No products in the cart.

Vietnamese Dog and Cat Food Market

- Brand: DigiRoads

Vietnamese Food and Beverage Market Report on Dog and Cat Food: This 100+ pages report offers detailed insights into market trends, growth drivers, and competitive landscape. Available in PDF and Excel formats for comprehensive analysis and easy data access.

Category: Food and Beverage

Brand: DigiRoads

Vietnamese Dog And Cat Food Market Report | Market Size, Industry Analysis, Growth Opportunities, & Forecast (2025-2030)

Vietnamese Dog And Cat Food Market Overview

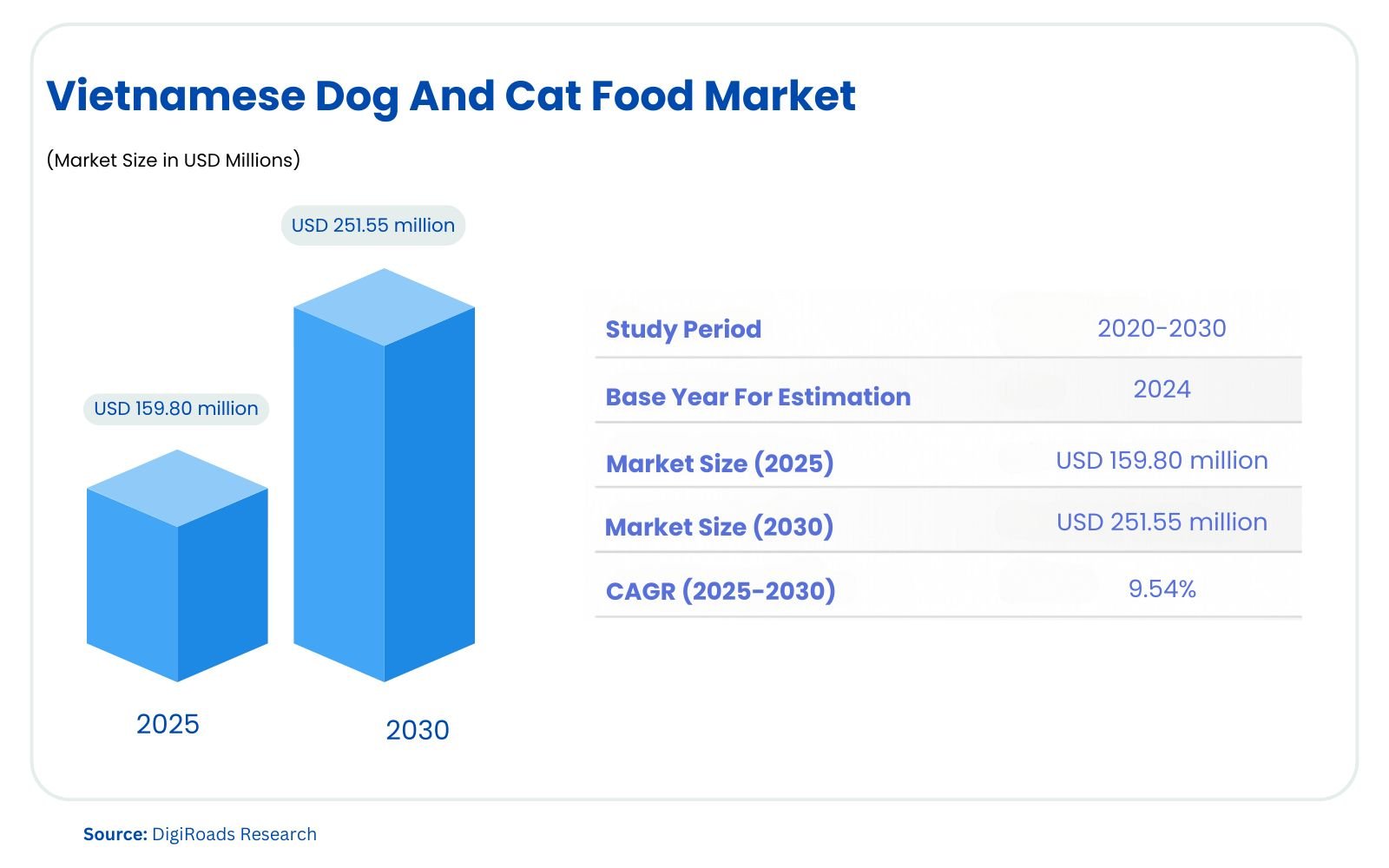

The Vietnamese dog and cat food market is set to expand significantly, with an estimated market size of USD 159.80 million in 2025 and projected to grow to USD 251.55 million by 2030, experiencing a robust CAGR of 9.54% during the forecast period 2025–2030. The Vietnamese dog and cat food market is poised for significant growth from 2025 to 2030, driven by increasing pet ownership and a rising shift toward commercial pet food products. With younger adults and teenagers embracing pets as part of their families, the demand for premium and nutritionally balanced pet food has surged. Dogs dominate the market share due to their larger population and higher food consumption rates, while cats are emerging as the fastest-growing segment.

As disposable incomes rise, pet owners are increasingly opting for high-quality dry and wet food, alongside specialized diets such as grain-free and veterinary diets. Convenience stores, online channels, specialty stores, and supermarkets serve as the primary distribution channels, with online sales witnessing notable expansion due to e-commerce growth.

Key trends include a preference for natural, organic, and nutraceutical-infused pet food that addresses health concerns like digestive sensitivity and oral care. As Vietnam accounts for a growing share of the Asia-Pacific pet food market, businesses are focusing on innovation and sustainability to meet evolving consumer preferences.

This report provides an in-depth analysis of market segmentation, emerging trends, and growth opportunities shaping Vietnam’s dog and cat food industry.

Market Report Coverage:

The “Vietnamese Dog And Cat Food Market Report—Future (2025-2030)” by Digiroads Research & Consulting covers an in-depth analysis of the following segments in the market.

| Pet Food Product | Food |

| Food | Dry Pet Food |

| Dry Pet Food | Kibbles, Other Dry Pet Food |

Study Assumptions and Definitions

The study on the Vietnamese Dog and Cat Food Market relies on a set of assumptions and definitions to ensure consistency and clarity throughout the analysis. The primary assumption is that the pet food market includes products intended for consumption by pets, such as food, treats, nutraceuticals/supplements, and veterinary diets. This scope is comprehensive, covering both commercial and specialized pet food products consumed by various pets, primarily dogs and cats. The market excludes resellers, focusing solely on companies that produce and sell pet food directly to consumers.

