time-saving solutions, making them highly appealing to working professionals and families.

- Health and Dietary Preferences: The rising health-consciousness among U.S. consumers has led to a shift towards gluten-free, sugar-free, and allergen-free bakery products. With nearly 34 million people in the U.S. suffering from diabetes and an increasing awareness of obesity-related risks, demand for healthier frozen bakery options is surging.

- Long Shelf Life and Sustainability: Frozen bakery products offer extended shelf life (6 to 18 months), reducing food waste and making them a convenient choice for consumers.

- Growing Bakery Consumption: U.S. culture, particularly during festivals and gatherings, includes the consumption of bakery products. This cultural habit fuels ongoing demand, further bolstered by the proliferation of bakery stores.

Key Innovations:

- Gluten-Free and Allergen-Free Products: As the demand for gluten-free products increases, major players are investing in research and development to create new frozen bakery items that cater to those with gluten sensitivities or allergies.

- Nutritional Enhancements: Companies are incorporating superfoods, such as Omega-3 fatty acids, probiotics, and fiber, into their products to address growing consumer interest in health-conscious eating.

- Sustainability Efforts: Innovations in eco-friendly packaging and the use of natural, non-toxic preservatives are gaining momentum, aligning with increasing consumer preference for environmentally sustainable products.

Market Challenges

- Health and Wellness Concerns:

The growing awareness around health and wellness, particularly regarding high sugar, fat, and calorie content in bakery products, challenges the demand for traditional frozen bakery products. Consumers with specific dietary needs (e.g., low-carb, low-sugar) may avoid certain products, leading to reduced market potential. - Allergies and Sensitivities:

Ingredient-related allergies, especially to gluten, dairy, and nuts, create challenges in formulating bakery products that cater to all consumer segments. Balancing taste and nutritional value while making allergen-free products is a major hurdle. - Environmental Regulations:

The use of refrigerants required to store and transport frozen bakery products is being scrutinized due to environmental concerns. Stricter regulations on refrigerants and carbon footprints could impact production and distribution costs, thereby affecting profitability. - High Transportation and Storage Costs:

Frozen bakery products require temperature-controlled storage and transportation, which involves significant costs. Any fluctuation in fuel prices or logistical disruptions can result in increased costs for manufacturers and retailers, ultimately affecting product pricing and market competitiveness. - Intense Competition:

The presence of numerous commercial and retail bakeries, along with online services offering homemade frozen bakery goods, intensifies competition. This results in pricing pressures, forcing companies to innovate constantly or risk losing market share. - Supply Chain Disruptions:

External factors like labor shortages, raw material supply issues, and natural disasters can disrupt production and distribution channels, leading to product shortages or delays in meeting consumer demand.

Market Opportunities

- Rising Demand for Gluten-Free and Sugar-Free Products:

As more consumers adopt gluten-free, low-sugar, and allergen-free diets, there is an increasing opportunity for manufacturers to develop innovative frozen bakery products that meet these needs, tapping into a growing health-conscious demographic. - Expansion of Online Retail and E-Commerce:

The rapid growth of online shopping and home delivery services presents a significant opportunity for frozen bakery products. Companies can leverage e-commerce platforms to reach a wider customer base and provide convenience-driven offerings directly to consumers. - Product Innovation and Healthier Alternatives:

Consumers are increasingly looking for healthier frozen bakery options, such as those enriched with fiber, protein, Omega-3 fatty acids, and probiotics. Innovating with new ingredients to improve nutritional value can help companies tap into the wellness-focused consumer segment. - Sustainability and Eco-friendly Products:

There is a growing consumer preference for environmentally conscious brands. Investing in eco-friendly packaging, sustainable sourcing of ingredients, and the use of natural preservatives offers brands a competitive edge in an increasingly green market. - Convenient and Ready-to-Eat Offerings:

The demand for ready-to-eat and ready-to-bake products continues to rise as busy consumers seek convenient meal solutions. Brands can capitalize on this opportunity by developing new product lines that cater to time-starved individuals without compromising on quality or taste. - Regional and Local Market Expansion:

Expanding distribution into emerging regional markets and targeting specific local preferences can present new growth opportunities. Tailoring products to regional tastes and dietary habits can help businesses build a loyal customer base. - Collaboration with Health and Wellness Brands:

Partnerships with health-focused brands or even healthcare providers can open new avenues for promoting frozen bakery products that align with specific health objectives, such as diabetic-friendly or weight management diets.