The study defines Pet Food as food items formulated to meet the nutritional needs of pets, including both dry and wet food types. Dry Pet Food is typically low in moisture, with forms like kibble or flaked food, while Wet Pet Food contains higher moisture content, often found in cans or pouches. Pet Nutraceuticals/Supplements refer to health-boosting products, including probiotics and omega-3 fatty acids, that go beyond basic nutrition. Pet Treats are snacks given to pets, often used for training or rewarding good behavior. Pet Veterinary Diets are specialized foods for pets with medical conditions, like kidney disease or allergies. The research methodology incorporates data from multiple sources and market experts to ensure accuracy in projections and assumptions.

Market Scope

The market scope for the Vietnamese Dog and Cat Food Market includes all pet food products consumed by pets, including food, treats, nutraceuticals/supplements, and veterinary diets. It covers both commercial and specialized pet foods for animals like dogs, cats, and other pets such as birds and rabbits.

The study includes dry and wet food types, pet treats for various purposes (like training or dental care), and products that promote health, such as nutraceuticals and veterinary diets tailored for specific medical needs. The market analysis excludes the resale of pet food without value addition, focusing on the production and sale of pet food directly to consumers. The scope also covers different distribution channels, including supermarkets, convenience stores, online platforms, and specialty stores. The study examines market trends, growth drivers, and future projections, specifically focusing on segments such as food types, pet nutraceuticals, treats, veterinary diets, and distribution channels within the Vietnamese pet food market.

MARKET OUTLOOK

Executive Summary

The Vietnamese Dog and Cat Food Market is experiencing rapid growth, driven by an increasing pet population and a growing shift toward commercial pet food products. The market has expanded significantly in recent years from 2019 to 2024. This growth is primarily due to the rising adoption of pets, particularly dogs and cats, among younger adults and urban populations.

The pet food market is segmented into food, nutraceuticals/supplements, treats, and veterinary diets. Dry pet food, especially kibble, holds a significant share of the market, while wet pet food, though smaller, is also growing. Nutraceuticals and supplements, including products such as omega-3 fatty acids, probiotics, and vitamins, are gaining popularity as pet owners become more conscious of their pets’ health. Veterinary diets, tailored to pets with specific health conditions like kidney disease or digestive issues, are increasingly sought after.