RECENT STRATEGIES & DEVELOPMENTS IN THE MARKET

Product Diversification into Gluten-Free and Sugar-Free Segments

- Companies like Tyson Foods and General Mills have expanded their product lines to include gluten-free and sugar-free options. This strategy caters to the growing number of health-conscious consumers, with 64% of U.S. consumers shifting toward gluten-free products.

- In 2025, Sara Lee Frozen Bakery introduced the Strawberry Angel Food Cake, a sugar-free, cholesterol, and fat-free product catering to dietary needs, particularly in hospitals.

Innovation in Nutritional Value

- Rich Products Corp and Aryzta AG have launched bakery products fortified with Omega-3 fatty acids, fiber, and prebiotics to meet the demand for healthier frozen bakery goods.

- Flowers Foods has introduced bakery items enriched with whole grains and high-protein ingredients, tapping into the wellness trend.

Focus on Sustainability and Eco-friendly Practices

- Pepperidge Farm and other major players are increasingly adopting sustainable packaging solutions, such as biodegradable and recyclable materials, to reduce environmental impact. This aligns with consumer preferences for eco-friendly products.

- Investment in green refrigeration technologies is being prioritized to minimize carbon footprints during transportation and storage of frozen bakery products.

Expansion of Online Distribution Channels

- Online grocery sales of frozen food items have seen substantial growth, with 18.2% growth in frozen food sales reported by the American Frozen Food Institute. Companies like Dawn Foods have enhanced their digital presence and partnered with online retailers to meet the growing demand for home delivery.

- J&J Snack Foods Corp has improved its online presence to cater to the increasing number of customers opting for home delivery and digital shopping.

Increased R&D in Allergen-Free Products

- Lancaster Colony Corporation and Harlan Bakeries LLC are investing heavily in R&D for allergen-free frozen bakery products. With one in four Americans suffering from food allergies, these companies aim to cater to a larger consumer base by creating safer alternatives for those with dietary restrictions.

Strategic Mergers and Acquisitions

- In recent years, Rich Products Corp has acquired smaller regional frozen bakery companies to expand its market share in the U.S. and diversify its product offerings.

- Tyson Foods has strengthened its portfolio by acquiring smaller brands that specialize in health-conscious and innovative frozen bakery products, capitalizing on the growing trend of functional foods.

Expansion into Health-Conscious and Specialized Diet Segments

- CSM Bakery Solutions has introduced products targeting specialized diets, such as low-carb, high-protein, and paleo bakery goods, responding to the surge in demand for niche dietary options.

- General Mills has launched a range of products under its Nature Valley brand that offers high-protein, gluten-free frozen options, capitalizing on both health trends and convenience.

KEY BENEFITS FOR STAKEHOLDERS

Retailers and Distributors

- Expansion of Product Portfolio: Retailers and distributors can benefit from offering a wider range of frozen bakery products, including gluten-free, sugar-free, and allergen-free options, catering to diverse consumer needs.

- Increased Customer Footfall: The growing popularity of frozen bakery products, especially ready-to-eat and ready-to-bake categories, will drive higher customer engagement and footfall in stores and online platforms.

- Competitive Edge: By stocking innovative products that align with health and wellness trends (e.g., fortified with fiber, Omega-3), retailers can differentiate themselves from competitors and attract health-conscious shoppers.

Manufacturers and Suppliers

- Growing Market Demand: Manufacturers can capitalize on the rising demand for healthier, convenient frozen bakery products, especially with innovations in gluten-free, low-sugar, and high-protein options.

- Product Innovation: Manufacturers can stay ahead of competition by investing in R&D for functional and allergen-free bakery products, opening opportunities for new product lines and market expansion.