Dogs continue to dominate the pet food market, while cats are emerging as the fastest-growing segment. Distribution channels in Vietnam include supermarkets, specialty stores, online platforms, and convenience stores, with e-commerce becoming an increasingly important channel for pet food sales.

The market is poised for strong growth over the next decade, driven by factors such as rising urbanization, increasing disposable incomes, and growing pet ownership. As Vietnamese consumers continue to shift toward high-quality, specialized pet food, the pet food industry is expected to experience significant expansion in the coming years.

COMPETITIVE LANDSCAPE

The Vietnamese Dog And Cat Food Market is moderately fragmented, with regional and multinational players competing fiercely for market share.

Key Market Players

- Nestlé Purina Petcare

- Mars Petcare

- Hill’s Pet Nutrition

- Procter & Gamble (P&G) Pet Care

- Colgate-Palmolive (Hill’s Science Diet)

- Unicharm Corporation

- Vitakraft Pet Care

- Diamond Pet Foods

- Monge & C. S.p.A.

- Agro Products & Agencies Ltd.

- Butcher’s Pet Care

- Cargill, Inc.

Market Share Analysis

The Vietnamese Dog and Cat Food Market is highly competitive, with several global and regional players holding significant market shares. As of 2024, Nestlé Purina Petcare, Mars Petcare, and Hill’s Pet Nutrition dominate the market, accounting for a large portion of the overall sales. These companies benefit from their strong brand recognition, extensive distribution networks, and wide product portfolios that cater to various pet food needs, including dry and wet foods, nutraceuticals, and veterinary diets.

Nestlé Purina Petcare leads with its well-known brands such as Purina and Friskies, offering a broad range of affordable and premium products. Mars Petcare, with brands like Pedigree and Whiskas, also commands a major share, focusing on both budget-friendly and high-quality pet food options. Hill’s Pet Nutrition, offering specialized food for health and veterinary purposes, is particularly strong in the premium segment.

While multinational brands dominate, there is an increasing presence of local players and niche companies offering organic, natural, and grain-free products. Smaller companies are also capitalizing on the growing demand for premium and customized pet food products.

The market share distribution reflects the shift towards premium and specialized pet foods, with the market anticipated to grow rapidly due to increasing pet adoption, especially among younger generations. As disposable incomes rise, the demand for high-quality, nutritionally balanced pet food is expected to continue to surge, benefiting key players.

MARKET DYNAMICS

Market Drivers and Key Innovations

The Vietnamese Dog and Cat Food Market is driven by several factors, including the increasing pet adoption rate, changing lifestyles, and rising disposable incomes. A significant driver is the growing trend of younger adults and millennials adopting pets, particularly dogs and cats, as companions. This demographic shift is increasing the demand for high-quality, commercial pet food products. As younger pet owners become more financially stable, they are shifting from homemade food to premium, nutritionally balanced pet food options.

Another driver is the increasing awareness of pet health and well-being, prompting pet owners to seek specialized products, including nutraceuticals, veterinary diets, and treats. There is a rising preference for products that promote oral health, digestive sensitivity, and overall longevity. The trend toward pet humanization, where pets are considered part of the family, further accelerates demand for high-quality and nutritious foods.

Key innovations in the market include the development of grain-free, organic, and natural pet foods, catering to pet owners concerned about allergens, food sensitivities, and chemical additives. Additionally, manufacturers are focusing on creating specialized products for pets with specific health conditions, such as renal disease or urinary tract problems.

Pet food companies are also introducing convenience-oriented packaging, including smaller-sized portions and eco-friendly options. The rise of e-commerce platforms has made these products more accessible, driving growth through online channels. Companies are leveraging technology to optimize product formulations, ensuring a higher level of personalization and nutritional benefits, appealing to the growing consumer demand for premium and specialized pet foods.

Market Challenges

- Price Sensitivity: Many pet owners in Vietnam, especially in rural areas, still prefer affordable, homemade pet food options over premium commercial products due to budget constraints.

- Lack of Pet Food Awareness: Despite growing interest, there is still a lack of awareness regarding the nutritional benefits and health advantages of high-quality commercial pet food, especially in smaller towns and rural areas.

- Limited Product Availability: Access to a wide variety of specialized pet food products is limited in certain regions, particularly outside major cities, restricting market expansion.

- Dependence on Imports: A significant portion of pet food products in Vietnam are imported, leading to higher prices and vulnerability to supply chain disruptions and foreign exchange rate fluctuations.

- Regulatory Challenges: Inconsistent regulations related to pet food standards and imports pose challenges for both local and international companies seeking to enter the market.

- Competition from Local Brands: Local pet food brands often offer lower-priced products, creating tough competition for premium international brands and limiting market share growth for higher-end products.

- Cultural Barriers: Traditional attitudes towards pet care, especially in rural areas, might hinder the adoption of commercial pet food in favor of homemade meals or locally sourced alternatives.

- Pet Health Concerns: A lack of understanding about the health benefits of specialized diets, such as those targeting digestive issues or renal problems, may limit the growth of Vietnamese Dog And Cat Food Market.

Market Opportunities

- Growing Pet Ownership: The increasing adoption of pets, particularly among younger adults in urban areas, presents a significant opportunity for the expansion of the pet food market in Vietnam.

- Shift to Commercial Pet Food: As pet owners become more aware of the health benefits of commercial pet food, there is a growing demand for premium and nutritionally balanced pet food products, especially among middle and upper-income households.

- Rising Disposable Incomes: The rise in disposable incomes, especially in urban centers, provides an opportunity for the premium pet food segment, allowing more pet owners to invest in high-quality products for their pets.

- Expansion of E-commerce: The rapid growth of online retail platforms offers opportunities to reach a broader customer base, including pet owners in remote areas, with a wide variety of pet food options.

- Product Diversification: Introducing innovative pet food options such as grain-free, organic, and natural pet food products can cater to the growing demand for healthier, specialized diets.

- Veterinary Diets Market: With an increasing focus on pet health, especially among older pets, there is an opportunity to expand the veterinary diet segment, targeting pets with specific health concerns like renal disease or digestive issues.

- Rural Market Penetration: Expanding distribution networks and increasing awareness in rural areas could tap into the untapped potential of a large segment of pet owners.

- Pet Treats Segment Growth: With the rising popularity of pet treats, especially those that promote dental health, there is a growing market opportunity to develop and market specialized treats for various pet needs.

RECENT STRATEGIES & DEVELOPMENTS IN THE MARKET

E-commerce Expansion:

- Companies are increasingly investing in online retail platforms to reach a broader audience, including pet owners in remote areas.

- E-commerce sales of pet food in Vietnam have been growing rapidly, with online retail expected to capture a significant share of the market in the coming years.

Product Innovation:

- Manufacturers are focusing on developing new and specialized pet food products, including organic, grain-free, and hypoallergenic options to meet the growing demand for premium and health-conscious pet foods.

- Innovations like freeze-dried treats and functional pet food products, such as those aimed at joint health or digestive support, are increasingly popular.

Partnerships and Collaborations:

- International pet food companies are partnering with local distributors to strengthen their market presence in Vietnam. This includes companies like Mars Petcare and Nestlé Purina expanding their footprint through local retail channels.

- Veterinary clinics and pet food manufacturers are increasingly collaborating to promote specialized veterinary diets targeting pets with specific health issues.

Veterinary Diets Market Growth:

- The demand for pet veterinary diets is on the rise due to the growing focus on pet health, particularly for managing chronic diseases such as kidney failure or urinary tract issues.

- In 2024, the veterinary diet segment contributed to a significant share of the overall pet food market, with products like renal diets and oral care diets gaining popularity.

Increased Investment in Pet Nutrition:

- Pet food companies are focusing more on the nutritional value of their products, adding bioactive ingredients like omega-3 fatty acids, probiotics, and vitamins to appeal to health-conscious pet owners.

- The market for pet nutraceuticals and supplements is growing, driven by pet owners’ increasing willingness to invest in products that support their pets’ health and longevity.

Marketing and Branding Efforts:

- Pet food brands are adopting more targeted marketing strategies, emphasizing the health benefits and high-quality ingredients of their products.

- Social media campaigns and influencer partnerships are being leveraged to connect with younger, tech-savvy pet owners and boost brand awareness in the competitive market.