- Brand Loyalty: By meeting consumer preferences for sustainability, such as eco-friendly packaging and clean label products, manufacturers can build stronger consumer loyalty and enhance brand reputation.

Consumers

- Healthier Choices: Consumers benefit from a wider variety of healthier frozen bakery options that cater to their specific dietary needs, such as gluten-free, sugar-free, and low-carb.

- Convenience: Ready-to-eat and ready-to-bake products offer time-saving solutions for busy individuals, ensuring they can enjoy fresh bakery items with minimal preparation time.

- Sustainability Benefits: Eco-conscious consumers can feel confident in supporting brands that prioritize sustainable sourcing, packaging, and production processes.

Investors and Financial Stakeholders

- Revenue Growth Opportunities: With the market expected to reach USD 95.59 billion by 2030, stakeholders can benefit from strong growth prospects, as increased consumer demand and product innovation fuel the market’s expansion.

- Market Stability: The market’s steady growth, driven by trends like health-consciousness and convenience, presents a stable investment opportunity.

- Diversification: Stakeholders in frozen food sectors can diversify their portfolios by capitalizing on the expanding frozen bakery segment, which is increasingly becoming a staple in U.S. households.

Health & Wellness Advocates

- Improved Product Accessibility: With increased offerings in allergen-free, low-sugar, and nutrient-enriched products, health and wellness stakeholders can influence the development of better food options for people with dietary restrictions or health concerns.

- Support for Public Health Initiatives: The rise in demand for healthier alternatives aligns with broader public health initiatives aimed at reducing obesity and managing diabetes, contributing positively to societal health outcomes.

At DigiRoads Research, we emphasize reliability by employing robust market estimation and data validation methodologies. Our insights are further enhanced by our proprietary data forecasting model, which projects market growth trends up to 2030. This forward-thinking approach ensures our analysis not only captures the current market landscape but also anticipates future developments, equipping stakeholders with actionable foresight.

We go a step further by offering an exhaustive set of regional and country-level data points, supplemented by over 60 detailed charts at no additional cost. This commitment to transparency and accessibility allows stakeholders to gain a deep understanding of the industry’s structural and operational dynamics. By providing exclusive and hard-to-access data, DigiRoads Research empowers businesses to make informed strategic decisions with confidence.

In essence, our methodology and data delivery foster a collaborative and data-driven decision-making environment, enabling businesses to navigate industry challenges and capitalize on opportunities effectively.

Contact Us For More Inquiry.

Table of Contents

INTRODUCTION

- Market Overview

- Years Considered for Study

- Market Segmentation

- Study Assumptions and Definitions

- Market Scope

RESEARCH METHODOLOGY

MARKET OUTLOOK

- Executive Summary

- Market Snapshot

- Market Segments

- By Product

- Bread

- Pizza Base

- Cakes

- Batters

- Cookies

- Others

- By Distribution Channel

- Supermarkets & Hypermarkets

- Bakery Stores

- Online Services

- Others

- By Region:

- California

- Texas

- New York

- Florida

- Illinois

- Pennsylvania

- Ohio

- Georgia,

- North Carolina

- Michigan

- U.S. states

- By Product

COMPETITIVE LANDSCAPE

- Recent Strategies (Key Strategic Moves)

- Market Share Analysis

- Company Profiles

- Tyson Foods Inc.

- General Mills Inc.

- Rich Products Corporation

- Aryzta AG

- Lancaster Colony Corporation

- J&J Snack Foods Corp.

- Dawn Food Products Inc.

- Harlan Bakeries LLC

- Turano Baking Co.

- Gonnella Baking Company

- Flowers Foods Inc.

- CSM Bakery Solutions

- Pepperidge Farm Inc. (A division of Campbell Soup Co.)

- Campbell Soup Co.

- Sara Lee Frozen Bakery

MARKET DYNAMICS

- Market Drivers

- Market Challenges

- Market Opportunities

- Porter’s Five Forces’ Analysis

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Threat of New Entrant

- Threat of Substitutes

- Competitive Rivalry

GLOSSARY OF PROMINENT SECONDARY SOURCES

DISCLAIMER

ABOUT US