Expanding Distribution Networks:

- Retail chains like supermarkets and hypermarkets are increasingly stocking premium and specialized pet food products, making them more accessible to a wider consumer base.

- Companies are enhancing their distribution networks to penetrate rural areas, addressing the demand for pet food from pet owners beyond urban centers.

KEY BENEFITS FOR STAKEHOLDERS

Access to Growing Market:

- Stakeholders such as manufacturers, distributors, and retailers can capitalize on the rapidly growing pet food market in Vietnam, driven by increasing pet ownership and rising disposable incomes.

Opportunities for Product Diversification:

- Businesses have the chance to diversify their product portfolios by offering specialized products like organic, grain-free, and veterinary diets, addressing the health-conscious consumer base.

Increased Profitability:

- With the shift toward premium and functional pet food, stakeholders can benefit from higher margins associated with health-focused and niche products, including pet nutraceuticals and supplements.

Long-Term Growth Potential:

- The pet food market in Vietnam is expected to expand significantly over the next few years, providing long-term growth opportunities for companies investing in the sector.

Brand Loyalty and Consumer Trust:

- By focusing on quality, transparency, and innovation, stakeholders can build strong consumer loyalty, especially among pet owners who prioritize the health and well-being of their pets.

Collaboration Opportunities:

- Manufacturers and distributors can collaborate with veterinary clinics, e-commerce platforms, and retailers to expand their reach and strengthen brand positioning in the market.

Sustainability and Eco-friendly Trends:

- Companies that incorporate sustainability into their production processes and product offerings can tap into the growing market demand for environmentally conscious pet food options.

Health and Wellness Focus:

- The increasing awareness of pet health offers opportunities for stakeholders to create and promote pet foods with added health benefits, such as omega-3 fatty acids, probiotics, and vitamins, which appeal to a health-conscious consumer base.

At DigiRoads Research, we emphasize reliability by employing robust market estimation and data validation methodologies. Our insights are further enhanced by our proprietary data forecasting model, which projects market growth trends up to 2030. This forward-thinking approach ensures our analysis not only captures the current market landscape but also anticipates future developments, equipping stakeholders with actionable foresight.

We go a step further by offering an exhaustive set of regional and country-level data points, supplemented by over 60 detailed charts at no additional cost. This commitment to transparency and accessibility allows stakeholders to gain a deep understanding of the industry’s structural and operational dynamics. By providing exclusive and hard-to-access data, DigiRoads Research empowers businesses to make informed strategic decisions with confidence.

In essence, our methodology and data delivery foster a collaborative and data-driven decision-making environment, enabling businesses to navigate industry challenges and capitalize on opportunities effectively.

Contact Us For More Inquiry.

Table of Contents

INTRODUCTION

- Market Overview

- Years Considered for Study

- Market Segmentation

- Study Assumptions and Definitions

- Market Scope

RESEARCH METHODOLOGY

MARKET OUTLOOK

- Executive Summary

- Market Snapshot

- Market Segments

- Pet Food Product:

- Food, Pet Nutraceuticals/Supplements, Pet Treats, Pet Veterinary Diets

- Pet Nutraceuticals/Supplements:

- Milk Bioactives, Omega-3 Fatty Acids, Probiotics, Proteins and Peptides, Vitamins and Minerals, Other Nutraceuticals

- Pet Veterinary Diets:

- Diabetes, Digestive Sensitivity, Oral Care Diets, Renal, Urinary Tract Disease, Other Veterinary Diets

- Pet Food Product:

COMPETITIVE LANDSCAPE

- Recent Strategies (Key Strategic Moves)

- Market Share Analysis

- Company Profiles

- Nestlé Purina Petcare

- Mars Petcare

- Hill’s Pet Nutrition

- Procter & Gamble (P&G) Pet Care

- Colgate-Palmolive (Hill’s Science Diet)

- Unicharm Corporation

- Vitakraft Pet Care

- Diamond Pet Foods

- Monge & C. S.p.A.

- Agro Products & Agencies Ltd.

- Butcher’s Pet Care

- Cargill, Inc.

MARKET DYNAMICS

- Market Drivers

- Market Challenges

- Market Opportunities

- Porter’s Five Forces’ Analysis

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Threat of New Entrant

- Threat of Substitutes

- Competitive Rivalry

GLOSSARY OF PROMINENT SECONDARY SOURCES

DISCLAIMER

ABOUT US